EURUSD Talking Points:

- EUR/USD will be in the spotlight over the next two weeks as rate decisions take place out of both Europe and the US, with each carrying the expectation for a dovish policy move out of the respective Central Bank.

- The big question is whether these drivers can produce a break of the recent volatility slump that’s shown in the pair.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

EUR/USD in Focus Ahead of FOMC, ECB – Can They Break the Vol Slump?

The next two weeks bring key rate decisions out of both the US and Europe; each of which are highly-expected to carry some form of dovish policy as discussed by our own Nick Cawley earlier today. The ECB meeting is set for next Thursday, and the FOMC rate decision is the Wednesday after. In the US, the Federal Reserve is expected to cut rates for the first time in over a decade to the tune of 25 basis points. There are even some expectations for up to 50 basis points of cuts at the July meeting, and markets are currently looking for a total of three 25 basis point cuts by the end of this year. In Europe, expectations are high for a 10 basis point cut as Mario Draghi hosts one of his final rate meetings at the bank with his term is set to conclude in November.

In EUR/USD, volatility remains rather low as prices continue to show an element of digestion that’s been around for a couple of months now. After starting a bearish trend in April of last year on the back of fears around the political scenario in Italy, EUR/USD built-in support above the 1.1100 handle in the month of May , presenting a number of bear traps as sellers dried up. Since then, prices have stuck to a series of higher-highs and higher-lows through the month of June and the first-half of July.

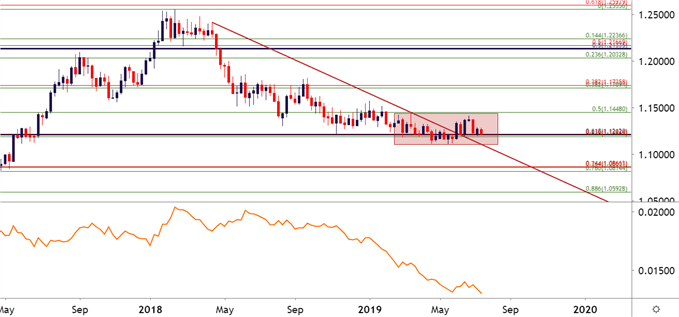

On the below weekly chart of EUR/USD, the Average True Range indicator has been applied to illustrate this waning volatility as prices have continued to compress through 2019 trade.

EUR/USD Weekly Price Chart: ATR Applied, Volatility Compression

Chart prepared by James Stanley

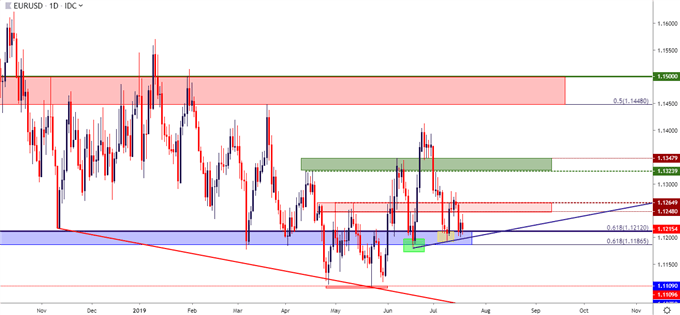

EUR/USD Higher-Highs, Lows Since Bear Traps in May

The sell-off in EUR/USD was already fairly extended coming into 2019. And this year has produced a dovish flip at the Fed after the bank’s four rate hikes last year. This has helped to bring some USD-weakness into the mix and when combined with the longer-term oversold nature of the Euro, this allowed for a short-squeeze scenario to come into play in the month of June.

Key for that theme form a technical basis was a range of support that’s had some element of pull on price action since coming back into play last November. This range runs from 1.1187-1.1212, with the former of those prices functioning as the 50% marker of the 2017-2018 up-trend; and the former price is the 61.8% retracement of the ‘lifetime move’ in the Euro. That 1.1212 level has come into play during many market themes since the Euro’s inception; and current price action is continuing to base support around this level.

EUR/USD Daily Price Chart

Chart prepared by James Stanley

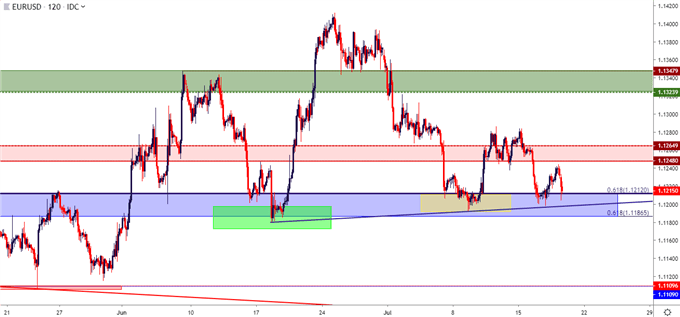

EUR/USD Strategy

At this point, the door remains open for topside swing strategies. This could be driven by expectations for a continued short-squeeze in the pair, bearish strategies around the US Dollar, or a dovish stance out of the FOMC beyond the rate cut that’s well priced-in for later this month. Until that support zone ultimately gives way, traders are likely going to want to remain cautious around short-side stances in the pair with targets directed towards that 1.1000 big figure that hasn’t been traded at for more than two years.

EUR/USD Two-Hour Price Chart: A Month of Higher Lows as Key Support Holds Sellers at Bay

Chart prepared by James Stanley

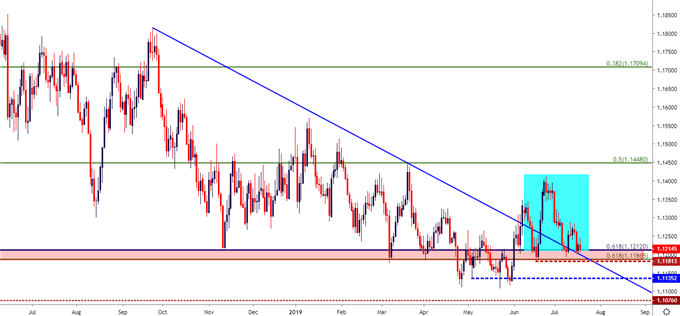

EUR/USD Bearish Scenarios

As mentioned above, given the adherence to support and the past month of higher-lows, EUR/USD bears will likely want to remain cautious until that longer-term zone of support gives way. But – given that we have an ECB meeting next week ahead of the FOMC, and that potential certainly exists, particularly if the bank talks up the prospect of even more QE.

For this approach, a break of the late-June swing-low around 1.1180 could open the door for bearish breakout strategies down to 1.1120. At that point, break-even stops could be investigated with deeper target potential down to 1.1135, 1.1076 and then the big figure at 1.1000.

EUR/USD Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX