Gold, Retail Trader Positioning, Technical Analysis – IGCS Update

- Gold prices fell the most last week since June 2021

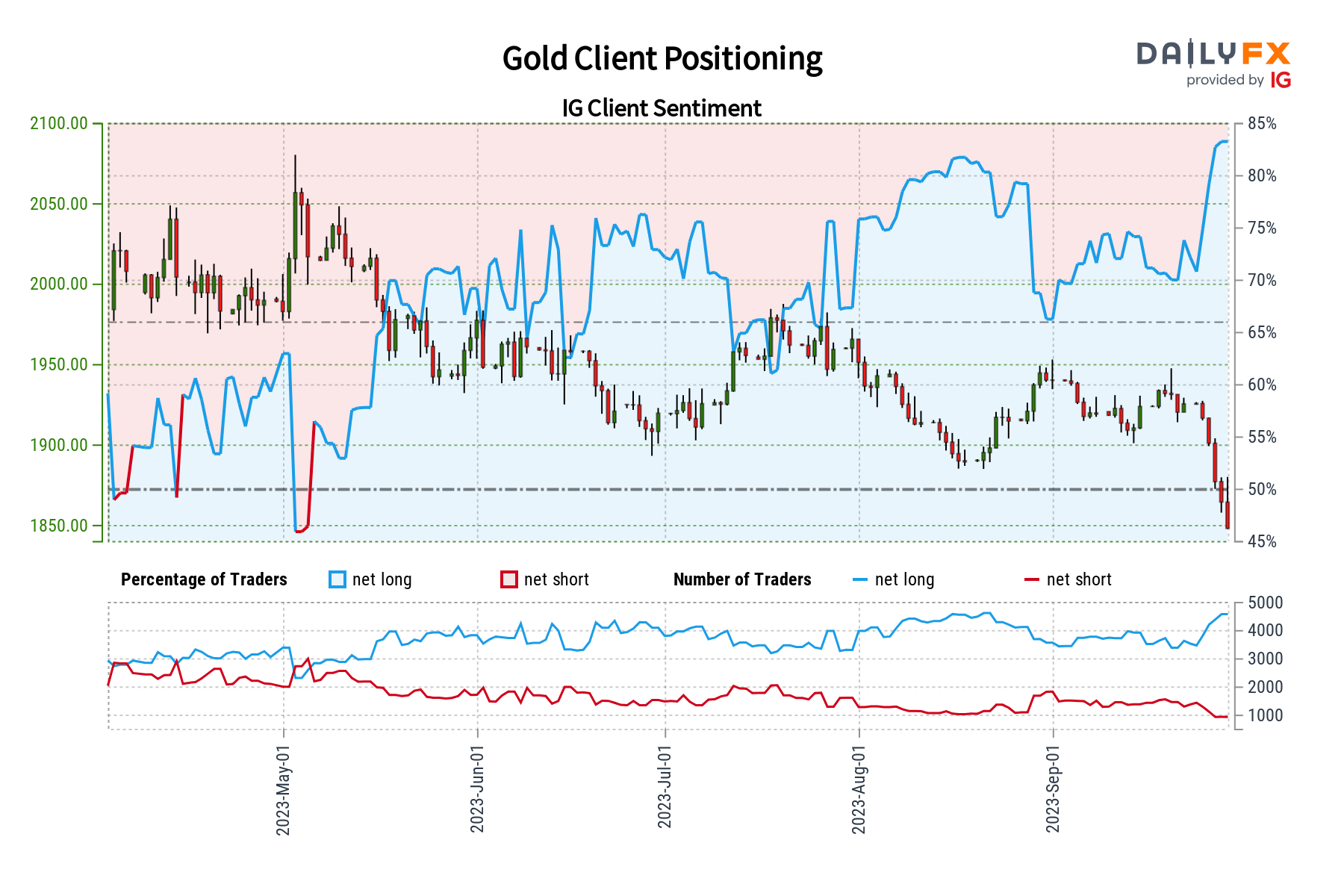

- And now, 85% of retail traders (IGCS) are net-long

- Overall, things are not looking great for XAU/USD

Gold prices sank about 4 percent last week. To give some context, we have not seen this kind of performance since June 2021. Meanwhile, retail traders continue to increase their upside exposure in XAU/USD. This can be seen by looking at IG Client Sentiment (IGCS), which frequently worked as a contrarian indicator. As such, things may not be looking too good for gold as the new week begins.

Gold Sentiment Outlook - Bearish

The IGCS gauge shows that a strong majority of 85% of retail traders are net-long XAU/USD. Since they are overwhelmingly biased to the upside, this continues to hint that prices may fall down the road. This is as upside exposure increased by 4.9% from last Thursday through Friday and 34% compared to one week ago from last Friday. With that in mind, the combination of overall exposure and recent changes produces a stronger bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -6% | -1% |

| Weekly | -4% | 0% | -3% |

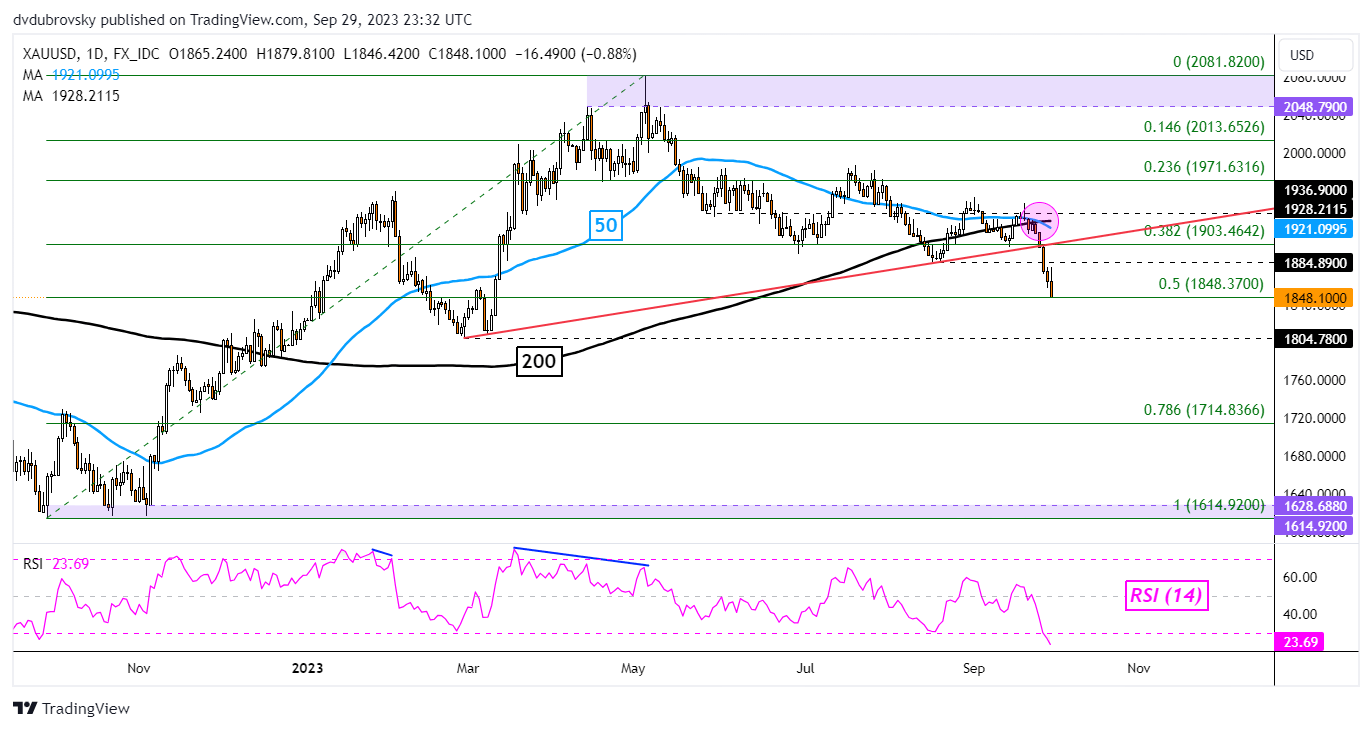

XAU/USD Daily Chart

On the daily chart, gold prices have continued to make further downside progress after confirming a breakout under the rising trendline from February. Now, a bearish Death Cross between the 50- and 200-day Moving Average has recently formed, further underscoring a bearish technical bias.

Now, prices are facing the midpoint of the Fibonacci retracement level of 1848.37. A breakout lower exposes the February low of 1804.78 before the 78.6% level of 1714.83 comes into focus. Otherwise, a turn higher places the focus on the 1884.89 inflection point.

-- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com