Gold, Silver, Retail Trader Positioning, Technical Analysis – IGCS Commodities Update

- Gold and silver prices have been rising in recent weeks

- Retail traders have been increasing their downside bets

- This is a sign that XAU/USD and XAG/USD may rise

Gold and silver prices have been aiming cautiously higher in recent weeks. Meanwhile, using IG Client Sentiment (IGCS), we can see that simultaneously retail traders have been gradually increasing their downside exposure in the precious metals. IGCS tends to function as a contrarian indicator. With that in mind, could further upside be in store for XAU/USD and XAG/USD?

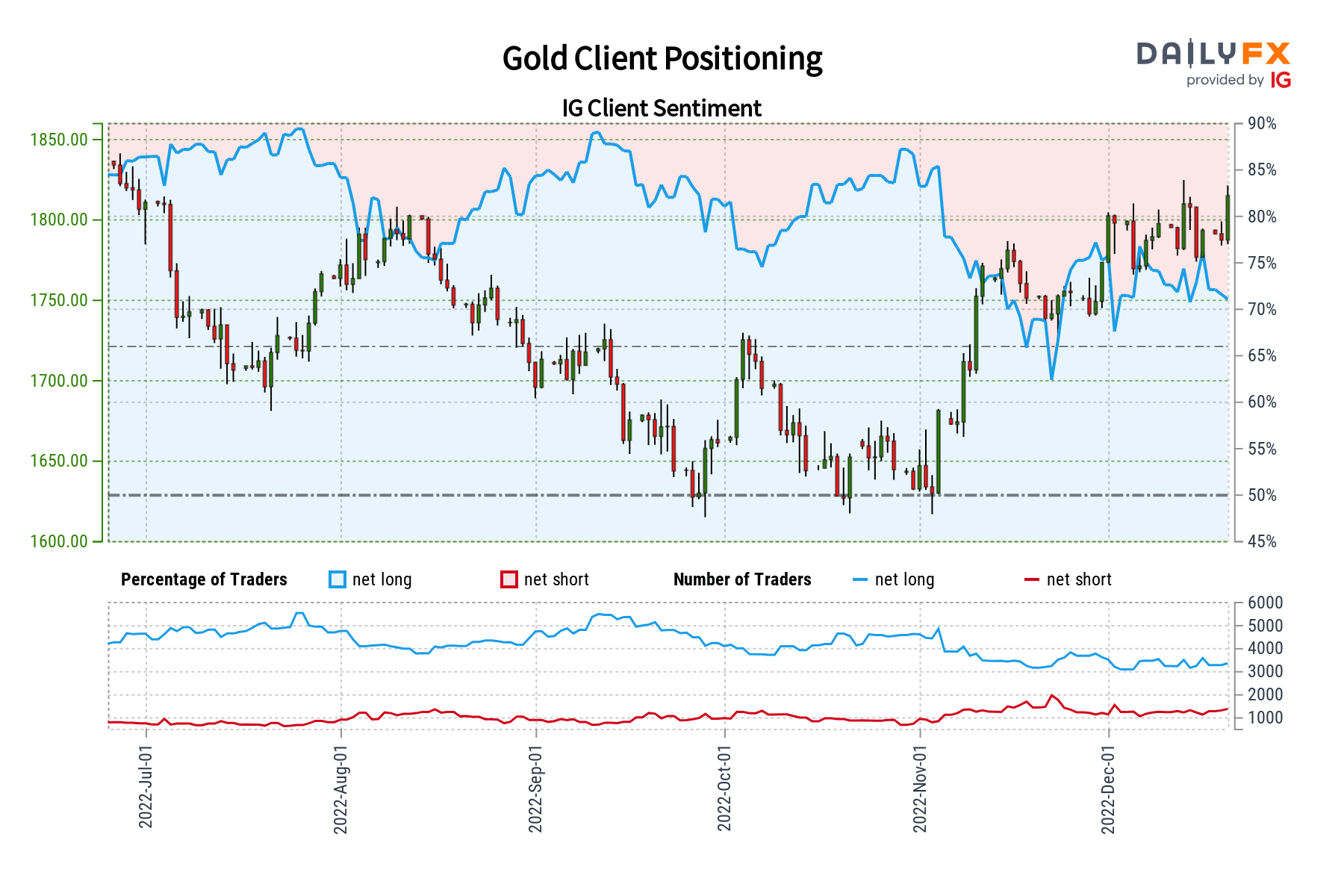

Gold Sentiment Outlook - Bullish

The IGCS gauge shows that about 66% of retail traders are net-long gold. Since most of them are still biased to the upside, this hints that prices may fall. However, downside exposure has increased by almost 15% and 24% compared to yesterday and last week, respectively. With that in mind, despite overall positioning, recent changes in exposure hint that gold may continue higher.

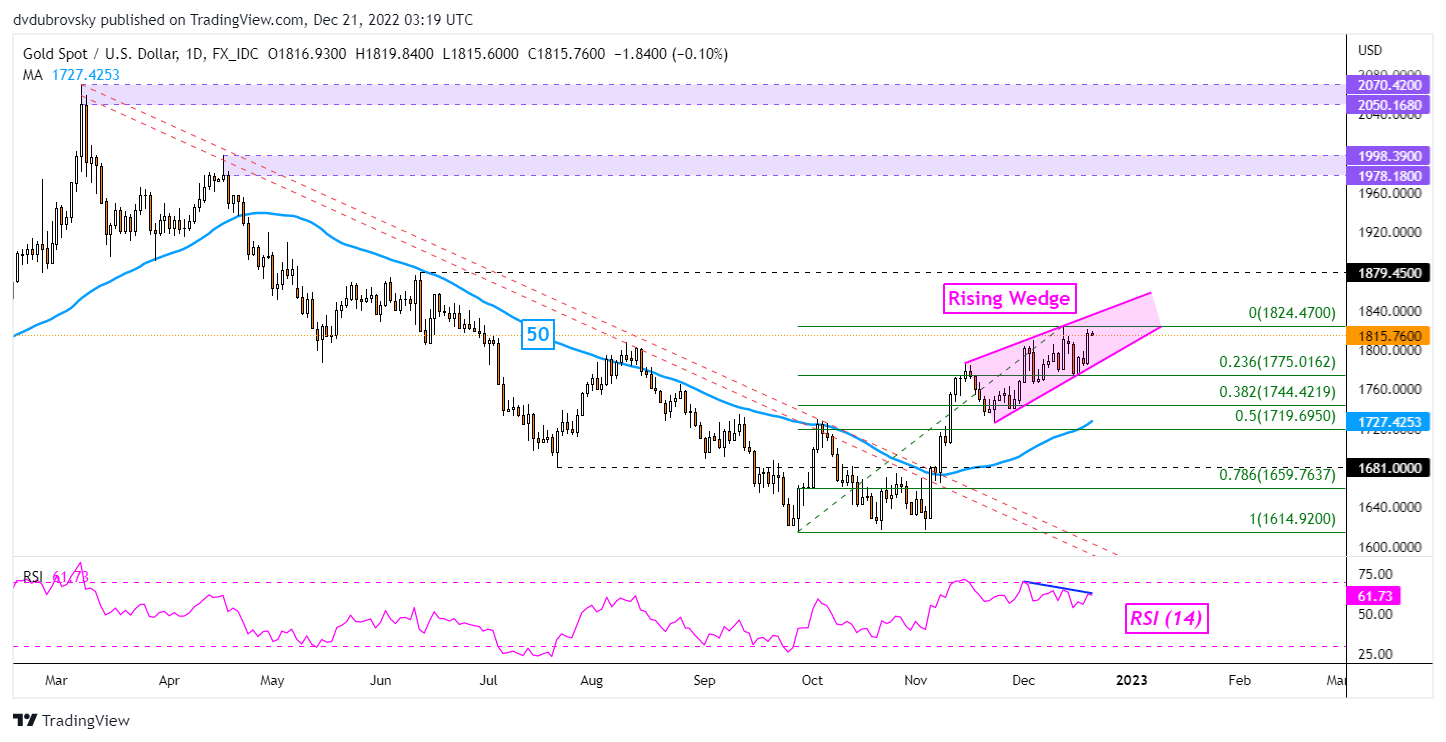

XAU/USD Daily Chart

On the daily chart, XAU/USD continues aiming higher within a bearish Rising Wedge chart pattern. While gold remains in the formation, the technical bias may remain tilted upward. However, a breakout under the wedge could increase the risk of a reversal. That would place the focus on the 50-day Simple Moving Average (SMA). Otherwise, extending gains beyond 1824 exposes the June high at 1879.

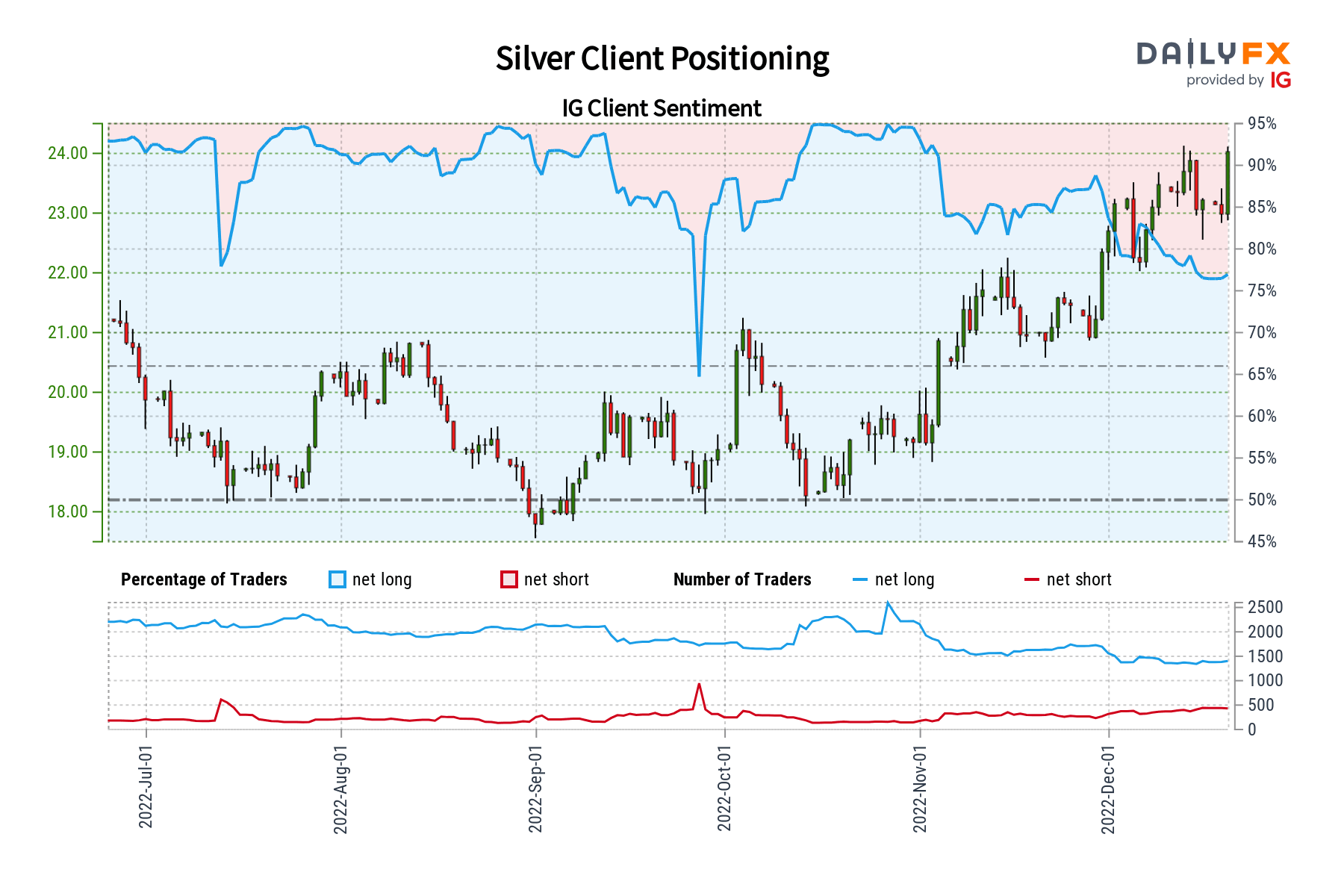

Silver Sentiment Outlook - Bullish

The IGCS gauge shows that about 65% of retail traders are net-long silver. Since the majority of investors maintain upside exposure, this hints that prices may fall. However, downside exposure has increased by 64% and 97% compared to yesterday and last week, respectively. With that in mind, despite overall positioning, recent changes in exposure hint that silver may continue higher instead.

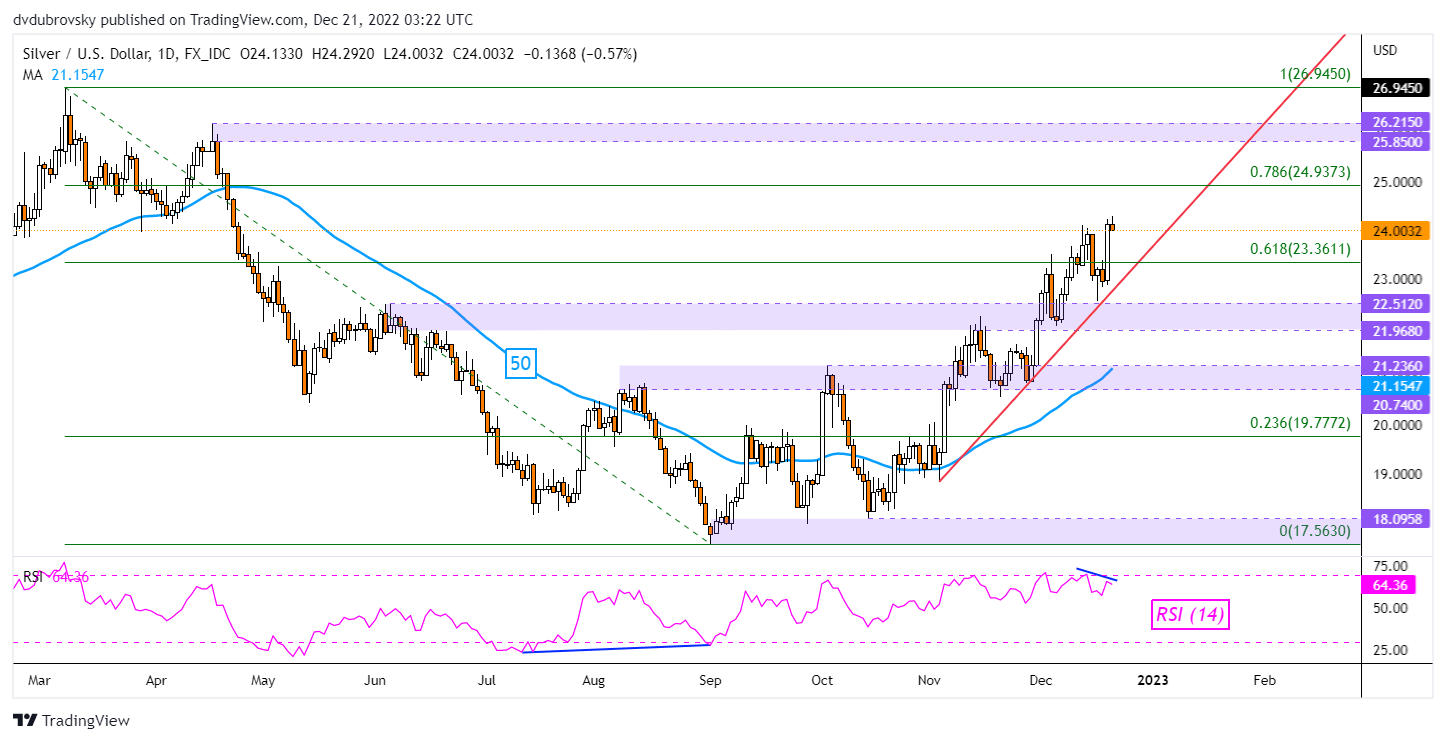

XAG/USD Daily Chart

Silver recently closed at its highest since the middle of April. However, negative RSI divergence does show that upside momentum is fading. That can at times precede a turn lower. If that is the case, XAG/USD remains above the rising trendline from late October. The latter may hold as support, reinstating the upside focus. Key resistance seems to be the 78.6% Fibonacci retracement level at 24.937.

*IG Client Sentiment Charts and Positioning Data Used from December 20th Report

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX