Gold, Silver, Retail Trader Positioning, Technical Analysis – IGCS Commodities Update

- Gold and silver prices have been rising following SVB’s collapse

- Retail traders responded by boosting their downside exposure

- Is this a sign that more upside could be in store for XAU & XAG?

In the wake of last week’s collapse of Silicon Valley Bank, gold and silver prices have soared as Treasury yields declined. Retail traders have responded by increasing downside bets in XAU/USD and XAG/USD. This can be seen by looking at IG Client Sentiment (IGCS). IGCS tends to function as a contrarian indicator. With that in mind, if retail traders continue boosting bearish bets, could gold and silver see further upside?

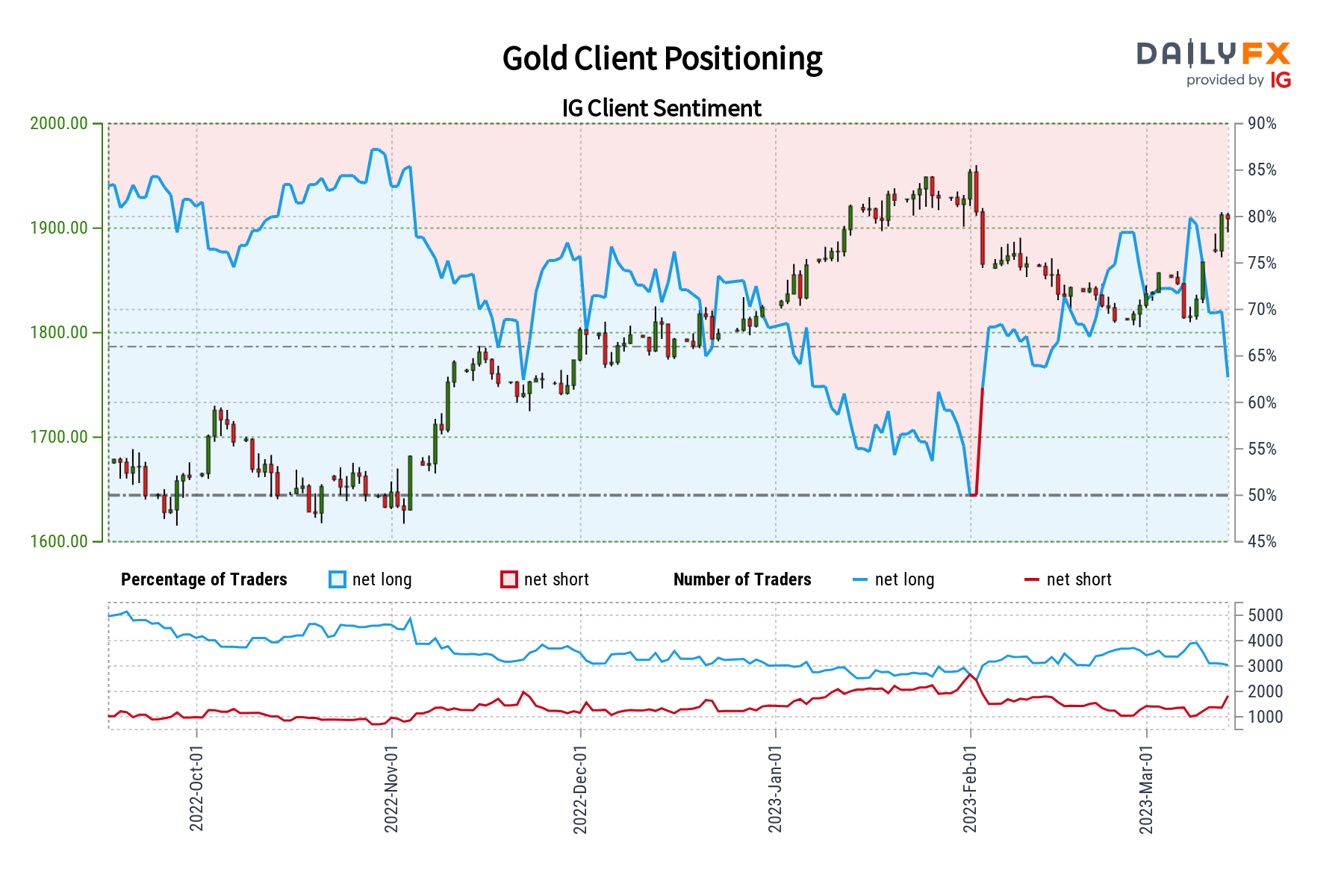

Gold Sentiment Outlook - Bullish

The IGCS gauge shows that about 60% of retail traders are net-long gold. Since most of them are net-long, this hints prices may continue falling. But, downside exposure has increased by 7.85% and 92% compared to yesterday and last week, respectively. With that in mind, recent shifts in positioning hint that the price trend may soon reverse higher.

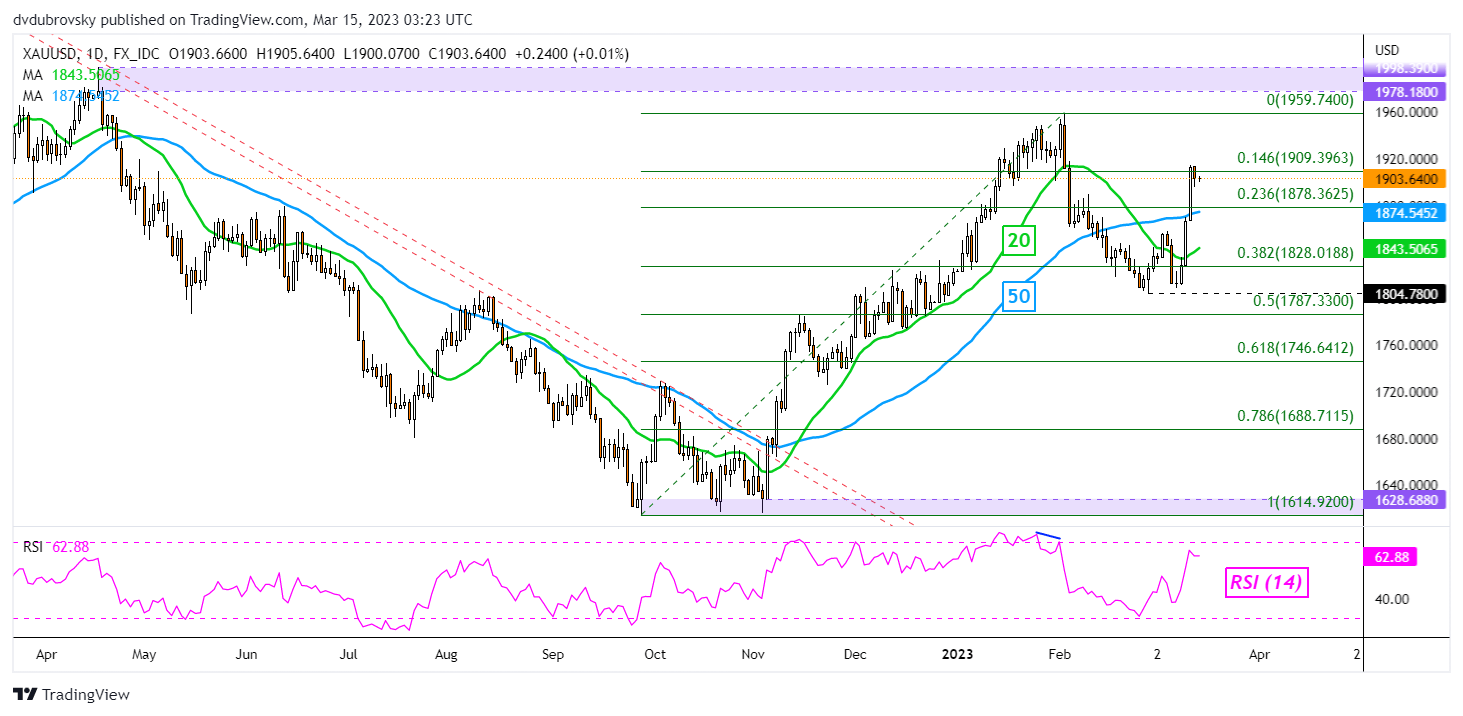

XAU/USD Daily Chart

On the daily chart, gold confirmed a breakout above the 50-day Simple Moving Average (SMA) as well as the 20-day equivalent. This is offering an increasingly neutral setting. There is now the potential for a bullish Golden Cross to form in the days ahead. Immediate resistance seems to be the minor 14.6% Fibonacci retracement level at 1909. Confirming a breakout above that price exposes the February peak at 1959.74. Pushing under 1804 could reinstate a more bearish bias.

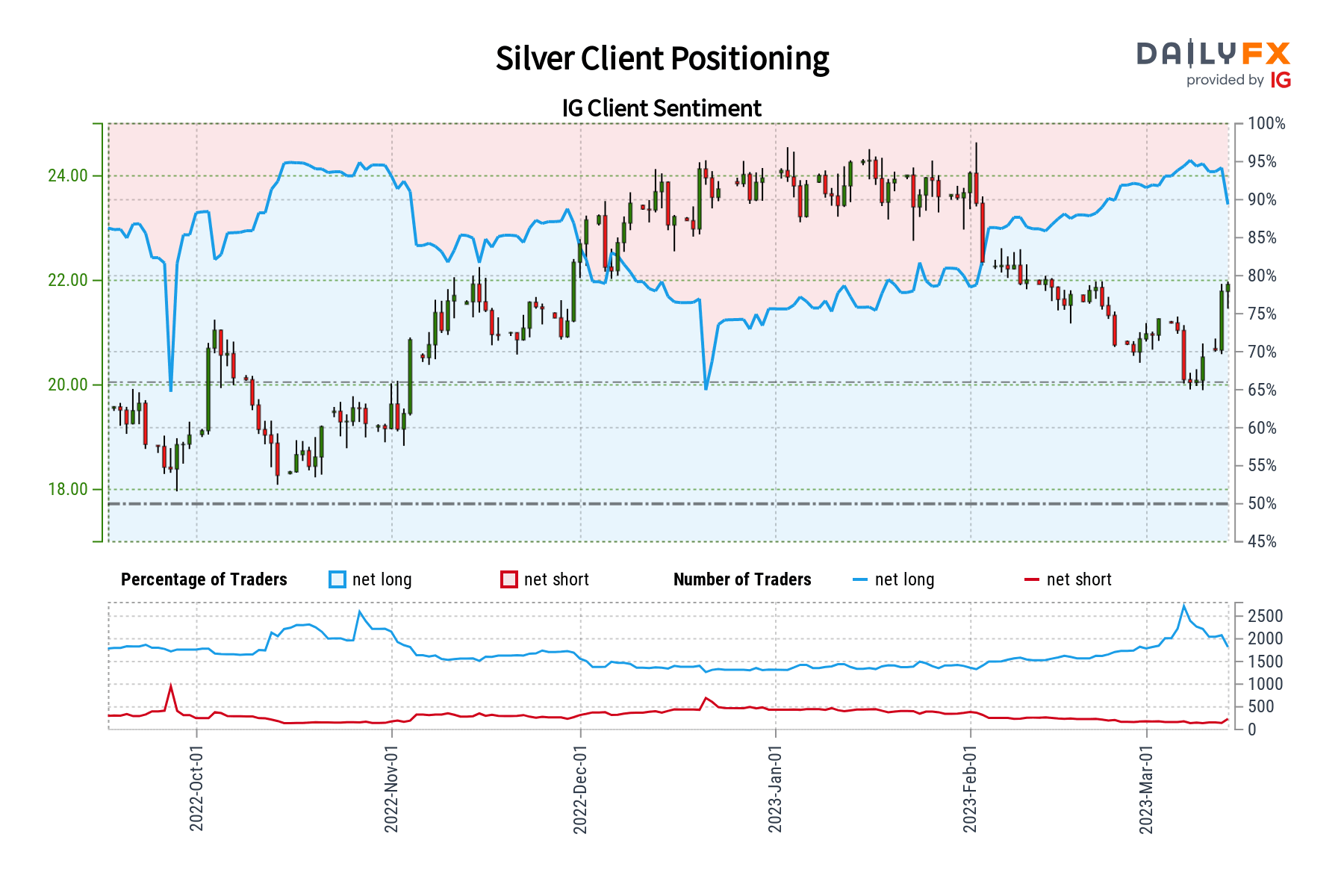

Silver Sentiment Outlook - Bullish

The IGCS gauge reveals that about 88% of retail traders are net-long silver. Since most of them are still biased higher, this hints prices may continue falling. But, downside exposure has increased by 2.71% and 62.14% compared to yesterday and last week, respectively. With that in mind, recent shifts in exposure hint that the price trend may soon reverse higher.

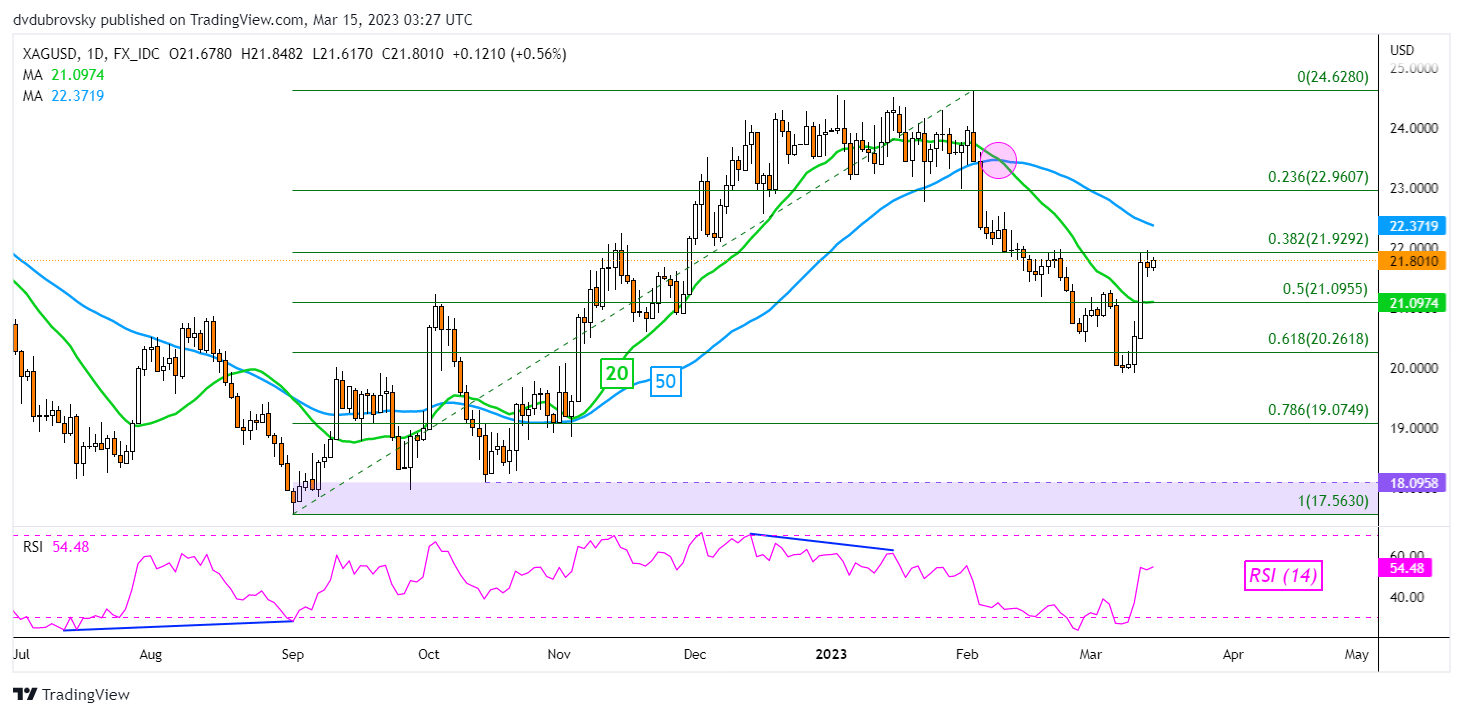

XAG/USD Daily Chart

Unlike gold, silver prices have only confirmed a breakout above the 20-day SMA, with the 50-day line still standing above. As well as that line, another key point of immediate resistance is the 38.2% Fibonacci retracement level at 21.92. Confirming a breakout above these 2 points could offer an increasingly near-term bullish trajectory, placing the focus on January peaks. Otherwise, downtrend resumption entails pushing under the early March low.

-- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX