- For trading ideas, please check out our Trading Guides. And if you’re looking for something more interactive in nature, please check out our DailyFX Live webinars.

To receive James Stanley’s Analysis directly via email, please sign up here.

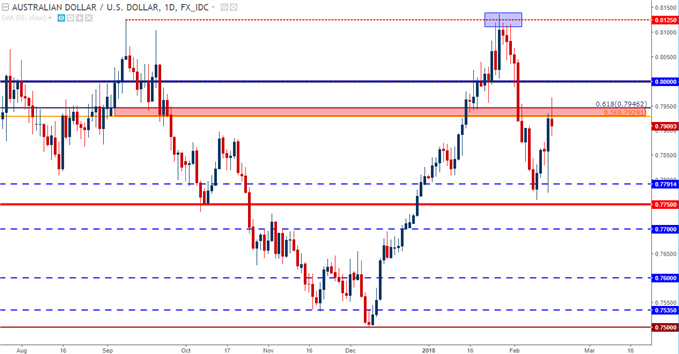

AUD/USD Rally to Resistance on US Dollar Weakness

The Australian Dollar started to see pressure in late-January after a false-breakout around multi-year highs, and that theme remained for most of the first half of February. This week has produced another lurch-lower in the US Dollar as that bigger theme of weakness continues, but this has helped to perk AUD/USD up to a level of confluent resistance that could be usable for bearish strategies.

The confluent zone is demarcated by two different Fibonacci retracement levels: the 50% Fib of the 2001-2011 major move rests at .7929, and the 61.8% retracement of the 2008-2011 move is at .7946. Collectively, these prices help to produce a zone of resistance that thus far has been able to help elicit sellers after this week’s advance.

Are you looking for longer-term analysis on AUD/USD, check out our DailyFX Forecasts.

This also opens the door to short-side strategies. Stops can be investigated above the psychological level of .8000, so that if bulls are able to continue driving, losses can be mitigated at around 100 pips. Initial profit targets can be set to .7785 for a better than 1-to-1 risk-reward ratio; at which point stops can be adjusted to break-even. Secondary profit targets can be set to .7700, .7600 and then .7525.

AUD/USD Daily Chart: Response Around Confluent Resistance .7929-.7946

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the Australian Dollar, or the USD? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on our AUD/USD, EUR/USD, USD/JPY and U.S. Dollar pages. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX