- Reviewed by James Stanley, Nov. 24, 2021

A forex trading journal is a log of your trades that can help you refine your strategies based on learning from previous experiences. Just as a business owner tracks inventory, a trader should also keep up with their closed positions.

While keeping a trading journal may be difficult at first, recording your trades can help answer some critical questions about your trading techniques. It can increase the consistency of your trading, keep you accountable, and improve your technique overall. In this piece we will explore what you need to know about journaling, providing the following:

- A forex trading journal Excel template

- Tips on finding the journaling method that suits you

- Tips on the ideal forex trading workflow.

Forex Trading Journal Excel

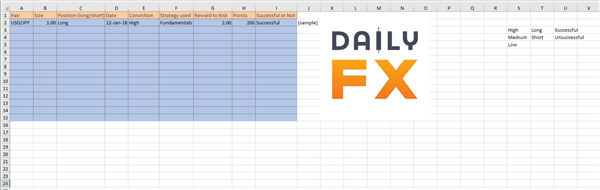

Screenshot showing a forex trading journal template

As in the forex trading journal Excel example above, your journal might contain information such as the currency pair traded, size of the trade, whether your position is long or short, the date of the trade, your conviction level, whether you’ve used a fundamental or technical strategy, the reward to risk ratio, points movement, and whether the trade was successful or not.

You may also want to include details such as the entry price, stop price and limit price, as well as lots traded. The more data you keep, the easier it will be to assess your past trades at a later date.

Also, be sure to include space to add notes in your journal. Traders using multiple entry techniques will want to track things such as chart time frames, indicators used, market conditions (range, trend, breakout) and any other information that factors into a trading decision.

Through journals such as the one above, over time the trader will be able to identify characteristics of winning or losing trades.

Journaling Approaches From expert Analysts

Tyler Yell, Experienced Currency Strategist

Tyler has been trading since 2008 with a focus on FX, Options, ETF's, and Commodity Futures.

Tyler’s typical trading journal entry is a few lines that include:

- A review of the risk management/position sizing strategy employed

- The underlying environment (trending or rangebound, and volatility metrics).

He also includes notes on why an entry order should be placed and a stop placed at the point that an equity drawdown is minimized and his technical viewpoint changes.

‘I often reduce my trade size so that I can stay in the market longer or until the technical bias is invalidated,’ he adds.‘The follow-up focuses on what types of currency pairs are reacting best to the currently employed strategy.’

James Stanley, Currency Strategist at DailyFX

James has been trading since 1999 and focuses on equity indices and ETFs along with forex.

James keeps a ledger rather than a journal. He tries to update it once a week with trades placed since the last update. ‘I keep everything in percentage format so I can make apples-to-apples comparisons, from equities to options to FX,’ he says.

‘As I’m filling this in, I can see trends as they happen(ed), largely by focusing on P&L, and if something is amiss, I’ll usually just think about it for a day or two while I come up with some form of a solution.’

As for considerations for improvement during drawdowns, James considers how aggressive or conservative he wants to be. ‘If I hit a bad streak the answer is usually just pulling back the throttle, smaller sizes, less leverage, fewer but more selective entries.

‘The polar opposite of that is being too conservative, and I can usually catch that as it’s happening, so I don’t often have to encourage myself to get more aggressive.’

This brief insight into the journaling and trading workflows of our analysts may or may not resonate with your own. There is no correct method, but there are a range of approaches listed below that can be tried.

Finding the Journaling Method That Suits You

Finding the journaling method that suits you will take trial and error, and there are a couple of approaches. Either you will keep your trade journal private and review it on your own, or you can allow other traders to take a look at it and give feedback. Both methods are effective and will help keep you accountable.

If you go the personal journal route, it’s probably easiest to keep your thoughts and screenshots in a Word doc (although a physical notebook could work to simply jot down your thoughts).

For a public journal, you will probably want to record your trades and thoughts on an online blog or forum. This will allow traders from anywhere in the world to see your trades win, lose or draw.

Whether you are reviewing your journal yourself or allowing people online to review it, this gives you extra incentive to place clear, valid trades on your account and make it more difficult to deviate from your strategy.

You will know in the back of your mind that you will have to face your decisions later on in your journal and possibly have to face others if your journal is public. This will help you become more aware of times when you let emotions dictate your decisions rather than your strategy’s logic or when you decide to ‘get creative’ and place a rogue trade without a strong basis for it.

It’s good to have accountability. Many traders can fool themselves into thinking they are rationally making trading decisions only to find out later that they didn’t follow their strategy at all.

Top Forex Trading Tips: Journaling and Your Trading Workflow

The workflow for a trader should involve a combination of scanning the charts and reviewing the news, entering and managing trades, and journaling the trade at the end (and possibly start) of the process.

Review charts

Look at the opportunities available in the market, whether it be identifying technical chart patterns, or acting on fundamental factors such as news releases. At this point, you may want to journal the potential pairs to trade and your thought process on selecting them.

Find an opportunity

Identify an entry, mark up your chart and make a note on your chart on the reason for the entry.

Enter Trade

Once you place the trade, add your profit targets and take profits. At this point, you will probably be too busy with the trade to journal.

Manage Trade

Trade management at this point may include pyramiding, or multiple profit targets. Managing the trade requires your full attention, so your journaling may be limited to screenshots.

Review and Journal the Trade

Now that the trade is closed, you can set to work journaling, assessing your screenshots and any notes you took to analyze the trades, work out where you may have made a mistake, and consider what you need to do to improve.

Check out our resources on forex trading tips

For more information on forex trading tips, check out our forex real time news section. Also, be sure to download the forex trading journal template from Page 5 of the Building Confidence in Trading guide, which can be accessed via the link above.