Talking Points

- Forex Scalpers should always identify market conditions before trading

- Factor in the spread to reduce transaction costs

- Consider liquidity when trading to maximize trading

Scalpers are continuously faced with choices and tough decisions when trading Forex. On a day to day basis however, none is as important as deciding which currency pair to trade. Choosing a currency not only will affect the strategy we choose but ultimately our profitability as well. So today we will review two key factors that need to be evaluated prior to implementing your favorite scalping strategy.

Spreads and Cost

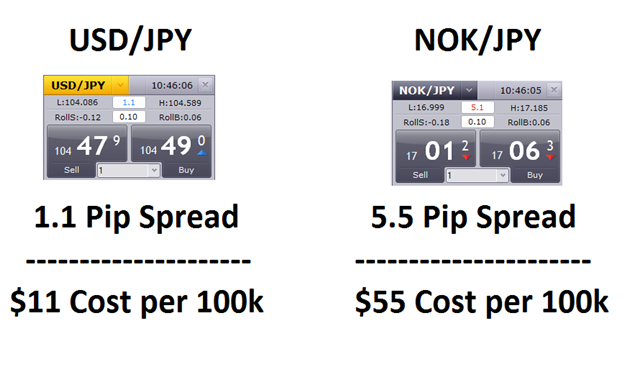

Spreads and costs should be on every trader’s minds, but they are particularly important to scalpers. Since scalpers tend to favor high frequency strategies, this means they will incur the spread more often than their average positions trader. So throughout the trading year, to keep costs down scalpers should gravitate to pairs with lower spreads. Let’s look at an example.

Above we can see the effects of trading a currency with a lower spread by comparing two yen pairs. First we have the USD/JPY with a 1.1 pip spread compared to the NOK/JPY with a 5.5 pip spread. Being Yen pairs at some point a trader may have to decide between the two pairs above. However when looking at spreads it should make this decision considerably easier. It costs more to trade the NOK/JPY! Traders save approximately $44 in spread costs per 100k transaction trading the USD/JPY!

Liquidity

Next when choosing a currency pair it is also important to consider liquidity. Liquidity in Forex is easily defined as the amount of currency quoted at any specific price point. Scalpers should value liquidity because it will ultimately coincide with the ease we enter and exit the market.

From a traders perspective, illiquid markets are known to be volatile and are more prone to market gaps based off of fewer buyers and sellers present in the market place. This happens since every buyer must transact with a seller, and the further they are off in regards to price the more a pair is prone to jump while exposing scalpers to slippage. This is compared to a deep market where there is a breath of market volume at multiple pricing points. With more liquidity available we increase the ease that we can enter and exit the market because more buyers and sellers are readily available to cross a scalper’s transaction.

Currency Pairs

Now that you know what to look for it’s time to narrow the field of potential pairs for scalping. Out of 50 plus different pairs offered for trading, traders should consider scalping pairs the Forex Majors . These pairs are comprised of the most frequently traded currencies in the world which helps when it comes to factoring in both spreads and liquidity.

Now that you are a little more familiar with the best currency pairs for scalping, we can now begin to look at the technical aspect of trading. Join me next week as we begin to evaluate charts and price action for Forex scalpers.

Did you miss one of the earlier editions of The Definitive Guide to Scalping? Catch up on all of the action with the previous articles linked below.

The Definitive Guide to Scalping, Part 1: Market Conditions

The Definitive Guide to Scalping, Part2: Currency Pairs

The Definitive Guide to Scalping, Part 3: Time Frames

The Definitive Guide to Scalping, Part4: Support & Resistance

The Definitive Guide to Scalping, Part5: Scalping Ranges

The Definitive Guide to Scalping, Part6: Scalping Retracements

The Definitive Guide to Scalping, Part7: Scalping Breakouts

The Definitive Guide to Scalping, Part8: Risk Management

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com

Follow me on Twitter @WEnglandFX.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE