*** Update - EURGBP trade entered on November 28 at 0.8835 ***

Pending Long – 0.8835

Stop Loss – 0.8790

Target 1 (50%) – 0.8935

Target 2 (50%) – 0.8985

The DailyFX Q4EURand GBP Forecast s are available to download.

EURGBP – Solid Technical Support Nears

A battle of two of the current weaker currencies in the market has kept moves limited in the past few days as Brexit negotiations continue and fears that the Euro-Zone growth is weakening grow. Against other currencies, especially the USD, both GBP and EUR continue to struggle and are likely to remain weak as fundamental rule price action.

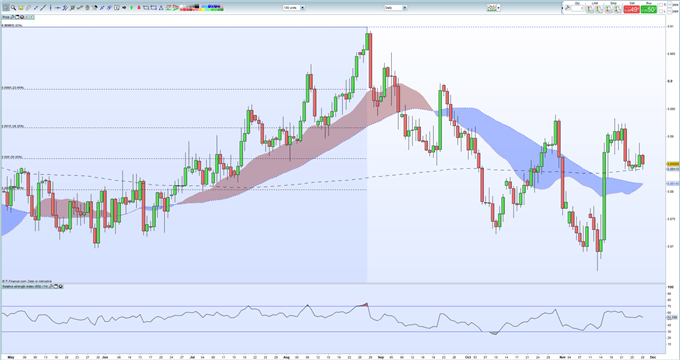

On a technical level, EURGBP is nearing a cluster of support levels that should hold unless something dramatic, and GBP positive, happens during current Brexit negotiations. On the charts, the 200-day moving average, currently at 0.8841 acts as first support with the 20- and 50-day moving averages at 0.8812 and 0.8814 close behind. To round off support levels, the 61.8% Fibonacci retracement level is fixed at 0.8803. This cluster of support should provide resilient in the current market and we would look to go long of a small break of the 200-day ma at 0.8835. We will keep a tight stop loss on this trade at 0.8790 and look for a short-time frame for the trade to play-out. Targets are set at 0.8935 (50%) and 0.8985 (50%).

It is worth noting that a break and close above 0.8940 breaks the sequence of lower highs started in late-August and would turn the chart slightly more bullish for the medium-term.

EURGBP Daily Price Chart (May – November 28, 2018)

IG Client Sentiment Data show that retail investors are 35.4% net-long EURGBP - a bullish contrarian trading bias – but when coupled with recent changes – traders are further net-long on a daily and weekly basis - this gives us a mixed EURGBP trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURGBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.