Talking Points

-Zigzags appear in the construction of many of the Elliott Wave patterns

-Zigzags subdivide as an A-B-C (5-3-5) sequence

-Many times, wave C can be estimated using common ratios and channeling

In Elliott Wave theory, a zigzag is a pattern consisting of 3 waves labeled A-B-C. Most of the time, the pattern will print in the direction against the main trend and is typically a counter trend formation. Zigzags are typically found in the 2nd wave of a 5 wave impulse and have a part in the formation of Elliott wave triangles. Many times, zigzags appear somewhere within a complex correction. There are even a few instances where a zigzag will print in the direction of the larger trend. As a result, the zigzag pattern is an integral price pattern which can be found in several locations within the eight wave Elliott Wave sequence.

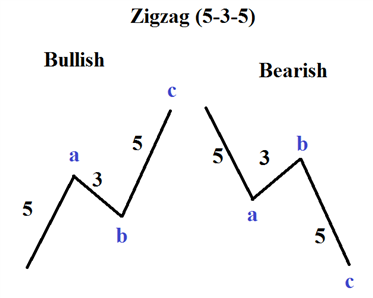

Zigzags can print in either the bullish or bearish direction.

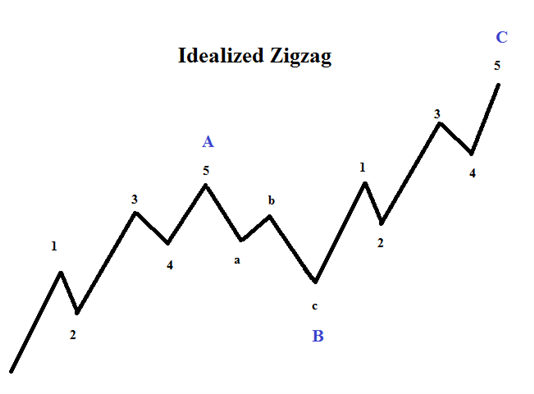

Idealized Zigzag

[Image 1]

Zigzags look like a lightning bolt on the chart. There are 2 rules for zigzags:

- The sub waves of an A-B-C zigzag appear as 5-3-5

- Wave B of the zigzag cannot retrace 100% of Wave A – most of the time wave B retraces 38-78% of wave A

[Image 2]

The 3 waves of the zigzag (A-B-C) subdivide as a 5-3-5 meaning the ‘A’ leg has 5 sub waves in it, the ‘B’ leg has 3 sub waves in it, and the ‘C’ leg has 5 sub waves in it. As a result of the ‘A’ and ‘C’ legs both containing 5 sub waves each, the impact of the whole zigzag structure is to be a deep retracement and recover a lot of price from the previous trend.

Also, the zigzag was designed to make progress against the trend. Therefore, wave B of a zigzag can be any 3 wave pattern (including another zigzag), but wave B cannot retrace 100% of wave A. A retracement of 99% is acceptable, though unlikely and progress needs to be made.

There are a couple of reasons why the 2nd wave of a 5 wave impulse is typically made up of a zigzag. The first reason is because the 1st wave is the start of a new trend, the 2nd wave can be latent desires for the old trend to continue. As a result, the 2nd wave acts as a shake out for the new trend traders and the old trend traders as a deep retracement is typically obtained. Second waves typically retrace 50-78.6% of the first wave.

Within the zigzag pattern, many times you can estimate the termination zone of wave C. In Elliott Wave Theory, alternating waves tend to be related in distance. Therefore, once we believe wave C has started, we can estimate the length of C based on the length of A. Wave C typically has an equal measurement to wave A, or a .618 or 1.618 multiple of wave A.

In the example below, we can see where wave ‘C’ was equal in length to wave ‘A’ at the black horizontal line labeled “100% 7488.2.”

Elliott Wave Zigzag That is an Equal Wave

![Equal Wave Zigzag [Image 3]](https://a.c-dn.net/b/0EBGT7/Elliott-Wave-Patterns-What-is-a-Zigzag-JWedu_body_EqualWaveZZ.png)

Additionally, it is common for the A-B-C zigzag to create a price channel. So we can use the price channel as a means to estimate the termination point of C and the zigzag pattern.

These price approximations become powerful when there are other wave relationships showing up in the same price zone as the estimated termination point.

Interested in learning more about zigzags, how to identify and trade them? Register and watch this hour long webinar recording solely on the topic of zigzags.

---Written by Jeremy Wagner, CEWA-M

Having a method to time trade entries is important. Managing your risk may be even more important. Learn how the better performing traders manage their risk by reading our Traits of Successful Traders research. [Free registration required.]

Follow me on twitter at @JWagnerFXTrader .

Read More: 3 Elliott Wave Flat Patterns to Know and Understand

The full suite of Elliott Wave resources can be found at the links below [registration required]:

Beginner and Advanced Elliott Wave trading guides

For more in depth study on Elliott wave patterns, we have these one hour webinar recordings:

Elliott Wave Impulse Patterns

Elliott Wave Zigzag Patterns

Elliott Wave Flat Patterns

Elliott Wave Triangle Patterns

Elliott Wave Diagonal Patterns

Starting Your Elliott Wave Counting