IMF GLOBAL FINANCIAL STABILITY REPORT – TALKING POINTS

- The IMF stated in its most recent Global Financial Stability Report that ‘financial vulnerabilities continue to build’ and have led to ‘elevated medium-term risks’

- A sharp repricing of risk, intensification of trade tensions, further slowdown in global economic activity, and political shocks are listed as potentially destabilizing catalysts

- Looking to expand your trading knowledge? Take a look at this free educational guide that discusses the key Traits of Successful Traders

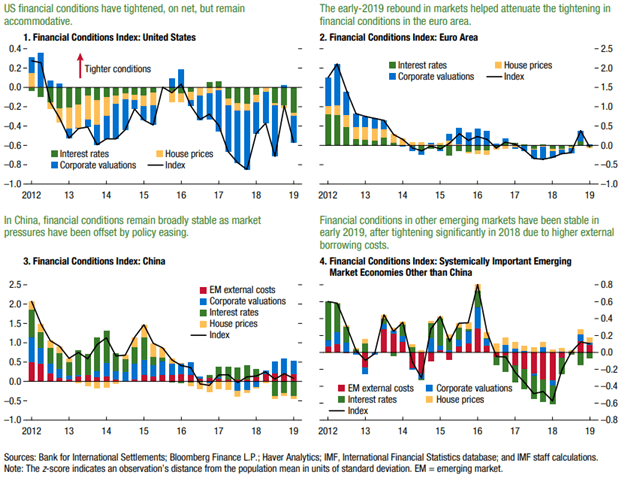

The International Monetary Fund has released its April 2019 Global Financial Stability Report (GFSR) which timidly assessed major threats currently faced by the global financial system. According to the latest GFSR, financial conditions generally remain accommodative across developed and developing nations but have tightened noticeably since October 2018 when the prior GFSR was published.

Due to persistent accommodative financial conditions, systemic weakness has grown more pronounced. As such, the GFSR warns about elevated risks over the medium-term posed by record-high levels of corporate debt, Eurozone woes, volatile portfolio flows, and lofty real estate prices.

IMF GLOBAL FINANCIAL CONDITIONS PRICE CHART: QUARTERLY TIME FRAME (JANUARY 2012 TO MARCH 2019)

Source: International Monetary Fund’s April 2019 Global Financial Stability Report

It is evident that financial conditions have become increasingly tighter since late-2017 despite easing somewhat last quarter subsequent to the sharp contraction experienced at the end of 2018. According to the GFSR, a backdrop of rising downside risks could cause financial conditions to contract sharply and abruptly. Highlighted as potential triggers included violent repricing of risks, escalation of trade tensions, further deterioration of global growth as well as possible political shocks.

Considering the acute rebound in risk assets after the widespread selloff that plagued markets over the fourth quarter last year, the IMF cautioned against the risk of recent positive investor sentiment suddenly deteriorating which would likely lead to financial conditions tightening precipitously.

The GFSR listed an unexpected shift towards less-dovish monetary policy, worsening economic growth and political risks as prospective causes for the next downturn in sentiment and financial conditions. If any of these potential catalysts materialize and consequently spark a tightening of financial conditions, a significant downturn could ensue and snowball into a much larger issue.

Complacency appears to have cultivated now considering that risk assets like stocks are within a couple of percentage points of their all-time highs despite growing signs of a deteriorating fundamental picture. Instead of pricing in these prevalent downside risks, equity markets look to have blindly rallied on the dovish shift by central bankers towards more accommodative monetary policy.

On a brighter note, however, the GFSR noted that if recent tariff hikes are scaled back and trade tensions deescalate, business confidence could rebound and lift economic growth. Moreover, prudent fiscal policy, proper regulation and defusing political pressures were also listed as possible solutions to reduce the aforementioned risks to financial stability.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter