NORDIC FX, NOK, SEK WEEKLY OUTLOOK

- US Dollar may rise against the cycle-sensitive Swedish Krona, Norwegian Krone

- Escalating US-China trade war tensions and Italian politics could spook markets

- Norges Bank may succumb to pressure of peers, dial down hawkish commentary

See our free guide to learn how to use economic news in your trading strategy !

The Swedish Krona and Norwegian Krone are likely in for a turbulent week ahead. The US-China trade war will continue to dominate headlines, though political risk out Italy may temporarily steal the spotlight. The Norges Bank rate decision will be closely watched by NOK traders while SEK investors turn their eye to CPI data and housing reports that may tell a chilling story about the Nordic financial system.

US-CHINA TRADE WAR: NO END IN SIGHT

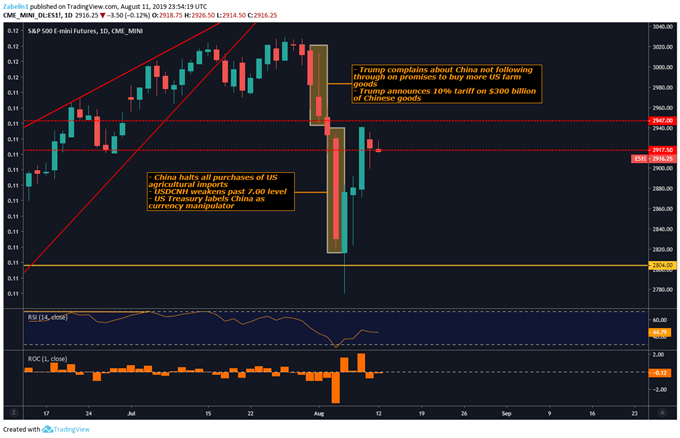

The US-China trade war continues to remain a headline risk with the prospect of meaningful reconciliation appearing to be a bleak hope. Markets were caught in Beijing and Washington’s crossfire this month which resulted in an over 5-percent loss in the S&P 500 in less than a week. The most recent developments include China’s decision to temporarily ban US agricultural imports with a possible a rare-earth mineral ban up next.

S&P 500 Suffers as US-China Trade War Tensions Escalate

S&P 500 chart created using TradingView

The global economy is increasingly showing more fragility as many central banks in major economies are cutting rates or are hinting at more accommodative policy. This is not entirely surprising, especially if one even scans the IMF’s most recent World Economic Outlook that highlighted heightened trade tensions as the primary factor inhibiting economic growth and cross-border investment.

ITALY POLITICAL RISK MAY SEVERELY PRESSURE NOK, SEK

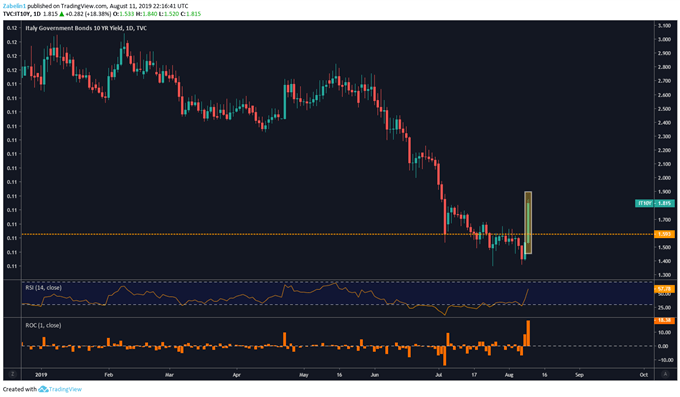

Italian politics may be the political headache de jure for European policymakers in the week ahead. The coalition government may dissolve as Deputy Prime Minister Matteo Salvini’s Lega Nord party prepares to file a vote of no confidence in the hopes of triggering a snap election. As a result, Italian bond yields spiked almost 20 percent on August 9, the biggest one-day change since the general election in May 2018.

Italian Political Risk May Shock Markets Again

Italian bond yield chart created using TradingView

If Mr. Salvini consolidates power, it could further pressure Italian sovereign bonds if investors anticipate that the Rome-Brussels budget dispute will once again resurface. Budget drafts for 2020 are due in October to the European Commission, the EU’s executive arm that almost unleashed the Excessive Deficit Procedure against Italy this year. This fear subsided around June, though it appears to be ready to make a reprise.

GERMAN, EUROZONE GDP: HOW BAD IS IT GOING TO BE?

Eurozone and German GDP will be released this week with anticipations of a quarter-on-quarter growth rate of 0.2 percent and -0.1 percent, respectively. With Germany’s reputation as the proverbial steam engine of Europe, a slowdown in the power node of growth may send a chilling message out to the region. Weaker demand out of the European core will likely weigh on the export-driven Swedish and Norwegian economies.

NORGES BANK MAY NEED TO RECONSIDER HAWKISH OUTLOOK

The Norges Bank (NB) will be announcing its rate decision this week with expectations that officials will vote to hold the benchmark interest rate at 1.25 percent. The NB remains one of the more hawkish central banks in the developed world. However, their inclination to raise rates may be undermined by weakening demand and the decline in crude oil prices.

For most of 2019, the Norges Bank has remained resilient and has been able to stave off adopting a more accommodative monetary policy that most of its peers have been forced to implement. The Norwegian Krone’s tie to Norway’s petroleum-based economy leaves it at the mercy of oscillations in crude oil prices that frequently move in tandem with market sentiment.

SWEDISH KRONA MAY SINK ON CPI DATA

It is likely the Krone will continue to seesaw between desperate hope and despair as political shocks and trade negotiations continue to rock markets. The Swedish Krona faces similar risks to the Krone, though local data this week may temporarily overshadow fundamental themes. Nordic traders will closely be watching the release of a CPI data dump that may miss estimates and fuel expectations of a delayed hike by the Riksbank.

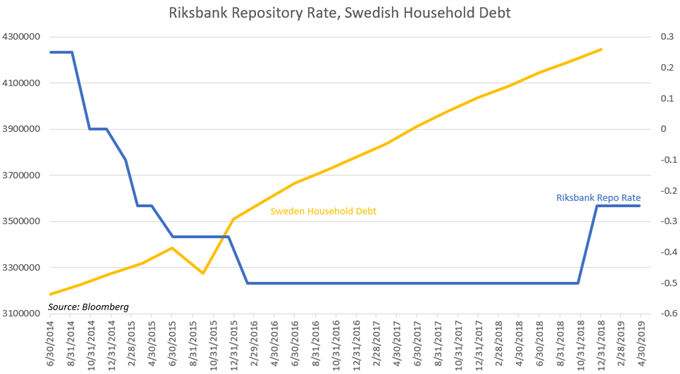

Investors may also keep a peripheral eye on the publication of housing data. Concerns about rising household indebtedness is continuing to haunt policymakers who fear an economic downturn could destabilize Sweden’s financial system and lead to a contagion effect that spreads throughout the Baltic states. A fragile global economy leaves what could be hidden weaknesses exposed to shocks that could trigger region-wide panic.

SWEDISH KRONA, NORWEGIAN KRONE TRADING RESOURCES

- Join a freewebinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter