Join me on Mondays at 7:30 EST/12:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

03/05 Tuesday | 03:30 GMT | AUD Reserve Bank of Australia Rate Decision

The Reserve Bank of Australia gathers this week for the second time in 2019, and once again, expectations for any change in policy are completely flat. Like at the February meeting, at 0% probabilities for either a 25-bps rate hike or cut, the coming RBA meeting will be defined by not what is done but rather by what is said. In a sense then, nothing has changed. Taking into account that inflation (+1.8% y/y last reading) is just below the midrange of the RBA’s target (+1-3%), the labor market is stable (5% unemployment rate), and the growing concerns of a global slowdown thanks to Australia’s two largest trading partners locked in a trade war, a broadly neutral tone by the RBA should be anticipated. There is a chance that the RBA begins tilting in a more dovish tone, however: prior to the February meeting, there was a 35% chance of a 25-bps rate cut by the end of 2019; prior to the March meeting, those odds have risen to 55%.

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

03/06 Wednesday | 15:00 GMT | CAD Bank of Canada Rate Decision

The Canadian Dollar remains on a rocky path thanks to ongoing turbulence in energy markets. With the oil industry accounting for nearly 11% of the Canadian economy, the steep decline in energy prices in Q4’18 had a material effect on growth: per the December Canadian GDP report, the economy contracted for the second consecutive month. Elsewhere, it can’t go unsaid that the Federal Reserve’s pause in its hike policy is giving the Bank of Canada to sit idly for the time being. Accordingly, rates markets aren’t pricing in greater than a 12% chance of a rate cut or hike at any point through July 2019. We’re expecting the BOC to signal that it’s firmly in a neutral policy stance, with the implicit understanding that energy prices will determine the next policy move.

Pairs to Watch: EURCAD, CADJPY, USDCAD

03/07 Thursday | 12:45 GMT | EUR European Central Bank Rate Decision

Even as economic data momentum has improved and inflation expectations have stabilized, the fact of the matter is that both market measures and realized data have showed that GDP and CPI are underperforming the ECB’s Staff Economic Projections back in December. The upcoming March Staff Economic Projections are very likely to see the 2019 inflation (December SEP: 1.6%; March SEP likely to 1.5%) and growth forecasts (December SEP: 1.7%; March SEP likely to 1.3-1.4%) knocked lower as a result; but the 2020 and 2021 forecasts are likely to stay intact.

While there will be some discussion of a potential funding cliff as ECB stimulus measures reach the end of their shelf life, it seems unlikely that another TLTRO is in the works for the March policy meeting. If “more monetary evidence” was required for such a policy move, not much evidence has materialized beyond weak topline economic data (corporate and sovereign credit spreads remain tame).

Accordingly, the previous hints at a hike to the deposit rate sometime around “summer 2019” should be eliminated completely by now; a June hike is almost certainly out of the question. But rates markets aren’t ready to throw in the towel for 2019 altogether, with overnight index swaps still pricing in a 53% chance of a move by December. Being pragmatic, it’s difficult to imagine that the new ECB president makes a policy change at their first meeting with new Staff Economic Projections, so any rate move in 2019 is realistically dead.

Pairs to Watch: EURGBP, EURJPY, EURUSD

03/08 Friday | 13:30 GMT | CAD Net Change in Employment & Unemployment Rate (FEB)

After a very strong January jobs report, the Canadian economy looks to return back to the trend that defined 2018: uneven performance. The February Canadian labor report is set to see a topline contraction of -2.5K, far below the +66.8K jobs added last month. The unemployment rate is due to stay on hold at 5.8% as a result (it is up from 5.6% in December). Such labor market data, coupled with the softening inflation backdrop, should give the Bank of Canada cover to keep rates on hold through mid-2019, mirroring the Federal Reserve’s policy tightening efforts (or lack thereof).

Pairs to Watch: EURCAD, CADJPY, USDCAD

03/08 Friday | 13:30 GMT | USD Change in Nonfarm Payrolls & Unemployment Rate (FEB)

Bloomberg News’ consensus forecast is estimating that the economy added +185K jobs in February, with the unemployment rate on hold at 4.0%. But there still appears to be some concern among market participants about a lingering impact of the US government shutdown. As a point of reference, the standard deviation of estimates for the November and January NFPs were 15.8K and 14.8K, respectively; for the January NFP, the standard deviation was 38K; and for the February NFP, it is 24K. So, there’s not as much uncertainty about the upcoming release as there was last month, but economists still aren’t back near their ‘normal’ level of disagreement; a wider dispersion of estimates is a clear sign that market participants unsure of how the data will actually arrive.

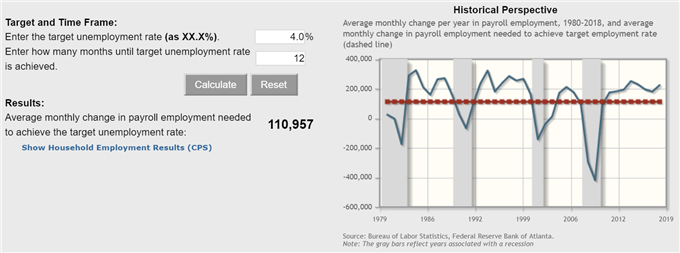

According to the Atlanta Fed Jobs Growth Calculator, the economy only needs +111K jobs growth per month over the next 12-months in order to sustain said unemployment rate at its current 4.0% level.

Pairs to Watch: EURUSD, USDJPY, DXY Index, Gold

Read more: Euro Forecast: March ECB Meeting to Highlight Risks to Eurozone

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX