When studying technical analysis many traders come across a variety of methods for determining support and resistance. One of the most used methods for finding these pricing levels includes Fibonacci retracements. These retracements can be found using by using the” insert” feature found inside most charting packages. From here, Fibonacci retracement lines can be drawn by measuring the distance between an established swing high and low in a trending market.

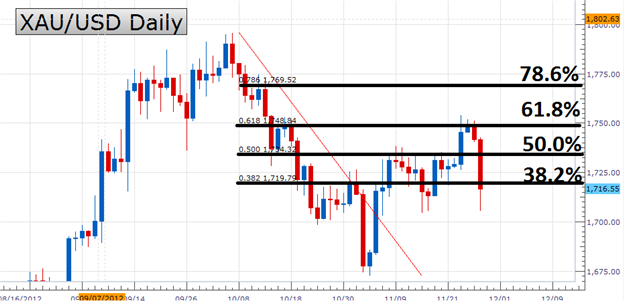

Below we can see Fibonacci retracements at work on a XAUUSD (Gold) daily chart. The Fibonacci retracements are measured by finding the distance between the daily high at $1,795.80 and the low at $1,672.50. Traditionally traders look for price to move towards the 23.6%, 38.2%, 50%, 61.8% and 78.6% levels for trading. Currently in our example, price has retraced as much as 61.8% of our initial decline. Traders watching this level for resistance can then move to employ the strategy of their choosing.

It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames. Once retracement levels are found, these technical points lend themselves to potentially trade a swing back in the direction of the primary trend. Traders can place entries near the Fibonacci retracements themselves, but more often than not Fibonnacci retracements can be used in conjuncture with other technical indicators.

Below we can again see our XAUUSD (Gold) Daily chart, this time including the MACD indicator. Traders will employ MACD to find out if momentum is returning lower, once price has found resistance near a Fibonacci retracement. Once a signal is confirmed, traders can plan to enter the market using market orders while limiting their risk using a stop above resistance established at the 61.8% retracement value.

Finally Fibonacci retracements can be useful in a breakout scenario. If prices continue to break out to higher highs, this is an implication that prices may be reverting against the direction of the prior move. In the example below, breakout traders can look for price to move through resistance at the 78.6% retracement. At this point entry orders can be set as XAUUSD begins to create new market highs. In this example stops can be set below resistance in the event of a false breakout.

Next: Trading the Pivot (8 of 47)

Previous: The Forces of Supply and Demand

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.