- U.S. Durable Goods Orders to Contract for First Time in Three-Months.

- Non-Defense Capital Goods Orders ex Aircrafts to Decline for Fourth Time in Last Eight Months.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Durable Goods Orders

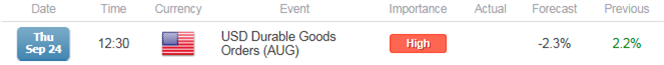

A 2.3% decline in demand for U.S. Durable Goods accompanied by a weakening outlook for business investments may produce near-term headwinds for the greenback as it fuels speculation for a further delay in the Fed liftoff.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The Federal Open Market Committee (FOMC) may continue to endorse a wait-and-see approach at the October 28 interest rate decision as the central bank adopts a more cautious outlook for the region, and signs of a slower recovery may encourage Chair Janet Yellen to preserve the zero-interest rate policy (ZIRP) throughout 2015 in an effort to further insulate the real economy.

Join DailyFX on Demand for LIVE SSI Updates!

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Advance Retail Sales (MoM) (AUG) | 0.3% | 0.2% |

| U. of Michigan Confidence (SEP P) | 91.1 | 85.7 |

| Wholesale Trade Sales (MoM) (JUL) | 0.1% | -0.3% |

Waning confidence accompanied by the ongoing weakness in private-sector consumption may drag on orders for large-ticket items, and a dismal development may put increased pressure on the Fed to further delay the normalization cycle especially as the central bank scales back its outlook for growth and inflation.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Building Permits (MoM) (AUG) | 2.5% | 3.5% |

| ISM Non-Manufacturing (AUG) | 58.2 | 59.0 |

| Personal Spending (JUN) | 0.2% | 0.2% |

On the other hand, the ongoing expansion in building and service-based activity may spur greater demand for durable goods, and a positive data print may keep the central bank on course to raise the benchmark interest rate in 2015 as Chair Yellen remains confident in achieving the Fed’s dual mandate for full-employment and price stability.

How To Trade This Event Risk(Video)

Bearish USD Trade: Orders Contract 2.3% or Greater in August

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Demand for Large-Ticket Items Beat Market Forecast

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD may face a larger rebound as it fails to retain the recent series of lower-highs and preserves the monthly-opening low (1.1086); need a break of the bullish RSI formation carried over from March to favor a resumption of the long-term downward trend.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, but the ratio remains off of recent extremes as it sits at -1.20, with 45% of traders long.

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Read More:

Macro Musings: Who Thought The Fed Would Raise Rates in 2015?

EUR/USD Monthly Open Range in Focus Following ECB Rhetoric

Impact that the U.S. Durable Goods report has had on EUR/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUL 2015 | 08/26/2015 12:30 GMT | -0.4% | 2.0% | -14 | -77 |

July 2015 U.S. Durable Goods Orders

Orders for U.S. Durable Goods unexpectedly rose 2.0% in July after increasing a revised 4.1% the month prior. At the same time, Non-Defense Capital Goods Orders excluding Aircrafts showed, a proxy for future business investments, showed a faster rate of growth as the figure climbed another 2.2% following a 1.5% expansion in June. The better-than-estimated readings may keep the Fed on course to life the benchmark interest rate in 2015 especially as Chair Janet Yellen continues to anticipate a stronger recovery to emerge throughout the remainder of the year. The initial market reaction was limited and short-lived, with EUR/USD failing to push below the 1.1350 region, but the greenback strengthened in the latter-half of the North American trade to end the day at 1.1310.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums