OIL FUNDAMENTAL FORECAST: BEARISH

- Crude oil prices eyeing fragile US-China trade negotiations

- Will Iran tanker tracker data show impact of US sanctions?

- EIA report, US DOE publications may impact crude outlook

See our free guide to learn how to use economic news in your trading strategy !

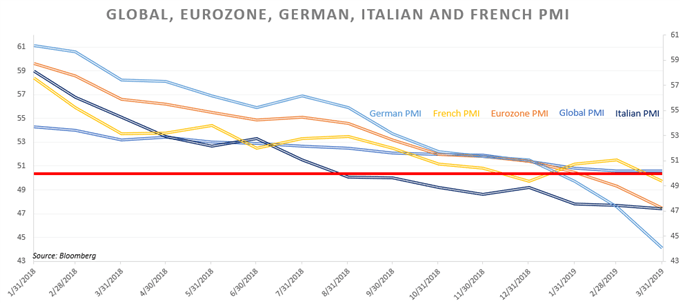

Crude oil prices may find themselves under pressure next week as a slew of data from the EIA, US, Iran and OPEC is set to cross the wires and reveal demand for the sentiment-linked commodity. On Tuesday, OPEC will be publishing its monthly report which will include production and demand forecasts. Given that prevailing global growth trends are showing weakness, such sentiment may be reflected in the outlook.

The following day, Iran tanker data will be published with expectations of reduced output as a result of the imposition of US sanctions. Against the backdrop are geopolitical risks from rising tension between Iran and Iraq that is being compounded by threats from officials in Tehran to close the Strait of Hormuz, a key choke point for oil exports emanating from the Person Gulf.

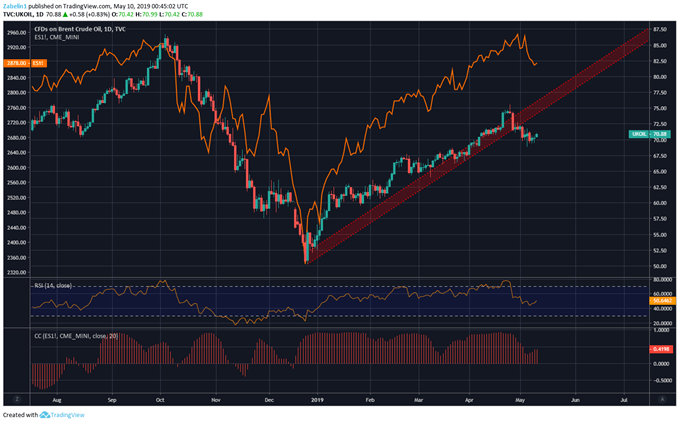

Despite rising risks of various potential supply shocks, crude oil prices are finding themselves jerked around more by prevailing trends in global sentiment. The fundamental theme driving the latter are US-China trade negotiations. Last week markets were roiled by news that Washington threatened to impose additional tariffs on Chinese imports. The S&P 500 along with crude oil prices and other risk-geared assets suffered.

Looking for a technical perspective on Oil? Check out the Weekly Oil Technical Forecast.

Crude Oil Prices, S&P 500 Futures

On May 15, the IEA will be publishing its monthly oil report which will also include forecasts for demand – or there lack of. In the US, if DOE crude oil inventories show rising stockpiles, it could pressure the sentiment-linked asset, compounded by fears that global demand for a key input is weakening. A boon for emerging markets, and a bane for crude oil exporters.

There will also a release of a preliminary reading of the University of Michigan sentiment indicator. Risk-oriented assets may be jolted if the reading shows a weakening outlook from the previous 97.2 release. Furthermore, external risks and growth indicators out of powerhouse economies – China, US and the EU – may also exert influence on sentiment and crude oil prices.

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter

Other Weekly Fundamental Forecast:

AUD Forecast: Australian Dollar Could Get Some Respite If Employment Keeps Revving