US Dollar, Singapore Dollar, Philippine Peso, Indonesian Rupiah, Malaysian Ringgit – Talking Points

- US Dollar mostly fell against ASEAN currencies this past week

- Fed Economic Policy Symposium, RNC source of volatility risk

- USD/SGD, USD/MYR may look past local data for external news

US Dollar ASEAN Weekly Recap

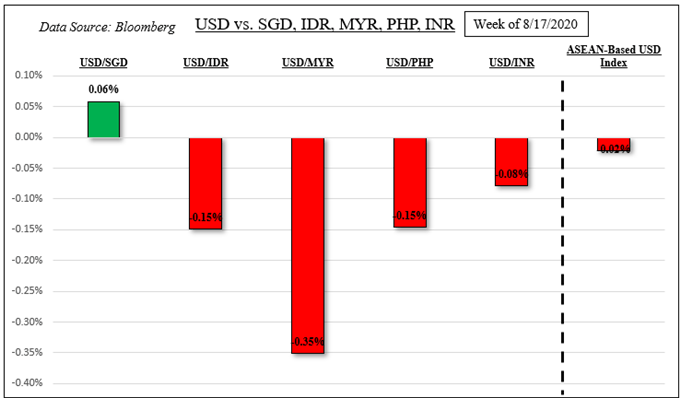

The haven-linked US Dollar mostly declined against its ASEAN counterparts last week. The Malaysian Ringgit, Indonesian Rupiah and Philippine Peso gained while the Singapore Dollar slightly weakened. Overall market sentiment continued improving. The S&P 500, a frequent bellwether for general risk appetite, gained over 0.7% these past 5 trading sessions.

USD/MYR fell the most, see chart below. This is as a Bloomberg survey of Q4 Malaysian GDP increased to 2.5% q/q versus 1.9% prior. In 2021, the nation’s economy is expected to rebound 6% after a 4.3% drop this year. Rising confidence in the outlook left the Bank of Indonesia and Philippine Central Bank on hold at the latest monetary policy announcements. This helped push the Indonesian Rupiah and Philippine Peso higher.

Discover your trading personality to help find optimal forms of analyzing financial markets

Last Week’s US Dollar Performance

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

External Event Risk – Fed Economic Policy Symposium, RNC, Consumer Confidence

The focus for ASEAN currencies will likely remain on risk appetite as that continues influencing capital flows around emerging markets. As such, it is important to take into consideration external event risk. All eyes will turn to this week’s annual Economic Policy Symposium hosted by the Federal Reserve. Commentary that echoes the tone set by this past week’s FOMC meeting minutes could dent equities.

These included doubt over the use of yield curve control and concerns about the economic outlook. If the central bank pours cold water on swift recovery expectations, that could offer a boost to the US Dollar. That may push USD/SGD, USD/MYR and USD/PHP higher. Be mindful that the Bank of Indonesia is being vigilant in actively intervening in foreign exchange markets to uphold its currency.

Another source of volatility could come from the Republican National Convention (RNC). There US President Donald Trump could reiterate some of his pledges, including his approach to foreign policy. Lately, US-China tensions have been in the spotlight after a review of the phase-one trade deal was postponed. Hawkish rhetoric against China could spook investors.

US economic data continues to outperform relative to economists’ expectations, opening the door to a rosy outcome in Conference Board Consumer Confidence on Tuesday. That could be a downside risk for the US Dollar. Meanwhile in the background, the Fed’s balance sheet just swollen past US$7 trillion again underpinning the central bank’s effort to keep credit markets lubricated. More support may further sink USD.

ASEAN, South Asia Event Risk – Singapore Industrial Production, Malaysian Trade Data

The ASEAN economic docket is fairly light this week, further emphasizing the focus for SGD, IDR, MYR and PHP on external event risk. On Wednesday, Singapore will release the latest update on industrial production. Output is expected to shrink 6.9% y/y in July versus -6.7% prior. On Friday, Malaysian exports are anticipated to drop 1.7% y/y in July versus 8.8% previously.

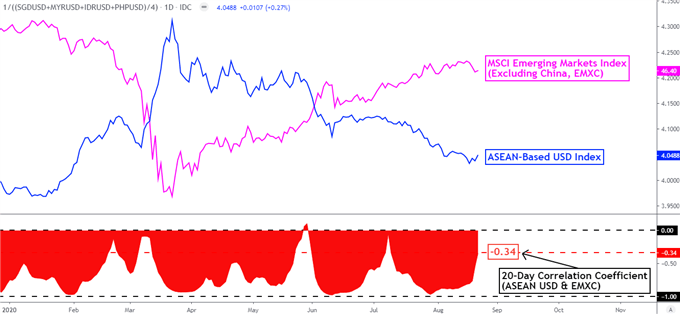

At the end of last week, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and the MSCI Emerging Markets Index, excluding China, (EMXC) stood at -0.34. This is down from -0.83 in the preceding week. Values closer to -1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-Based USD Index Versus MSCI Emerging Markets Index (Ex China) – Daily Chart

Chart Created Using TradingView

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

-- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter