S&P 500, RUSSIA-UKRAINE WAR, FRENCH PRESIDENTIAL ELECTION, FED SPEAK - TALKING POINTS

- Stocks may turn lower as geopolitical risks in Europe swell – will USD rise?

- Gloomy IMF growth outlook, Fed commentary could amplify risk aversion

- French presidential debate and economic data may add to broader volatility

Equity markets in Europe and the United States may be in for a rough ride ahead of a packed week of economic data and geopolitical stress. This includes the French presidential runoff, the ongoing Russia-Ukraine war, the IMF growth outlook, Fed commentary, and a cascade of economic data. This constellation of narratives suggests volatility ahead.

Stocks gapped lower at last week’s tradingopen and went on to close almost three percent lowerbefore the Easter holiday weekend. Thin trading on Monday amplified volatility and revealed a downside disposition of investors’ sentiment. Given the current fundamental circumstances, it is likely this downward trend may continue throughout the week, barring a surge of optimism.

RUSSIA-UKRAINE WAR UPDATE

Russian forces continue to move in from the east, with the latest source of tension coming from the city of Mariupol. The Kremlin notified the remaining Ukrainian soldiers that should they lay down their arms, they will be offered safe passage. Local officials have rejected Moscow’s offer and made it clear they will “fight to the end”.

Source: BBC News

Mariupol continues to be the most heavily bombarded city in Ukraine. If it is taken by the Russians, that would mark a key victory for the Kremlin. Its strategic position as a land corridor between Crimea and the Donbas region – as well as its port on the Sea of Azov – makes it a high priority. Its annexation would also strike a major blow to the already-battered Ukrainian economy.

Russia’s invasion has also led Sweden and Finland to consider joining the North Atlantic Treaty Organization (NATO), with public opinion in the latter country jumping from just 30% in support of joining to now over 60%. Sweden has historically remained neutral vis-à-vis NATO and Russia, but the invasion has notably strengthened the case for membership.

The two Nordic countries have moved in lockstep on the matter, and their recent pivot has prompted a sharp response from Russia. Moscow warned that it would deploy nuclear weapons in the Baltic Sea if either country joined. Looking ahead, investors and policymakers alike will be watching very closely how Stockholm and Helsinki respond.

For more updates on geopolitical risks, follow me on Twitter @ZabelinDimitri.

Disruptions in the supply of Russian oil have fanned the flames of inflation. This coupled with a recent power outage in Libya sent Brent crude 1 percent higher on Monday. To mitigate the effect of higher oil prices, countries including India and China have ramped up Russian imports.

Looking ahead, sanctions and other assorted commodities supply disruptions will likely continue to be the biggest drivers of financial turmoil. However, investment sentiment may not entirely change too much. As the Wall Street Journal coyly wrote: “There’s no point discounting a worst-case outcome because nobody will be around to benefit from a wise investment decision”.

FRENCH PRESIDENTIAL DEBATE

Last week, the first round of the French presidential election took place. The law stipulates that unless a candidate wins over 50% of the vote, a second round will be organized where only the two candidates with the most votes from the prior round can qualify to participate. Those two winners this time around were incumbent Emmanuel Macron and a familiar rival, Marine Le Pen.

Initial results were favorable for Macron, who received just under 30% of the estimated vote, while Le Pen secured roughly 23%. The two will have a final debate on Wednesday, April 20 ahead of the second and final vote on April 24.

Unease about the way forward appeared to have moved French equities. France’s benchmark CAC 40 equity index rose 0.3%after first-round results were announced, indicating investors were pleased with Mr. Macron’s performance. Still, the European Stoxx 600 Index fell 0.7% that day. Looking ahead, investors may expect higher volatility in local stock marketsif the race tightens.

READ MORE: How to Trade the Impact of Politics on Global Financial Markets

IMF OUTLOOK: GLOOMY PRESENTIMENTS

In addition to releasing the bi-annual Global Financial Stability Report (GFSR), the International Monetary Fund (IMF) is anticipated to publish a downgraded outlook for global economic growth. Managing Director Kristalina Georgieva announced that forecasts for 2022 and 2023 will be gloomier as a result of the Ukraine war and runaway inflation.

Concerns about stagflation – the combination of high inflation and low growth – are at the forefront as central banks ramp up interest rates. The effects of COVID-19 on supply chain integrity and overall economic growth continue to be felt. They are now also amplified by the Russia-Ukraine. Consequently, investors are watching with sharpened scrutiny what central banks are saying.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

FED SPEAK, ECONOMIC DATA AHEAD

In addition to G-20 ministers and central bankers convening at the IMF/World Bank spring meeting, Fed officials will be participating in various speaking engagements throughout the week. Furthermore, the US central bank will be releasing the highly anticipated Beige Book survey of regional economic conditions, all during a week dense with high-visibility economic data.

This includes US existing home sales and initial jobless claims. France, Germany, and the UK will be releasing preliminary manufacturing PMI data in the meanwhile. Canadian CPI for March will be closely watched following the Bank of Canada’s rate decision on April 13. It should be noted that these are just the highlights, with plenty of other data points set to be released that could shake up markets.

S&P 500 TECHNICAL ANALYSIS

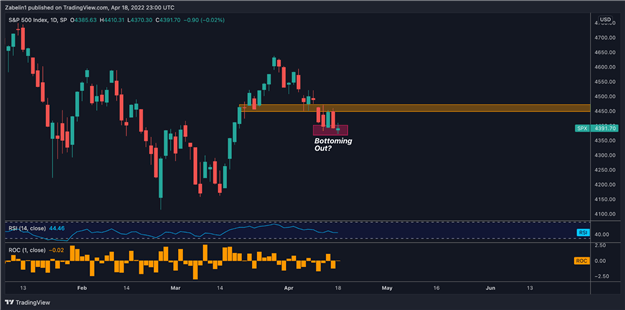

The benchmark equity index has been on a steady downtrend since March 29, having fallen approximately 5.20%. While there appear to be early signs of bottoming out over the past four trading days, investors may be cautious in extrapolating optimism.

S&P 500 Index - Daily Chart

Source: TradingView

If risk appetite firms, the index may find its enthusiasm curbed by a foggy layer of resistance between 4471 and 4448. Failure to puncture this ceiling could cast a bearish shadow on the S&P 500 outlook and potentially accelerate a return to the preceding downtrend.

Written by Dimitri Zabelin for DailyFX