NORDIC FX, NOK, SEK WEEKLY OUTLOOK

- USD/NOK, USD/NOK aiming to break above upper ranges

- Fundamental triggers this week may propel pairs higher

- Breaks above key resistance may reinforce bullish sentiment

See our free guide to learn how to use economic news in your trading strategy !

As outlined in last week’s technical outlook, USDNOK and USDSEK’s long term outlook suggests an upward bias for the pair’s movement. In the short term, however, both pairs may seem some minor congestion and possible consolidation before they resume their upward trajectory. Fundamental factors this week may be a key catalyst for breaking above the upper lip of each pair’s respective range.

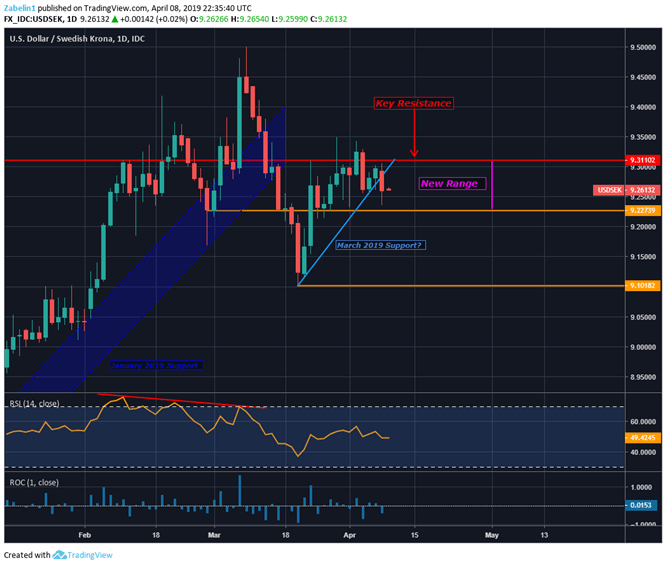

USDSEK TECHNICAL ANALYSIS

Since last week, the Swedish Krona has been outperforming relative to the US Dollar, though this appears to be more of a result of the latter’s overall weakness than a broader strengthening of SEK. The pair is expected to trade between the 9.2273-9.3110 (red and yellow line) range with some possible friction in soft-inter range resistance levels.

USDSEK – Daily Chart

Breaking above the upper lip would send a bullish signal to investors and could result in the pair trading higher if the breakthrough is met with follow-through. Following the March 7 ECB meeting, the pair jumped over one percent and reached a 17-year high before retreating. Despite the turn lower, it left a checkpoint and set the stage for what other potential re-entries will have to overcome to confirm uptrend resumption.

If you’re interested in trading the Swedish Krona and Norwegian Krone you may follow me on Twitter @ZabelinDimitri.

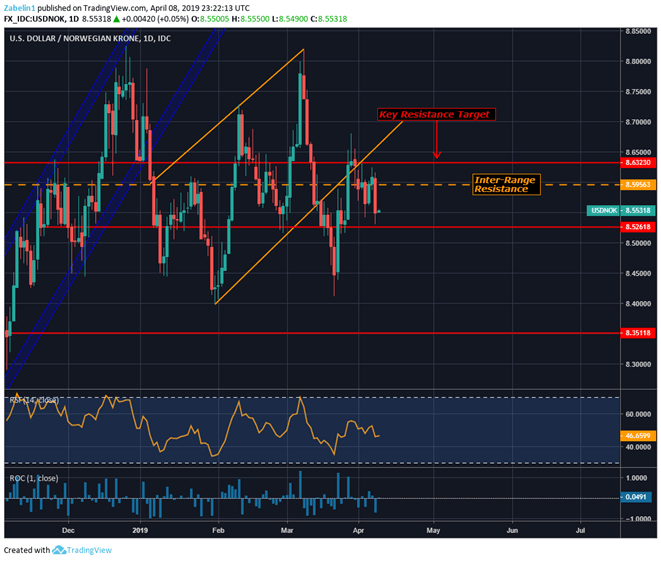

USDNOK TECHNICAL ANALYSIS

Since last week, USDNOK has fallen over one percent as crude oil prices climbed and overall US Dollar weakness was seen across the board. The pair is now stuck in what appears to be range between 8.6323-8.5956 (red lines) with possible inter-range resistance at 8.5956 (yellow dotted line). Despite the retreat, fundamental themes and triggers appear to be still in play and are set to continue pushing the pair higher.

USDNOK – Daily Chart

If USDNOK breaks and holds above the upper lip (8.6323), it could signal a reinforcement of bullish sentiment toward the pair and mark a significant price move. Since December, the pair has broken above this key psychological barrier but ultimately always retreated – albeit, with some hesitancy. The overall trend for the pair’s movement and several efforts to breach reinforce the pair’s stubborn persistence to climb higher.

SWEDISH KRONA, NORWEGIAN KRONE TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter