GOLD & CRUDE OIL TALKING POINTS:

- Gold prices fell as markets groaned at slow-moving ECB stimulus expansion

- Crude oil prices down alongside stocks as traders pine for more policy easing

- Soft US GDP data may sour risk appetite, hurt gold as USD claims haven bid

Gold prices slumped as the ECB appeared to be in less of a hurry to expand monetary stimulus than investors anticipated. That drove bond yields sharply higher and ultimately echoed in a stronger US Dollar, cooling the appeal of non-interest-bearing and anti-fiat assets.

Tellingly, the drop in gold tracked parallel to plunging stocks and crude oil prices. Investors seemed clearly unnerved by what they judged as an unwelcome lack of urgency in delivering policy support, signaling that their assessment of global growth prospects is far gloomier than that of central bank officials.

Gold Prices May Fall with Stocks, Crude Oil on Soft US GDP Data

This sets the stage for the release of second-quarter US GDP data, where expectations envision the slowest annualized growth rate in three years (at 1.8 percent). Leading PMI data has argued as much for some time and a string of recent disappointments on US news-flow warns the realized result may be softer still.

Markets seem to have run out of room to price in ever-more dovish Fed policy outcomes. Investors were perhaps hoping for a bit of extra help from the ECB, but its tiptoeing appears to have left them wanting. That sets the stage for a straight-forward risk-off outcome if US economic growth looks sluggish.

Gold may fall alongside sentiment-geared assets yet again in this scenario as haven-seeking demand buoys the US Dollar even as a would-be supportive drop in yields is capped by anchored rate cut bets. Cycle-sensitive crude oil prices seem likely to suffer too.

Get the latest crude oil and gold forecasts to see what will drive prices in the third quarter!

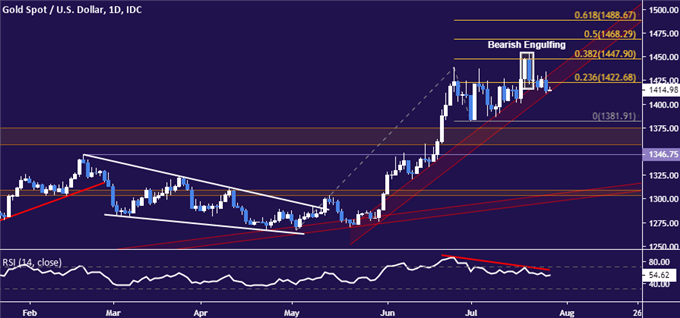

GOLD TECHNICAL ANALYSIS

Gold prices pressuring trend line support set from late may after the appearance of a Bearish Engulfing candlestick pattern and negative RSI divergence hinted that a top is forming. A daily close below this barrier – now at 1412.24 – exposes the July 1 low at 1381.91 next. Alternatively, a breaking above the 38.2% Fibonacci expansion at 1447.90 targets the 50% level at 1468.29.

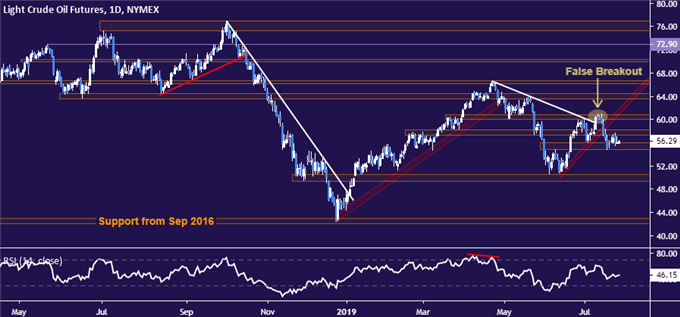

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to oscillate above support at 54.84. A daily close below this barrier sets the stage for a challenge of the 49.41-50.60 area. Alternatively, a move upward that clears resistance at 58.19 opens the door for a retest of the 60.04-84 zone.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter