Talking Points:

- Gold prices get boost from ECB, look on to FOMC meeting outcome

- Crude oil price correct lower after recovering to touch a 6-week high

- See our crude oil and gold forecasts for a look at longer-term trends

The outcome of the ECB rate decision offered a dual benefit to gold prices. First, the central bank struck a broadly dovish tone (as expected), with President Mario Draghi forcefully asserting the need for continued accommodation even as he conceded that the fate of the QE program will be discussed in autumn. The promise of loose monetary conditions was understandably supportive for non-interest-bearing assets.

Second, the Euro soared as the markets willfully ignored all but the promise to reconsider the asset purchase effort. The single currency added a full percentage point against the US Dollar, which seemed to echo as broader weakness for the greenback across the G10 FX space. That played to gold’s anti-fiat properties and offered the yellow metal a further lift.

From here, the absence of top-tier event risk leaves prices without fresh catalysts. A degree of portfolio rebalancing may take hold as investors look ahead to next week’s FOMC monetary policy announcement, which might see gold retrace some recent gains. Sentiment trends also bear watching for their ability to drive bond yields and thereby influence gold’s relative appeal.

Meanwhile, crude oil prices corrected lower after touching a six-week high. A lull in pertinent news flow seemed to allow room for profit-taking. The docket is relatively quiet through the rest of the week, with only the Baker Hughes rig count report and CFTC futures positioning data on tap. These rarely inspire immediate volatility, meaning the consolidate tone might persist into the weekend.

Need help turning gold and crude oil news flow into a strategy? Check out our trading guide !

GOLD TECHNICAL ANALYSIS – Gold prices edged up toward resistance at 1250.38, the 50%Fibonacci retracement, after a brief pause to digest prior gains. A daily close above this barrier exposes the 61.8% level at 1261.16. Alternatively, a reversal back below the 38.2% Fib at 1239.60 opens the door for a retest of the 23.6% expansion at 1226.26.

Chart created using TradingView

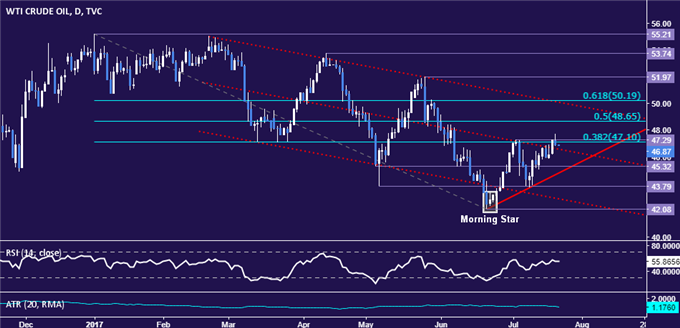

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices stalled at resistance in the 47.10-29 area (38.2% Fibonacci retracement, July 4 high). A reversal below channel midline support at 46.58 paves the way for another challenge of chart inflection point support at 45.32. Alternatively, a push above resistance sees the next upside barrier at 48.65, the 50% Fib.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak