CRUDE OIL & GOLD TALKING POINTS:

- Crude oil price bounce fizzles amid emerging market turmoil

- Gold prices torn as yields decline, US Dollar finds haven bid

- US, Japan trade talks may trump IEA report and US CPI data

Crude oil prices attempted a tepid recovery yesterday following the prior session’s brutal selloff. The move higher was swiftly aborted however as worrying geopolitical news flow – notably from Russia and Turkey – triggered a selloff in emerging market assets and broadly soured investors’ mood. The sentiment-sensitive WTI benchmark retreated from intraday highs to close with a narrow loss.

Gold price action was likewise muddled by the bloodletting in the EM space. Haven-seeking flows buoyed the US Dollar alongside Treasury bonds, depressing yields. That put the yellow metal’s role as baseline anti-fiat alternative at odds with its character as non-interest-bearing alternative. Not surprisingly, that translated into inconclusive performance (although sellers narrowly prevailed by the daily close).

US, JAPAN TRADE TALKS MAY TRUMP IEA REPORT AND CPI DATA

Looking ahead, the monthly IEA Oil Market Report may help shape physical flow expectations. Crude prices may edge up if it echoes an EIA prognosis published earlier in the week that envisioned a downshift in US output growth coupled with a pickup in demand. Meanwhile, gold is eyeing US CPI data. Anything short of a wild deviation from forecasts seems unlikely to command attention however.

On balance, that probably puts sentiment trends back into focus. Continued emerging market turmoil is likely to continue to cloud the landscape but news of a breakthrough in trade talks between US and Japanese officials may tip the scales in favor of a slightly “risk-on” bias. Earlier talks with the EU seem like an apt template, with President Trump eager to give up unpopular auto import tariffs for token concessions. In this scenario, a pickup in bond yields might nudge gold lower while crude oil tracks share prices upward.

See our guide to learn about the long-term forces driving crude oil prices !

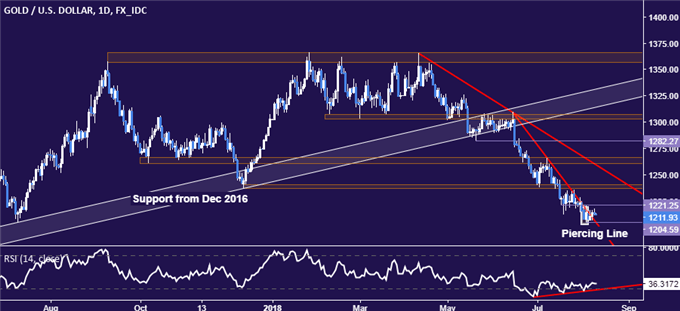

GOLD TECHNICAL ANALYSIS

The formation of a bullish Piercing Line candlestick pattern coupled with RSI divergence hints gold prices may be bottoming. A break above range floor support-turned-resistance at 1221.25 exposes the 1236.6-40.86 area. Near-term support remains at 1204.59, the August 3 low.

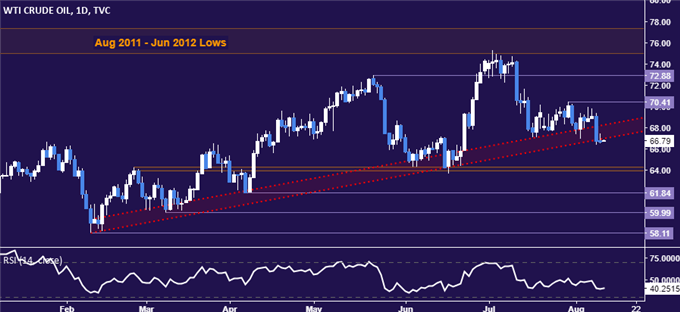

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices look vulnerable to deeper losses after breaking trend line support established early February. The next layer of support is in the 63.96-64.26 area, with a further move below that exposing 61.84. Near-term resistance is at 70.41, followed by a minor barrier at 72.88 on the way up to the 75.00-77.31 zone.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter