Talking Points

- Unemployment falls to a 42-year low of 4.5%

- BOE deputy governor not ready to vote for a rate hike, yet.

Looking for trading ideas? - Get your free DailyFX Third-Quarter Trading Forecast and Trading Guide here.

UK unemployment edged lower Wednesday, to 4.5% from 4.6%, while 175,000 new jobs 3m/3m were created in May, beating expectations of 120,000 new positions. And there was good news as well on the wages front with weekly average earnings ex-bonus rising to 2.0% from a prior 1.8% and beating expectations of a 1.9% rise. Average earnings slipped to 1.8%, in-line with expectations, from 2.1% prior.

GBPUSD, after starting the European session around 1.28200, picked up to trade unchanged on the day around 1.28495. The early weakness in the British Pound came on the back of commentary from Bank of England (BOE) deputy governor Ben Broadbent who said that he was not ready to vote for a UK interest rate hike as there were too many ‘imponderables’ hanging over the UK economy.

Chart: GBPUSD 5 Minute Timeframe (July 12 2017)

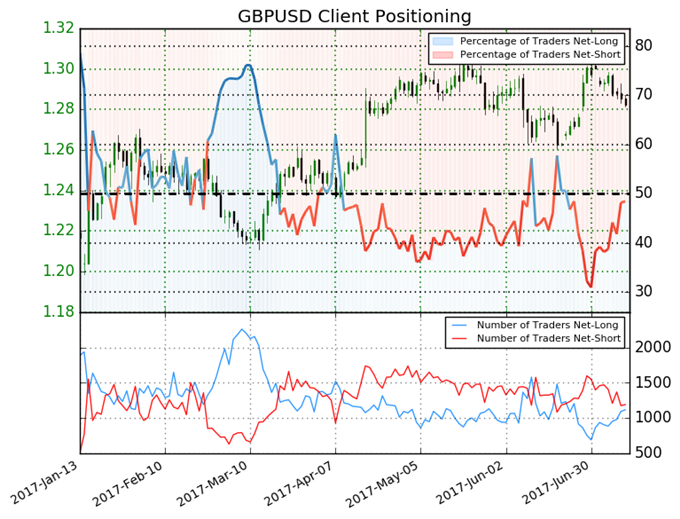

And a look at the latest IG Retail Sentiment Indicator shows that while traders remain net-short of sterling – normally a bullish contrarian indicator – traders are actually less net-short than yesterday and last week, suggesting a shift in sentiment and the potential for the pair to move lower.

Retail trader data shows 48.4% of traders are net-long with the ratio of traders short to long at 1.07 to 1. In fact, traders have remained net-short since Jun 23 when GBPUSD traded near 1.26787; price has moved 1.2% higher since then. The number of traders net-long is 13.0% higher than yesterday and 20.6% higher from last week, while the number of traders net-short is 12.9% lower than yesterday and 17.3% lower from last week.

If you would like to get your free IG Client Sentiment trading guide, please click here.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Don't trade FX but want to learn more? Read the DailyFX Trading Guides