- Update on trade setup we’ve been tracking in USD/CAD and GBP/USD

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

Here's an update on the Canadian Dollar and the British Pound trade setups we’ve been tracking this week. For a complete breakdown of these trades and more, review this week’s Strategy Webinar.

New to Forex? Get started with our Beginners Trading Guide !

USD/CAD Daily Price Chart

I highlighted this setup in this week’s USD/CAD Technical Outlook as price was turning from confluence resistance at 1.3375- a level defined by the 50% retracement of the 2016 decline and the 61.8% line of the ascending pitchfork formation extending off the yearly lows.

USD/CAD is has taken out our initial support target at 1.3165 with price now probing a key support range at 1.3100/32 (low registered today at 1.3131). Watch the weekly close here in relation to the median-line. A close above would leave the pair susceptible to a rebound early next week. IF price is heading lower, rallies should be capped by the reversal-day close at 1.3248. From a trading standpoint, look to fade out of short exposure and bring stops to breakeven here. A downside break targets slope at ~1.3040s backed by the highlighted confluence region around ~1.2980s.

Learn the traits of a successful trader in our Free eBook!

GBPUSD Daily Price Chart

Our bottom line in this week’s GBP/USD Technical Outlook noted that, “The near-term risk is for a larger recovery on this rebound with our focus higher while above 1.3164.” Sterling stopped us out on the break below with price reversing off parallel support today. Note that this decline marks a third divergence point in the daily momentum profile and continues to highlight the risk for a recovery heading into July trade.

A weekly close above 1.3164 bodes well for the recovery play with key resistance (bearish invalidation) eyed at 1.3290-1.3311- a region defined by the June open, the 61.8% retracement of the monthly range, and the 50-line of the descending pitchfork extending off the yearly highs. That said, a break below 1.3027 would risk substantial losses for Sterling with such a scenario targeting 1.2877. From a trading standpoint, I’ll favor fading weakness while above the 1.31-handle targeting slope resistance.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

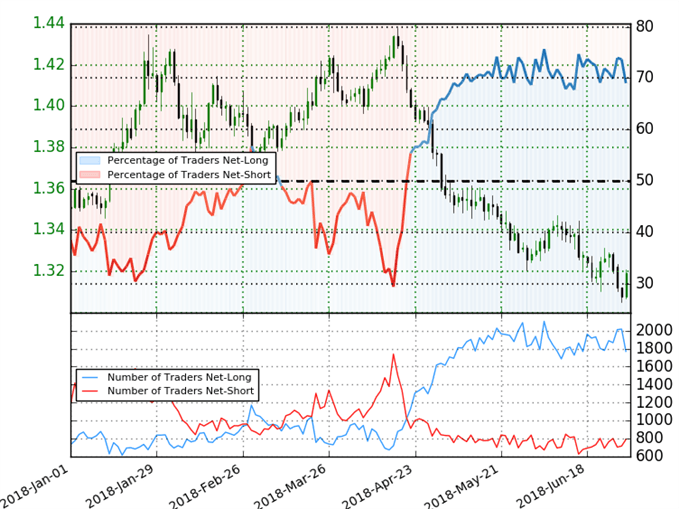

GBP/USDTrader Positioning

- A summary of IG Client Sentiment shows traders are net-long GBP/USD- the ratio stands at +2.23 (69.0% of traders are long) – bearishreading

- Traders have remained net-long since April 20th; price has moved 7.0% lower since then

- Long positions are 11.1% lower than yesterday and 3.8% lower from last week

- Short positions are 2.0% lower than yesterday and 2.2% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Sterling prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in GBP/USD retail positioning are impacting trend- Learn more about sentiment!

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com