Canadian Dollar, USD/CAD Talking Points

- Canadian Dollar at risk as BoC reinforces economic outlook woes

- USD/CAD technical analysis hints reversal higher may be in play

- IG Client Sentiment underpins USD/CAD bullish scenario ahead

Build confidence in your own USD/CAD strategy with the help of our free guide!

Canadian Dollar Fundamental Outlook

Looking at an average of its performance against its major counterparts, the Canadian Dollar experienced its worst day in about a month on Wednesday. This was thanks to October’s Bank of Canada (BoC) monetary policy announcement, where rates were left unchanged at 1.75 percent as expected. What seemed to catch Loonie traders off guard was a material shift in the central bank’s tone.

Indeed it was an ominous one as the central bank said that the resilience of the economy “will be increasingly tested”. This was accompanied by a downgrade in 2020 GDP estimates to 1.7 percent from 1.9%. Policymakers noted that the global economic outlook has weakened further since their rate announcement in July. Local business investment and exports are likely to shrink in the second half of this year.

The Bank of Canada has thus far managed to avoid cutting rates in 2019, making it a standout among some of the major central banks amid a worsening outlook on the global economy – as noted by the IMF. The Canadian Dollar has thus managed to sustain its relatively high yield as one of the more-liquid currencies. If the BoC has to consider entering an easing cycle - i.e.capitulating - this is a downside risk for CAD.

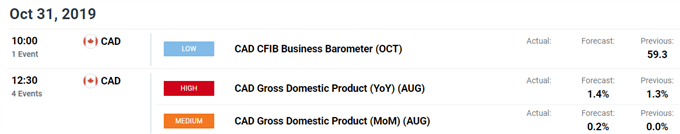

This will be tested when Canadian GDP crosses the wires on October 31. Growth in August is expected to rise 1.4 percent y/y versus 1.3% in July. This still leaves GDP rates around the same rates seen since the end of 2018. The larger picture has been slowing growth since 2017. While on average data has been tending to surprise higher in Canada, that has been by an increasingly smaller margin as of late.

Follow me on twitter @ddubrovskyFX for updates on the Canadian Dollar’s performance

Upcoming Canadian Economic Data

*All times listed in GMT

Stay updated on economic data outcomes on our calendar page !

Canadian Dollar Technical and Sentiment Analysis

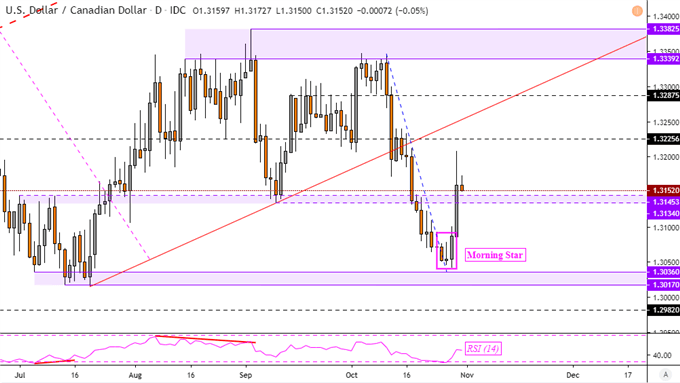

As anticipated, USD/CAD surged higher following the formation of a Morning Star bullish reversal pattern. Now that we have had a confirmatory upside close, this opens the door to an end of the dominant downtrend that has prevailed since earlier this month. The next level of resistance from here seems to be 1.3288 before USD/CAD faces the former rising trend line from July – red line on the chart below.

Meanwhile, the IG Client Sentiment report from October 30 showed that about 54.43 percent of USD/CAD traders remain net-long. Compared to the prior day, those net-short rose 55.84% while increasing 14.65% from a week ago. We typically take a contrarian view to crowd sentiment, and recent changes in positioning warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

Join me on Wednesdays at 1:00 GMT for discussions on what trader positioning is revealing about the outlook for markets !

The signals from fundamental, technical and IG Client Sentiment cues warn that there may be further weakness to be seen from the Loonie in the near-term. A better-than-expected local GDP report would likely pour cold water on these expectations in addition to a resolution between the US and China in their ongoing trade war.

USD/CAD Daily Chart

Chart Created Using TradingView

FX Trading Resources

- See how the Canadian Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter