US Dollar, Japanese Yen, USD/JPY - Outlook:

- Intraday charts point to some more gains in USD/JPY.

- However, the upside could be limited as USD/JPY approaches a stiff resistance area.

- What are the key signposts to watch?

USD/JPY SHORT-TERM TECHNICAL OUTLOOK - NEUTRAL:

The downside in the Japanese yen could be limited against the US dollar as it approaches strong support ahead of the changes at the helm of the Bank of Japan.

The nomination of former BOJ policy board member Kazuo Ueda as the central bank governor has cooled speculation of an earlier normalization of interest rates. In the past, Ueda has warned of the dangers of premature interest rate hikes, putting to rest any concerns about higher policy rates in the foreseeable future. However, a reassessment of the yield curve control policy can’t be ruled out given that he has highlighted its potential flaws. The perception that Ueda could tweak YCC given accelerating inflation could at the very least cap USD/JPY’s rise.

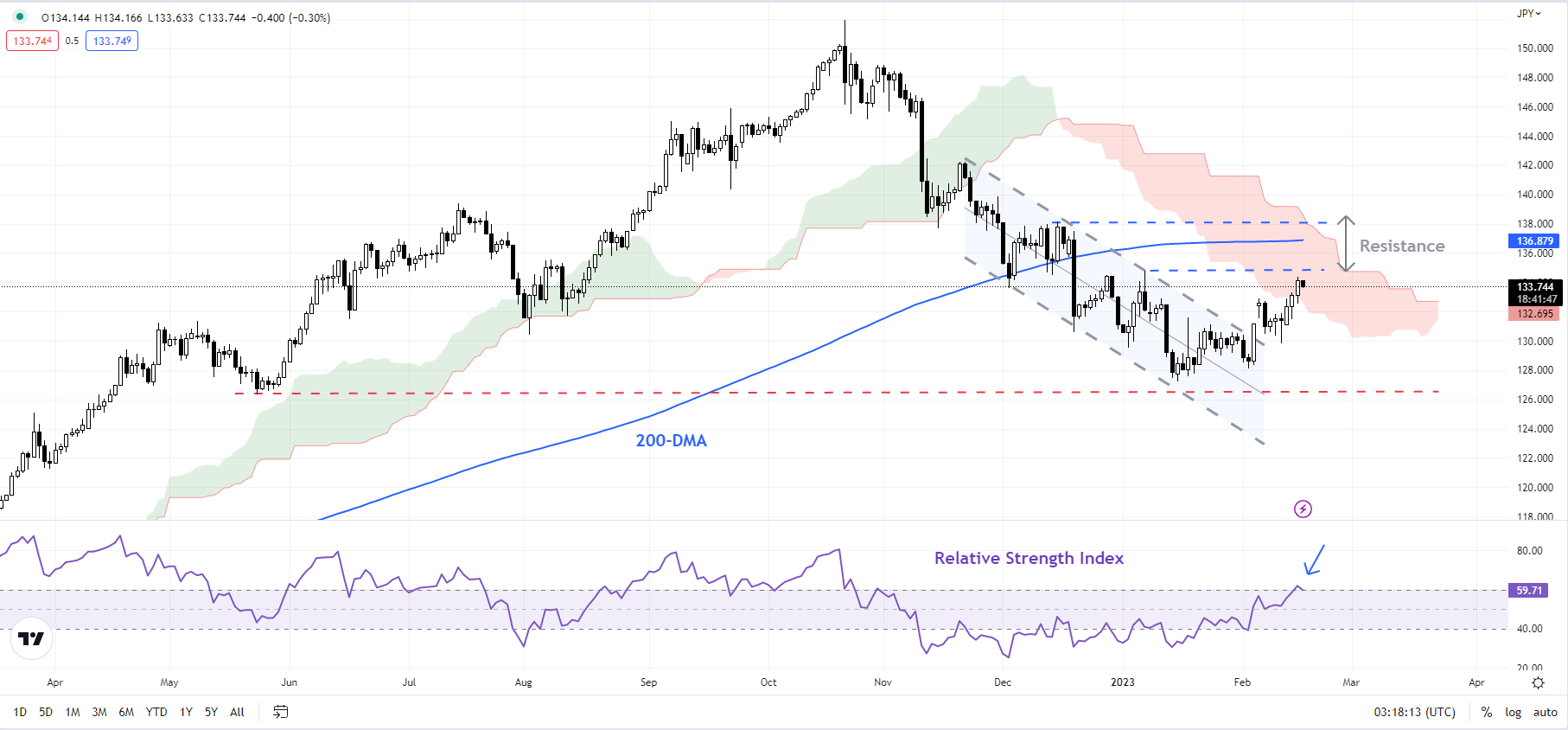

USD/JPY Daily Chart

Chart Created Using TradingView

USD/JPY, up over 5% from a seven-month low hit in January, is running into a tough converged hurdle at 134.00-137.00, including the 89-day moving average, the 200-day moving average, around the early-January high. The 14-day Relative Strength Index (RSI) is near a crucial ceiling of 60 from where the previous retreat in December took place. While the price action is still unfolding and the RSI could go higher, corrective rallies generally tend to stall around RSI levels of 55-60.

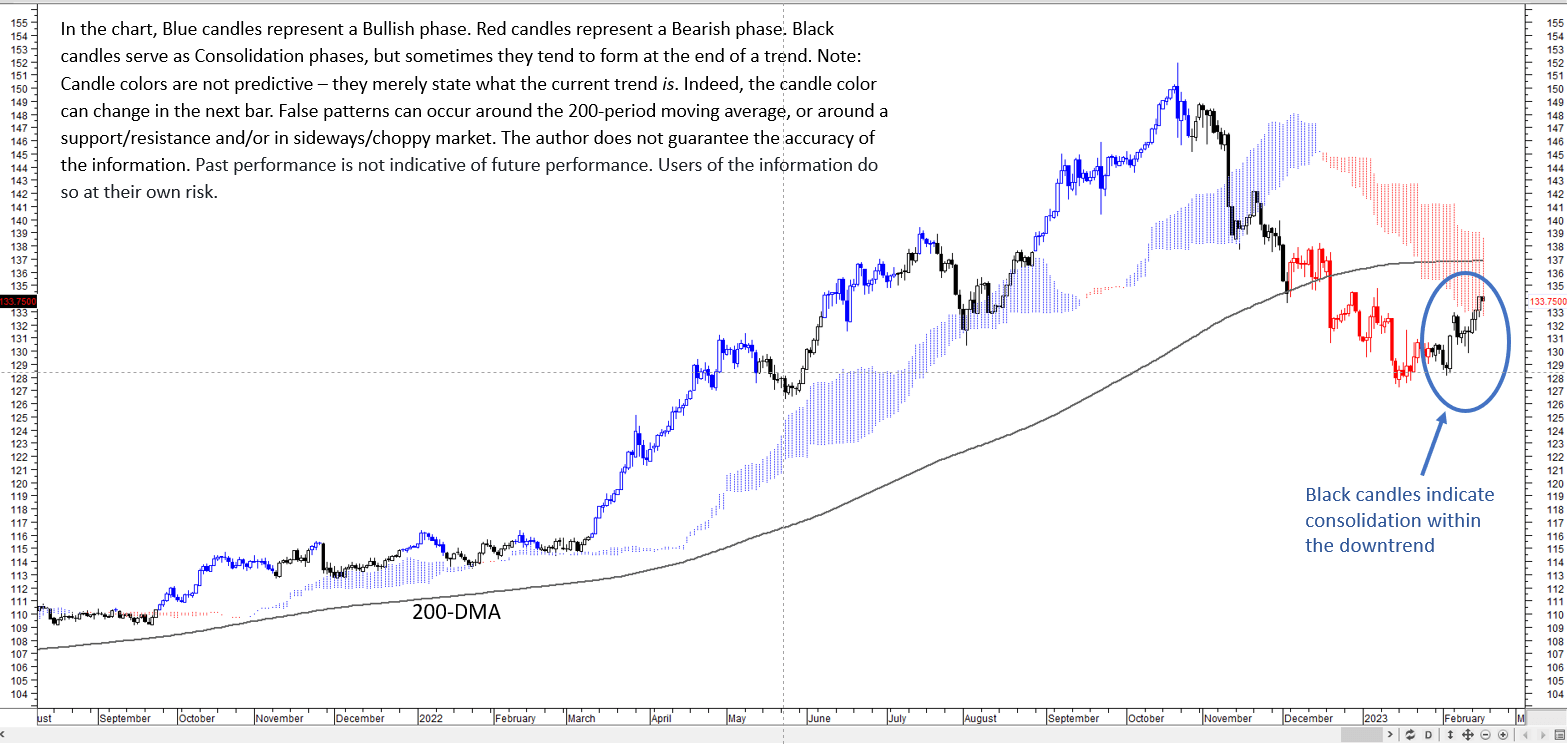

USD/JPY Daily Chart

Chart Created by Manish Jaradi using Metastock

As the color-coded candlestick chart, based on trending/momentum indicators, shows the medium-term trend is down for USD/JPY, and the most recent rally is a consolidation within the broader downtrend –a risk highlighted in recent updates (see “Japanese Yen Technical Outlook: Is USD/JPY Building a Base?”, and“Japanese Yen Technical Outlook: What’s Next for USD/JPY After BOJ”, published late January).

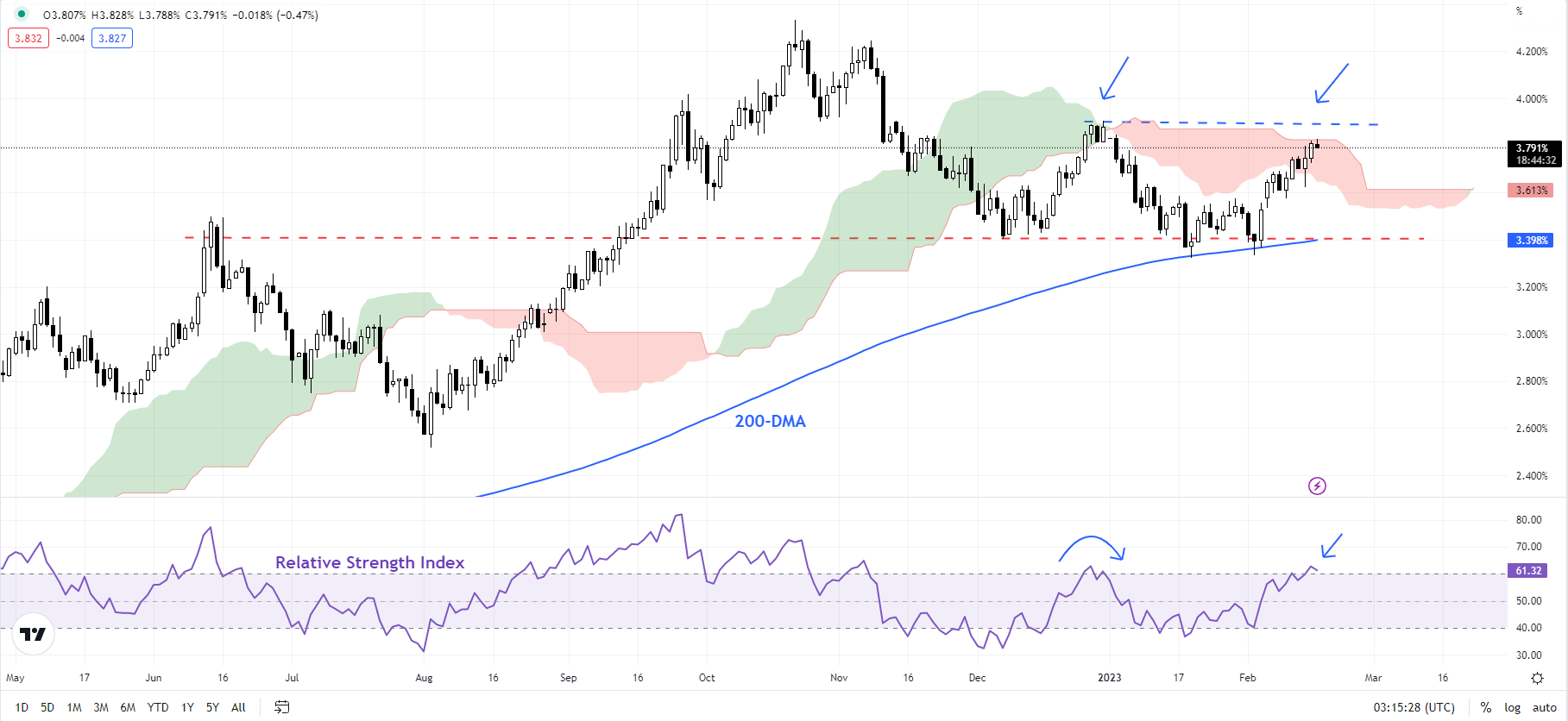

US Treasury 10-year Yield Daily Chart

Chart Created Using TradingView

This is further reinforced by developments on the technical charts of the US Treasury 10-year yield, which is now testing a similar stiff barrier, including the December high of 3.90%, roughly coinciding with the upper edge of the Ichimoku cloud. The difference of course is that the yield hasn’t broken a meaningful price pivot compared with USD/JPY, suggesting that BOJ policy could be starting to be a stronger driver than US Treasury yields for now.

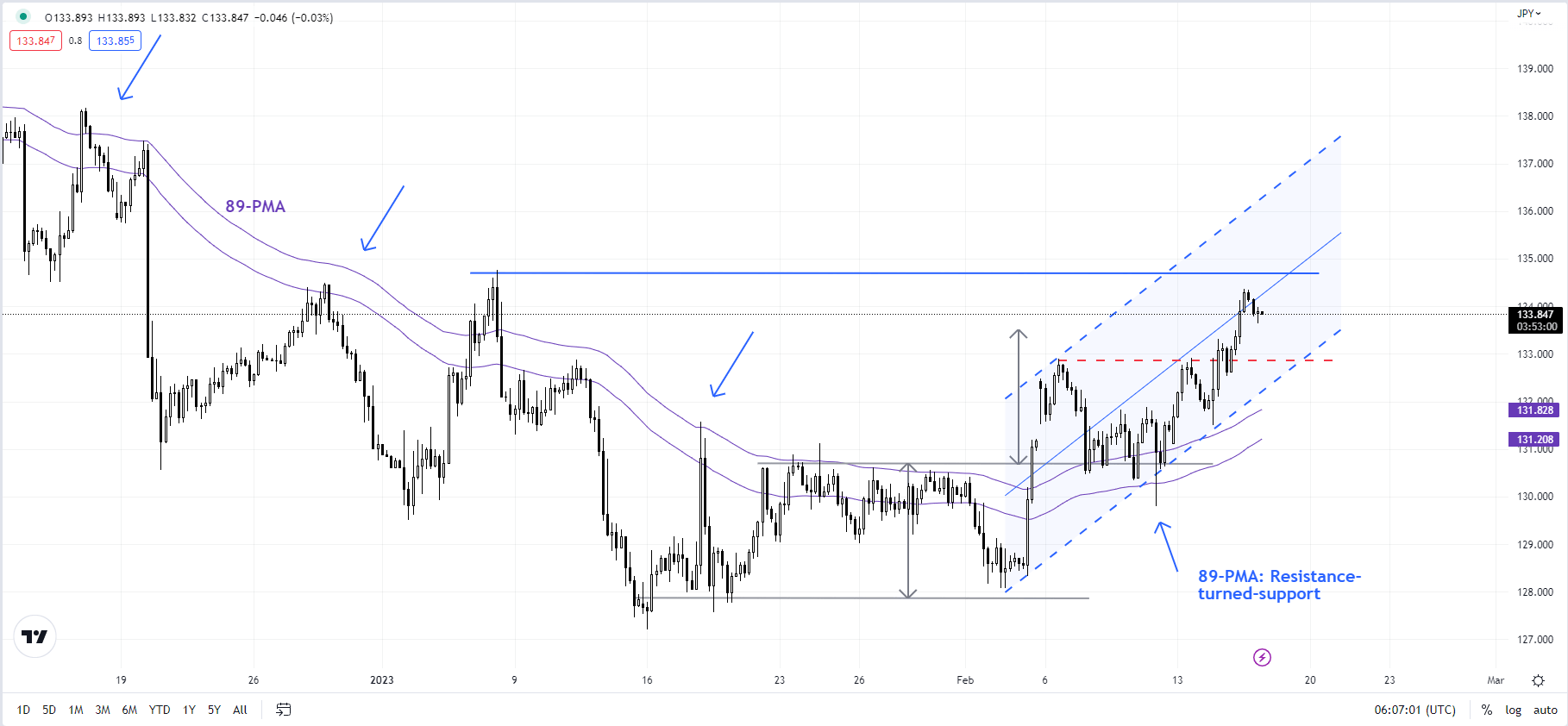

USD/JPY 4-Hourly Chart

Chart Created Using TradingView

Having said that, there are no signs of reversal of the nascent uptrend. The upward momentum on intraday charts continues to be strong (see 4-hourly chart). The immediate upward pressure is unlikely to ease while the pair holds above the initial cushion at the February 6 high of 132.90, roughly around the lower edge of a rising channel from early February.

--- Written by Manish Jaradi, Strategist for DailyFX.com