Article Summary: Once you’ve spent a little time in the markets, you become familiar with the fact that markets are quick to consolidate after a trend. However, knowing when to jump back in the trend can be difficult to answer. The ABCD pattern takes the shape of a lightning bolt and is comprised of 3 distinct moves within specific Fibonacci relationships that can help you spot potential reversal zones so you can jump back in the direction of the overall trend.

The AB=CD pattern is simple once you know how to spot it and draw the proper Fibonacci retracements. The AB=CD pattern is a price structure that is adapted from another pattern known as the Gartley Pattern and can be applied to all markets in all time frames. Because a picture is worth a thousand words, let’s get started with a recent set up:

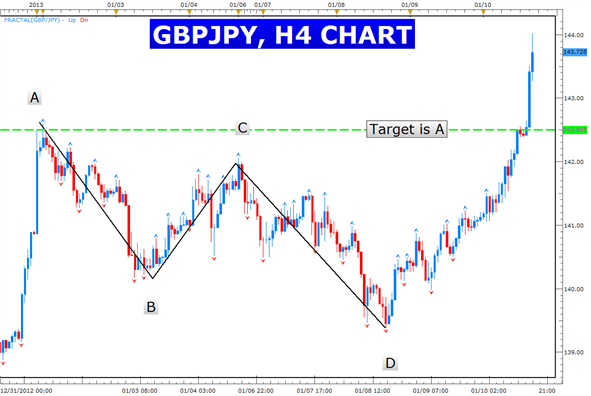

Learn Forex: AB=CD Pattern on GBPJPY, H4 Chart

Chart Created by Tyler Yell, CMT

There are three legs to this structure that will appear on the chart:

- A to B

- B to C

- C to D

Each part has a Fibonacci sequence that will confirm the move and the completion of the short term consolidation against the overall trend. Here are the Fibonacci ratios to determine the completion of the AB=CD pattern.

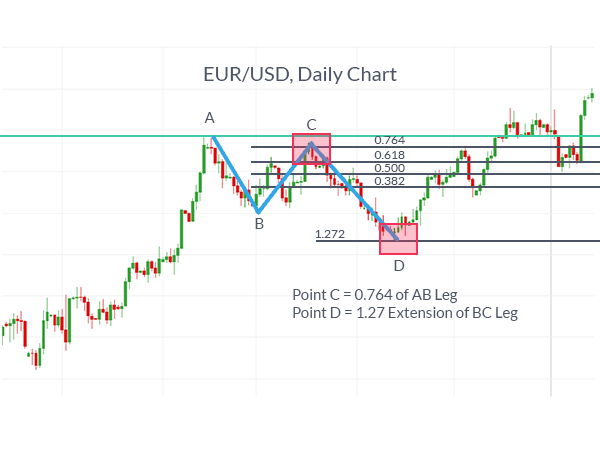

- C will be a .382 (less common), .500, .618 or .764 retracement of the AB Leg

- D will be a 1.27 or 1.618 Fibonacci extension of the AB Leg and will complete the pattern

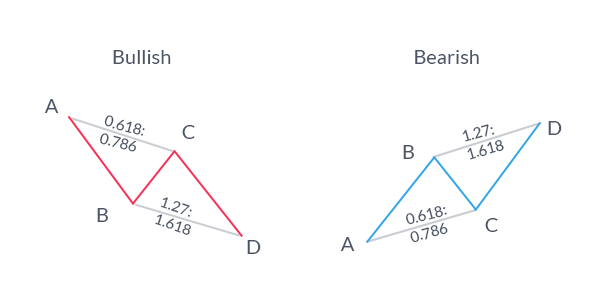

Naturally, there is a Bullish (meaning Buy at point D) and Bearish (meaning Sell at point D) Pattern. Here are the patterns absent from a current chart so you can see the Fibonacci ratios on clear lines:

Learn Forex: Classic AB=CD Patterns

One important note is that for the pattern to be valid, the C leg cannot extend or break the beginning of the pattern. Of course, we’re looking for the BC leg to finish at the possible Fibonacci retracement levels. Once that level is confirmed, we now look for the completion of D.

The completion of the CD leg will be measured as a Fibonacci extension of 1.27 or 1.618 of the BC leg. You can also take the distance of the AB leg to see how far the CD leg will travel as the AB=CD pattern gets its name because the two legs often mirror each other in distance and time.

Here is the same chart as above, GBPJPY, with the Fibonacci relationships explained.

Learn Forex: Fibonacci Retracement & Extensions displayed on GBPJPY, H4 Chart.

Trade Targets Once an AB=CD pattern has formed

Once the pattern has played out to the above ratios, you want to set your stop below or above the completion of D. Once you’ve done that, you can look for price to retrace back to point A or at least you can set a profit target for half or two thirds of the entire AB=CD move.

The AB=CD is a simple but powerful pattern. As you can see there many moving parts but when you learn how to spot and measure them they can be a powerful way to jump back into a trend after consolidation.

Conclusion

The two takeaway’s when trading this pattern is that it is best used in the direction of the overall trend. To help you identify the overall trend, you can use the Ichimoku Cloud or a Moving Average . Also, do not try and anticipate the pattern as it is forming. In other words, you are better served in finding a completed AB=CD pattern rather than trying to trade and guess the completion of an AB=CD pattern.

Happy Trading!

Next: Trading in the Clouds - The Art of Ichimoku, Part 1 (44 of 50)

Previous: The 77 Year Old Chart Pattern That Traders Still Love

---Written by Tyler Yell, Trading Instructor

Interested In Our Analyst's Best Views On Major Markets? Check Out Our Free Trading Guides Here