EUR/USD holds a narrow range after failing to test the 2018-low (1.1216), and the exchange rate may continue to consolidate ahead of the U.S. Non-Farm Payrolls (NFP) report as Federal Reserve officials strike a less-hawkish forward-guidance for monetary policy.

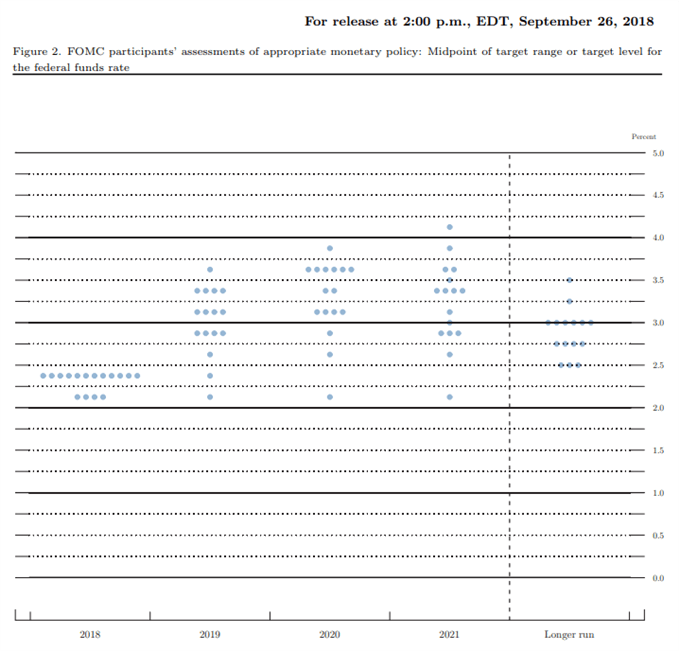

Even though the Federal Open Market Committee (FOMC) is widely expected to deliver a 25bp rate-hike later this month, recent comments from Fed Chairman Jerome Powell appear to be swaying the monetary policy outlook as the central bank head shows little interest in extended hiking-cycle.

Moreover, New York Fed President John Williams, a permanent voting-member on the FOMC, struck a similar tone as ‘there are risks on the horizon that we need to be very attentive to,’ and the committee may continue to change its tune in 2019 especially as Mr. Williams argues that ‘we’re well-positioned to adjust our path of interest rates if the economic data disappoint.’

With that said, Chairman Powell & Co. may continue to project a longer-run interest rate of 2.75% to 3.00% at the last meeting for 2018, and the FOMC appears to be on track to conclude its hiking-cycle next year as the central bank shows a greater willingness to tolerate above-target inflation.

In turn, updates to the NFP report may do little to influence the monetary policy outlook as Average Hourly Earnings are expected to hold steady at 3.1% per annum in November, and signs of limited wage growth may produce headwinds for the greenback on the back of waning interest-rate expectations.

Nevertheless, the diverging paths for monetary policy fosters a long-term bearish outlook for EUR/USD as the European Central Bank (ECB) is on track to carry the zero-interest rate policy (ZIRP) into 2019, with the Euro susceptible to a dovish policy statement as the Governing Council remains in no rush to normalize monetary policy. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

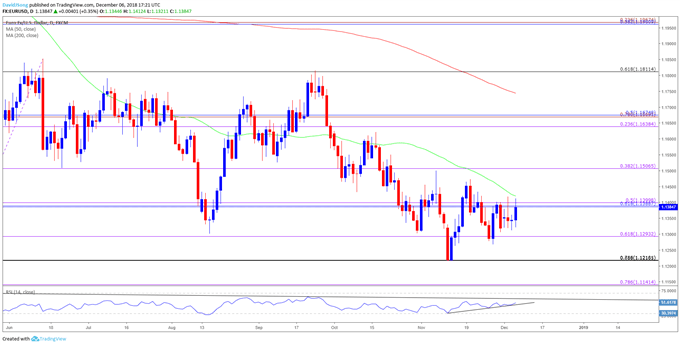

EUR/USD Daily Chart

Near-term outlook for EUR/USD remains uneventful as it carves a narrowing range, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator appears to be stuck in a wedge/triangle formation. In turn, the 1.1510 (38.2% expansion) region may keep EUR/USD capped over the coming days, with the first area of support coming in around the 1.1220 (78.6% retracement) area.

For more in-depth analysis, check out the Q4 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.