AUD/USD, Australian Dollar - Technical Outlook:

- AUD/USD’s rally has paused recently but doesn’t appear to be over just yet.

- Having said that, AUD/USD is approaching a major hurdle.

- What is the outlook and what are the key levels to watch?

AUD/USD SHORT-TERM TECHNICAL FORECAST - NEUTRAL

The Australian Dollar’s rally against the US Dollar may have stalled recently but doesn’t appear to be over just yet.

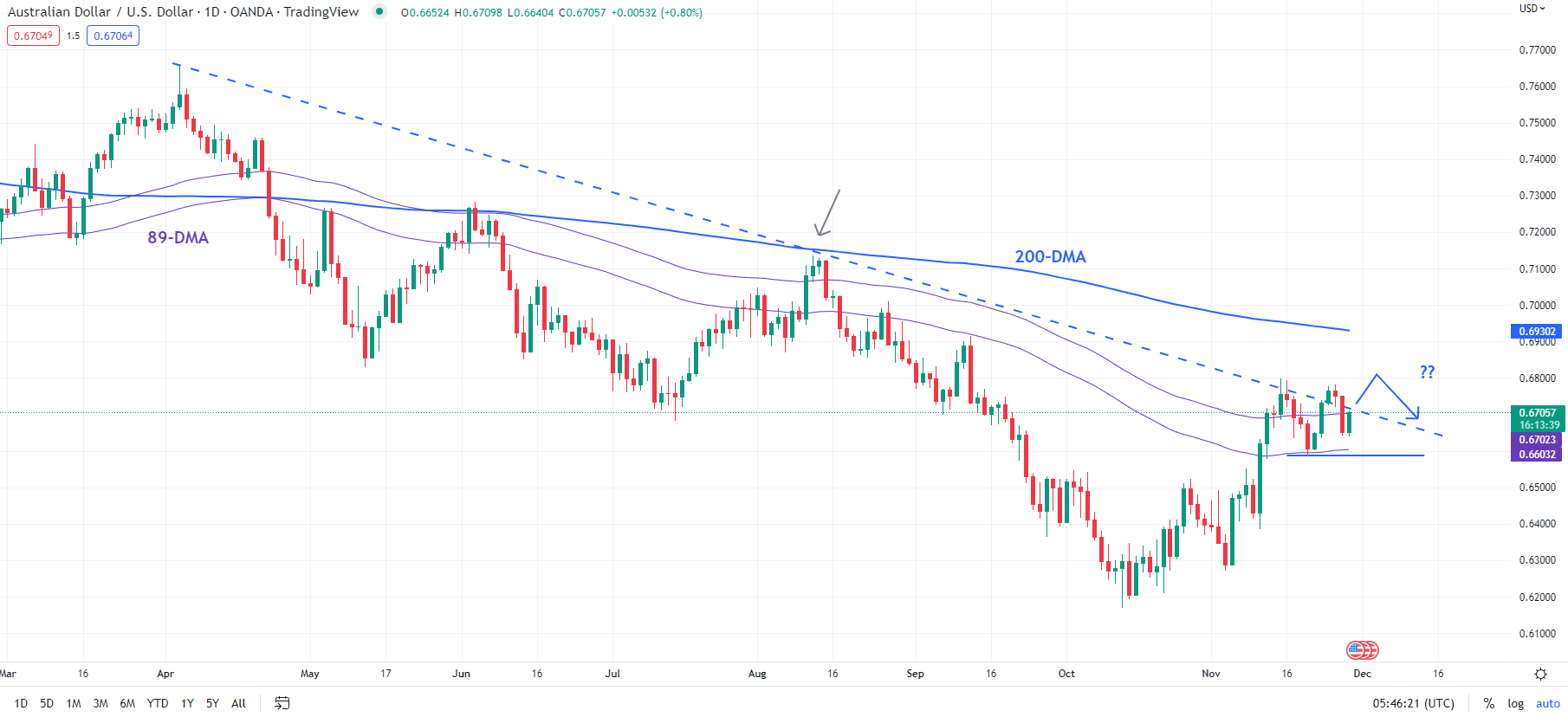

AUD/USD has settled in a narrow range over the past couple of weeks as it ran into a tough barrier, including a downtrend line from April, the 89-day moving average, and the July low of 0.6685 – a possibility highlighted in the previous update.

AUD/USD Daily Chart

Chart Created Using TradingView

The higher-top-higher-bottom pattern since October suggests that the interim trend remains bullish for now. While the pair stays above immediate support at the November 21 low of 0.6585, there is a good chance that it could retest the mid-November highs of 0.6800, and with major resistance on the 200-day moving average, now at about 0.6930. Previous rebounds around the middle of 2022 were capped by the moving average. Hence, a retreat from the long-term moving average wouldn’t be surprising.

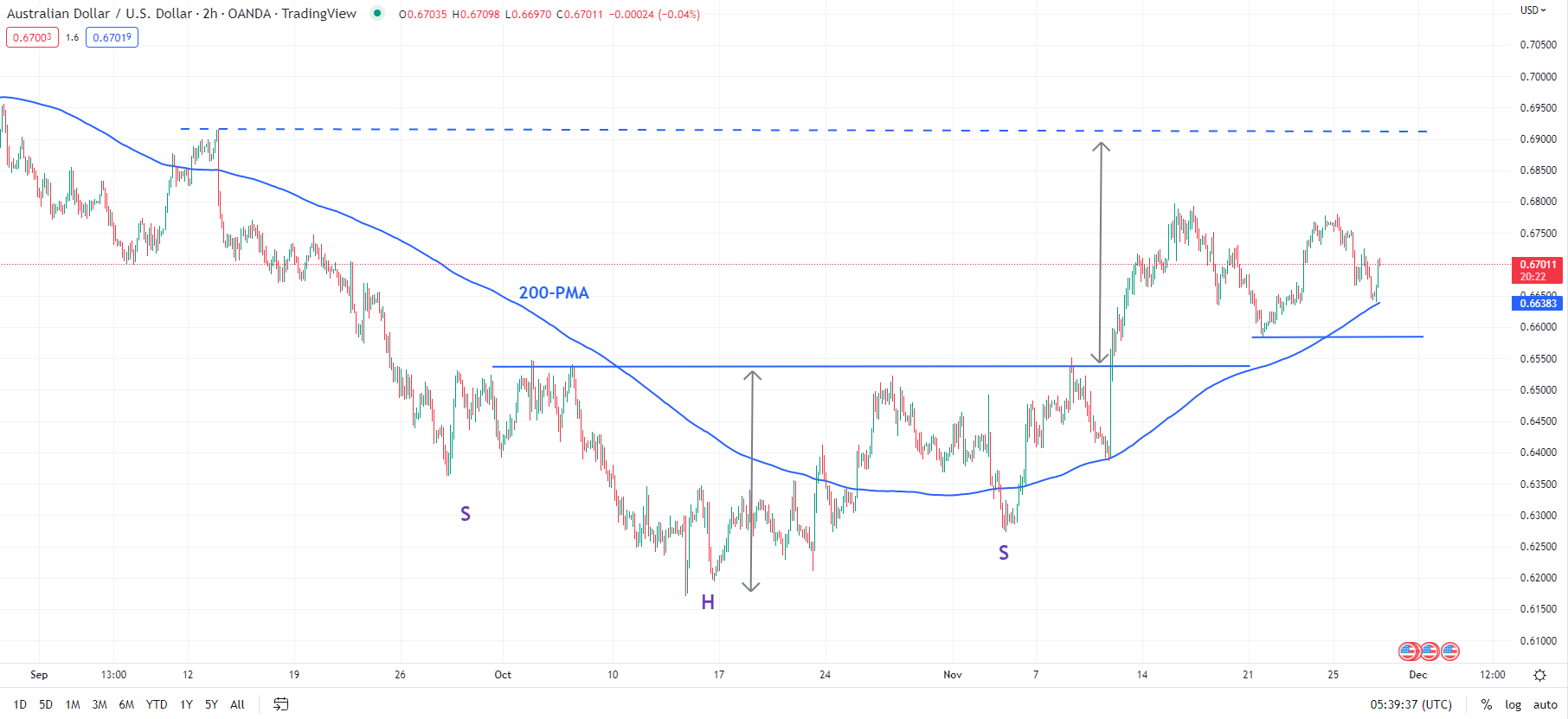

AUD/USD 120-minutes Chart

Chart Created Using TradingView

From a trend perspective, the short-term trend has been up, but whether the recent stalling in price action is a precursor to a reversal or a continuation of the uptrend remains to be seen. In this regard, 0.6585 is key support. Any break below would trigger a minor double top (the November 15 and 25 highs), pointing to a weakness toward 0.6400. This would imply a crack below the late-October high of 0.6520, confirming that the short-term upward pressure had faded. Such a break could open downside risks toward the October low of 0.6170.

--- Written by Manish Jaradi, Strategist for DailyFX.com