This daily digest focuses on Yuan rates, major Chinese economic data, market sentiment, new developments in China’s foreign exchange policies, changes in financial market regulations, as well as market news typically available only in Chinese-language sources.

- Bitcoin plunged -5.4% against the Yuan following PBOC’s warning.

- The onshore Yuan liquidity remained tight despite of the Central Bank’s injections.

- See the DailyFX Economic Calendar for the upcoming key events.

To receive reports from this analyst, sign up for Renee Mu’ distribution list.

Yuan Rates

-The PBOC strengthened the Yuan by +467 pips or +0.68% against the U.S. Dollar to 6.8525 on Wednesday. Both the onshore and offshore Yuan remained stronger than the guided level: the USD/CNY traded at 6.8359 and the USD/CNH traded at 6.8120 as of 10:35am EST. Amid a weak Dollar in the short-term, the Yuan may advance further against its U.S. counterpart. The next key support level to watch for the USD/CNH is 6.7818.

- Bitcoin plunged -5.4% against the Yuan on Wednesday following PBOC’s warning against risks in Bitcoin trading. China Central Bank’s Shanghai Head Office said on Wednesday that the regulator has found irregularities in major Bitcoin exchanges: Bitcoin China operated beyond the scope of and failed to use third-party custody accounts for investors’ funds; OKCoin and Huobi carried out margin trading without regulator’s approval and also failed to set up internal anti-laundering compliance program. Looking forward, traders will want to keep an eye on PBOC’s moves; it is less likely that the regulator will ban the digital currency, but may introduce regulations to strengthen oversight on its trading.

BTC/CNY 1-Day

Prepared by Renee Mu.

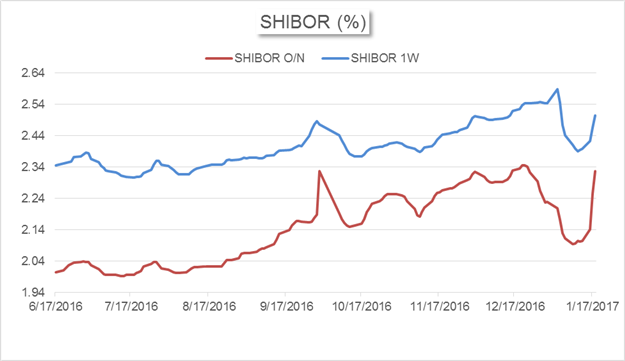

- The onshore Yuan liquidity continued to tighten on Wednesday. From overnight to 1-year term, Yuan’s borrowing costs all rose in Shanghai interbank market. SHIBOR O/N, 1-week, 1-month and 1-year increased +7.17 bps, +3.76 bps, +3.86 bps and +1.92 bps on the day.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

The PBOC added a net of 410 billion Yuan of cash through reverse repos on Wednesday, marking it the third consecutive day with a net injection. However, this has not eased the condition. According to Hexun News, a leading Chinese financial media, traders in major Chinese banks told that banks are concerned of whether the PBOC will renew Medium-term Lending Facility on Thursday and thus have been cautious in lending. Also, China’s monetary policy in 2017, which has become tighter compared to previous years, may have also weighed on the liquidity condition.

Market News

China Finance Information: a finance online media administrated by Xinhua Agency.

- The expansion in China’s housing prices has slowed down in the last month of 2016 amid restrictions on home purchases, according to a report released by the statistics bureau on January 18th. Property prices in tier-one cities saw decreases in December on a monthly basis: this is the first time that Beijing reported a drop in housing prices in 2016; prices in Shanghai fell for the second consecutive month and prices in Shenzhen fell for the third straight month. Regulations placed on the housing market are likely to remain in effective in 2017, as Chinese policymakers have set stabilizing the housing market as a national priority.

To receive reports from this analyst, sign up for Renee Mu’ distribution list.