Talking Points

- “It’s not an exit bill, it’s not a punishment, it’s not a revenge, it’s simply settling accounts.”

- EURGBP hits a fresh 8-month high.

Looking for fresh trading ideas? - Get your free DailyFX Third-Quarter Trading Forecast and Trading Guide here.

Ahead of next Monday’s meeting, EU chief negotiator Michel Barnier was in no mood to offer his UK counterpart David Davis an olive branch as he once again highlighted the obligations that the UK must adhere to before trade talks could commence. Barnier said that there still remained ‘numerous differences’ on the rights of EU expats in the UK and that it would be a problem if the European Court of Justice was not allowed to be the ultimate guarantor of rights, something that the UK strongly opposes.

And turning his attention to the UK’s exit bill from the EU, put by the latter at around EUR100 billion, Barnier said, “It’s not an exit bill, it’s not a punishment, it’s not a revenge, it’s simply settling accounts. It’s not easy and it might be expensive, but we are not asking for a single Pound or Euro more than they have legally agreed to provide. You can discuss this or that budget line, but they have to start by recognising that they have entered into commitments.”

They size of the EU’s exit bill, recently described by UK Foreign Secretary Boris Johnson as ’extortionate’ could well prove to be the first, insurmountable block between the two parties, leaving the UK without any trade agreements when the Brexit process concludes in March 2019.

The Repeal Bill will also be presented to Parliament Thursday, the start of the UK converting thousands of pieces of EU law into domestic law. The Bill will be looked at, amended and is expected to be voted on in the next two-three months.

While GBP pushed ahead against an albeit slightly weaker USD to trade just under 1.29000, against the EUR the British Pound fell to a fresh eight-month low, despite better-than-expected UK unemployment figures. GBP rallied back against the single currency but the upward trend in EURGBP, seen since late-April, remains intact on the weekly chart.

Chart: EURGBP Weekly Timeframe (February 10, 2016 - July 12 2017)

A break above the EURGBP 0.91420 level would leave the pair open to highs last seen during the Sterling ‘flash crash’ in October 2016.

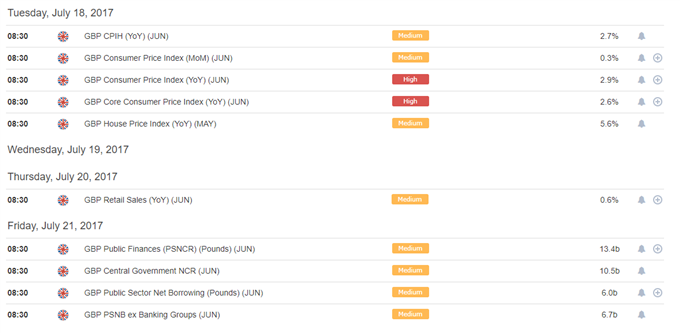

Apart from the Brexit meeting on Monday, the market will be closely following a raft of heavyweight data next week.

If you would like to get your free IG Client Sentiment trading guide and see how traders are positioned in a wide range of assets, please click here.

Markets

| Index / Exchange Rate | Change (Exchange Hours/GMT Session Rollover) | Market Close/Last |

|---|---|---|

| FTSE 100 | +1.38% | 7,423 |

| DAX | +1.52% | 12,620 |

| GBP/USD | +0.17% | 1.28680 |

| EUR/USD | -0.42% | 1.14180 |

| EUR/GBP | -0.51% | 0.88780 |

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Don't trade FX but want to learn more? Read the DailyFX Trading Guides