GOLD & CRUDE OIL TALKING POINTS:

- Gold prices sink as the US Dollar deftly juggles haven-, yield-based appeal

- Crude oil prices bounce as OPEC+ officials hint at new output cuts in 2019

- S&P 500 futures hint at risk-on bias, Adipec chatter may be market-moving

Gold prices fell even as bond yields tracked stocks lower and the priced-in rate hike path implied in Fed Funds futures flattened Friday. The US Dollar found renewed haven appeal against the risk-off backdrop, and its rise undermined the appeal of anti-fiat alternatives epitomized by the yellow metal.

Crude oil prices also tracked lower, succumbing to de-facto selling pressure because they are denominated in USD terms on global markets. A spirited recovery has been triggered over the weekend however – producing an upward gap at Monday’s trading open – after OPEC+ officials worried aloud about oversupply in 2019.

Markets seemed to read that as signaling that the cartel and like-minded producers – notably, Russia – may cut output quotas once again having raised earlier this year. That was meant to cushion the blow from the sidelining of shipments from Iran after the re-imposition of US sanctions.

GOLD DROP MAY CONTINUE, CRUDE OIL EYES ADIPEC

Looking ahead, gold may continue to suffer as risk appetite recovers. S&P 500 futures are pointing convincingly higher ahead of the opening bell on Wall Street, hinting that a recovery in yields is poised to pressure non-interest-bearing alternatives.

For its part, the Greenback seems to have become adept at pivoting from haven- to policy-based arguments for gains. Indeed, it is marching higher alongside US stock futures and Treasury yields in late Asia Pacific trade. More of the same is a toxic mix for gold.

Meanwhile, crude oil might find support from chatter emerging out of the Abu Dhabi International Petroleum Exhibition and Conference (Adipec). A slew of OPEC+ bigwigs are in attendance. They will probably continue to jawbone prices upward with allusions to cutting production levels anew.

A stronger US Dollar and hefty incoming event risk might temper upside follow-through however. Upcoming data flow seems ominous for anti-USD assets while EIA drilling productivity statistics and an annual IEA energy outlook report may highlight headwinds from swelling US output.

Learn what other traders’ gold buy/sell decisions say about the price trend!

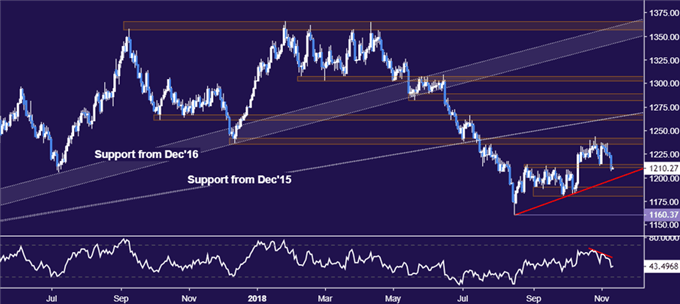

GOLD TECHNICAL ANALYSIS

Gold prices pushed through range support in the 1211.05-14.30 area, exposing a rising trend line at 1198.51. A further push below that targets the 1180.86-87.83 zone. Alternatively, a move back above 1214.30 exposes the 1260.80-66.44 region next.

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are probing back above the $60/bbl figure. A daily close back above this barrier paves the way to retest support-turned resistance marked by the April 6 lowat 61.84, followed by a falling trend line at 63.20. Alternatively, a reversal back below the 60.00 aims for the February 9 low at 58.11. The longer-term chart setup hints a major top has been established.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter