Talking Points:

- Gold prices digesting losses after dropping to five-month low

- Crude oil prices advance on OPEC push for output cut deal

- US retail sales data, Fed-speak may bode ill for commodities

Gold prices consolidated losses after having touched a five-month low in the aftermath of the US presidential election amid speculation that amid speculation that the on-coming policy pivot will boost inflation and encourage Fed tightening. Crude oil prices bounced amid reports that OPEC nations have re-doubled diplomatic efforts to secure a deal on output cut quotas ahead of a formal meeting later this month. The cartel unveiled the outlines of an accord in September but nailing down specifics has proven to be a challenge, as expected.

Looking ahead, US Retail Sales data and another round of Fed-speak may boost rate hike speculation, sending the US Dollar higher alongside Treasury bond yields. Gold is likely to weaken further as anti-fiat demand continues to fade in this scenario. Crude oil may also suffer as a stronger greenback puts de-facto pressure on the USD-denominated WTI benchmark, although OPEC-related news-flow and the API weekly inventory data set may disrupt prices’ response to broader trends.

See the schedule of upcoming webinars and join us LIVE to follow the financial markets!

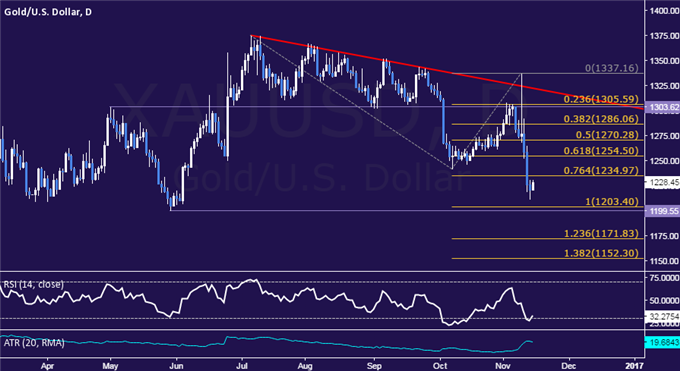

GOLD TECHNICAL ANALYSIS – Gold prices are hovering above support near the $1200/oz figure. A daily close below the May 30 low at 1199.55 targets the 123.6% Fibonacci expansion at 1171.83. Alternatively, a move back above the 76.4% level at 1234.97 exposes the 61.8% Fib at 1254.50.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices may be bottoming at support near the $43/bbl as positive RSI divergence hints at ebbing selling pressure. A break back above the 23.6% Fibonacci expansionat 43.95 on a daily closing basis exposes the 14.6% level at 44.70. Alternatively, a push through support in the 42.73-43.02 area (38.2% Fib, September 1 low) targets the 50% level at 41.74.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak