In this webinar recording from March 21, we answered one of the most common question I am asked. “How do I know where to begin counting waves using Elliott Wave Theory.”

It is a good question and much like one would put a 500-piece jigsaw puzzle together is how you can begin counting with Elliott Wave.

When putting a jigsaw puzzle together, I am looking for recognizable patterns and pieces that seem to fit in or near that pattern. For example, if it is a puzzle picture of an old barn out in the field, I am going to look for those pieces that seem to be connected with the barn.

We will apply that same concept to Elliott Wave. Look for recognizable patterns that help provide clues to identifying good chances at good risk to reward ratio trades.

Here are the three patterns discussed in the video that I will search for to help start the analysis.

- Equal Wave Pattern

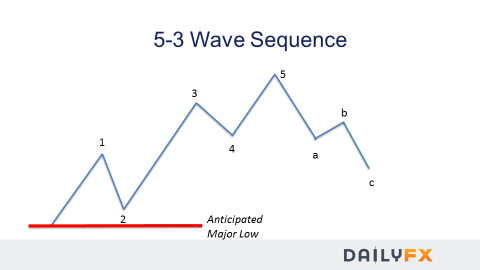

- 5-3 Wave Pattern

- Elliott Wave Triangle

(Example from the 5-3 Wave pattern – more can be learned from the Impulse video.)

See how Elliott Wave Theory is applied in the current environment in the main markets. Join Jeremy in the US Opening Bell webinar on Mondays.

If you cannot make the live webinars, but wish to learn more about Elliott Wave theory, grab our beginning and advanced Elliott Wave guides.

This video was the last in a seven part series. Find all seven here.

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at his Bio Page.

To receive additional articles from Jeremy via email, join Jeremy’s distribution list.