CRUDE OIL PRICE FORECAST – TALKING POINTS:

- Crude oil has climbed nearly 40 percent so far this year in response OPEC slashing production to restore supply and demand imbalances with further cuts still on the table

- Downward revisions to global economic growth forecasts continue to mount, however, which threatens bullish market sentiment and demand for crude oil

- Take a look at this article on How to Trade Crude Oil or check out these Top Crude Oil Facts to expand your trading knowledge

- Download the DailyFX Q2 Oil Forecast for our comprehensive outlook

Looking for a technical perspective on Crude Oil? Check out the Weekly Crude Technical Forecast.

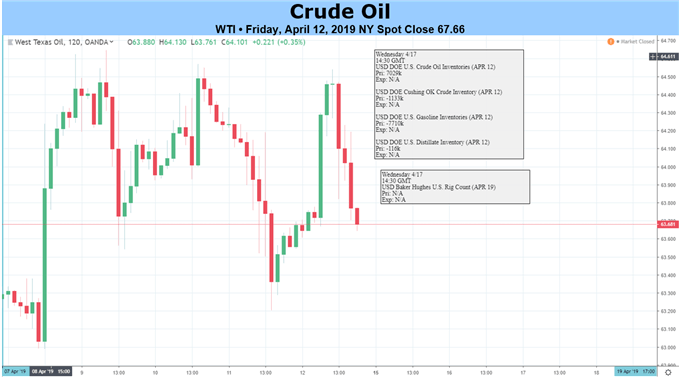

Crude oil continued its ascent this past week with prices gaining another 0.8 percent. Turmoil in Libya and ongoing tension in Venezuela likely weighed positively on crude seeing that the two countries are major oil exporters. Conflict between the US and Iran could have also helped boost oil prices considering the risk of President Trump extending Iranian restrictions.

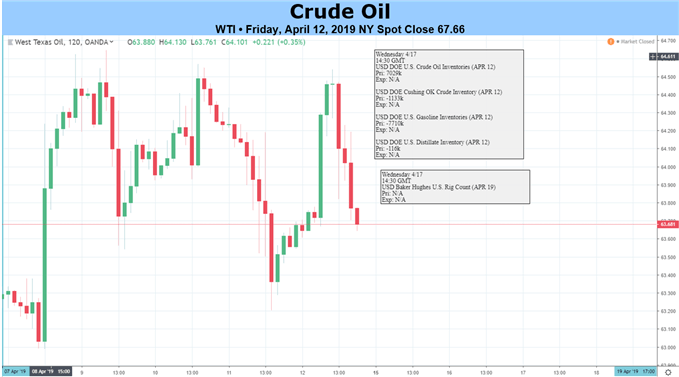

CRUDE OIL PRICE CHART: DAILY TIME FRAME (DECEMBER 28, 2018 TO APRIL 12, 2019)

The latest IEA report indicated a hefty drop in oil inventories over February which is likely another factor contributing to the climb in oil prices. Yet, majority of the aforementioned information is backward-looking or already baked into current prices.

On a less-brighter note, the World Trade Organization recently slashed its estimates for 2019 economic growth by a staggering 1.1 percent. Concerns over a further-deteriorating economy were subsequently echoed by the International Monetary Fund in its updated World Economic Outlook and Global Financial Stability Reports which struck a cautionary tone and cut GDP growth expectations from 3.5 percent to 3.3 percent.

Although, these developments regarding slower global growth seem to have gone unnoticed by risk assets and the oil market – eerily as it did at the end of 2018 prior to the widespread selloff. Moreover, news out that Russia has shied away from committing to extend oil production cuts along with OPEC could also weigh adversely on crude prices if this risk materializes.

That being said, the risk-reward proposition for oil bulls has grown increasingly less attractive with crude now eclipsing $63/bbl. Crude oil outlook remains neutral, however, due to upcoming seasonality effects that typically boosts oil prices in addition to uncertainty surrounding further OPEC supply cuts.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Other Weekly Fundemental Forecasts:

Australian Dollar Forecast – Australian Dollar Outlook Bearish on RBA. AUDUSD Eyes China Q1 GDP