Euro Fundamental Forecast: Neutral

- Economic conditions are improving in Europe ahead of the ECB meeting next week but motivation to ‘stay the course’ remains very strong

- Blockbuster week ahead as high-importance risk events stack up (FOMC, BoE, ECB, EU CPI and GDP, NFP etc)

Rate hikes from all three major central banks next week, apart from the Bank of England potentially, have been priced in ahead of next week’s meetings (Fed 25 bps, ECB 50 bps and BoE closer to 50bps than 25 bps). Therefore, markets will be more focused on clues regarding terminal rates and the path of future policy in the midst of lower inflation prints. With so many high-profile events on the docket next week, price action poses the threat of erratic moves however, the sheer volume of market moving information could provide the very catalyst markets have been searching for. The Neutral tag of the forecast has been put forward as shifts in sentiment next week have the potential to be drowned out by any number of other high impact data prints.

EU Economic Sentiment Improves (GDP Forecasts, PMI)

The milder winter weather in Europe appears to have kept a gas shortage crisis at bay which has helped motivate a slight upward revision in GDP growth from the German Economic Minister Robert Habeck. In fact, the German government now sees 2022 GDP growth at 0.2% for 2023, up from a prior contraction of 0.4%. Further good news appeared for the wider continent in the form of improved January (flash) PMI numbers released this week. Both manufacturing and services data beat estimates with the EU services statistic re-entering ‘expansionary’ territory (prints of 50 and above).

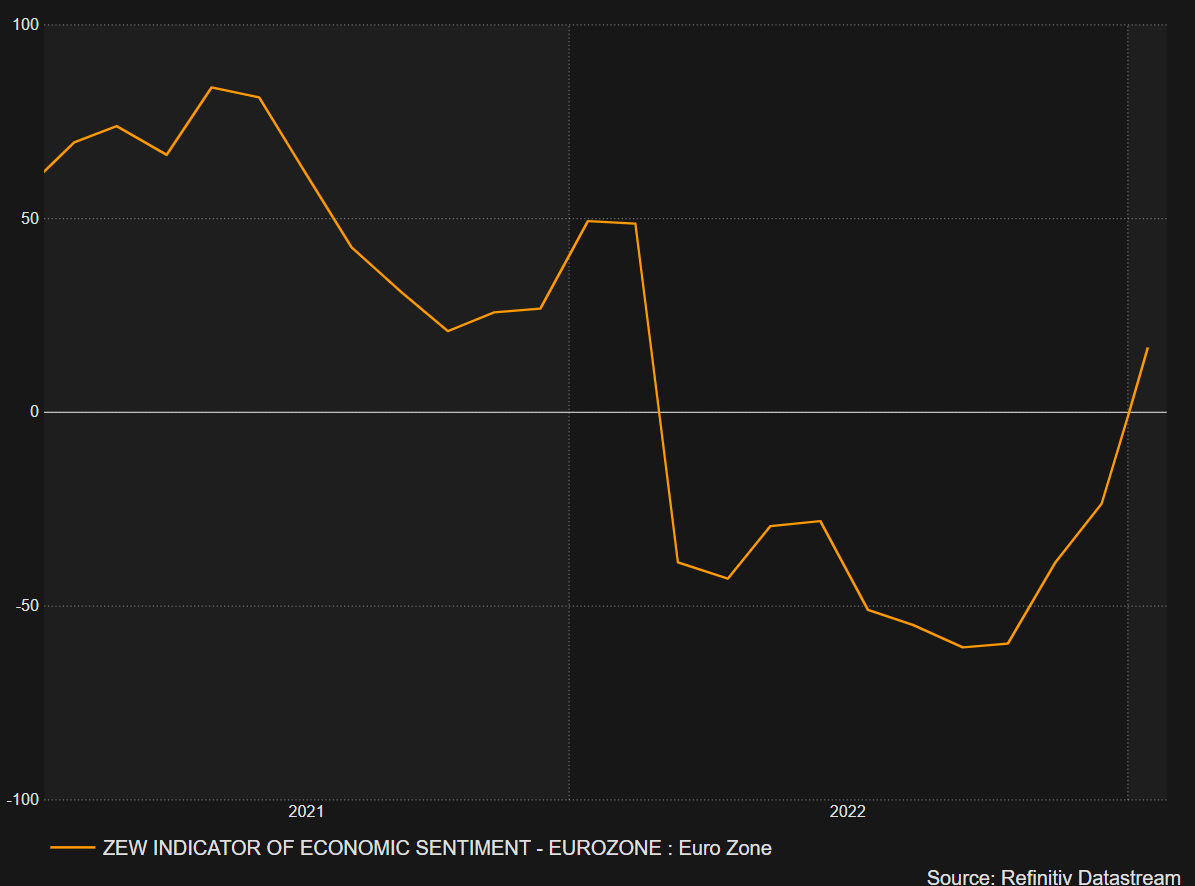

EU ZEW Economic Sentiment Showing a Massive Turnaround

Source: Refinitiv, prepared by Richard Snow

Will Q4 Avoid a Contraction?

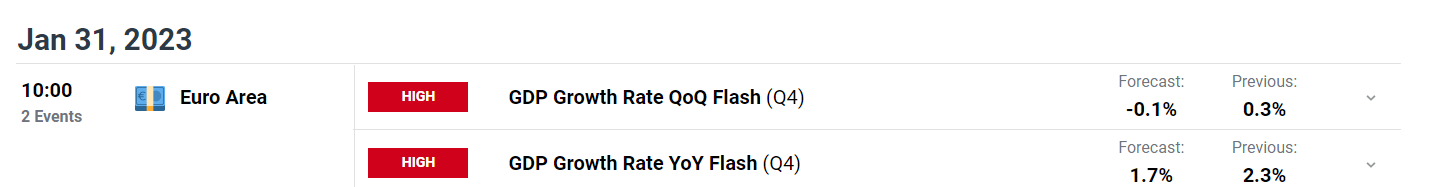

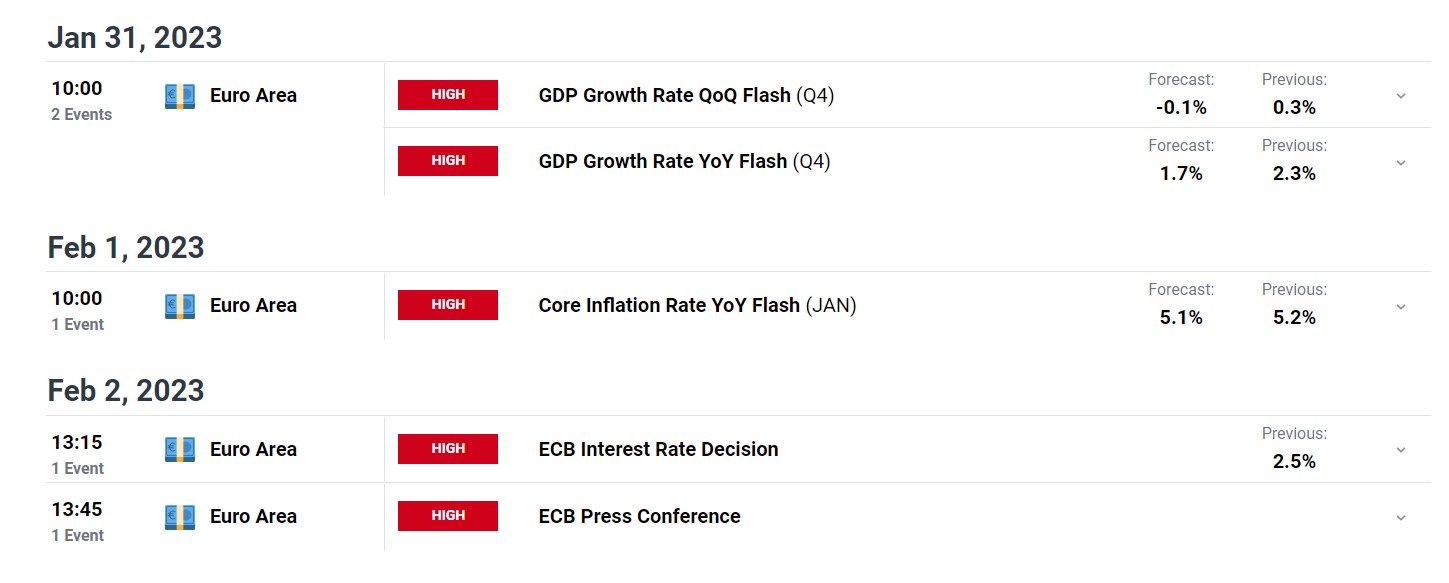

Euro GDP data is due next week and the forecast suggests that we’ll see a quarter on quarter contraction and a 1.7% rise compared to Q4 of 2021.

While green shoots of optimism have emerged around growth, the EU still has to contend with the likely scenario of a recession this year, although the ECB’s more hawkish member Klaas Knot believes a downturn could be avoided while the ‘neutral’ Villeroy commented before the media blackout period that he sees the EU avoiding a recession entirely on the back of improved activity.

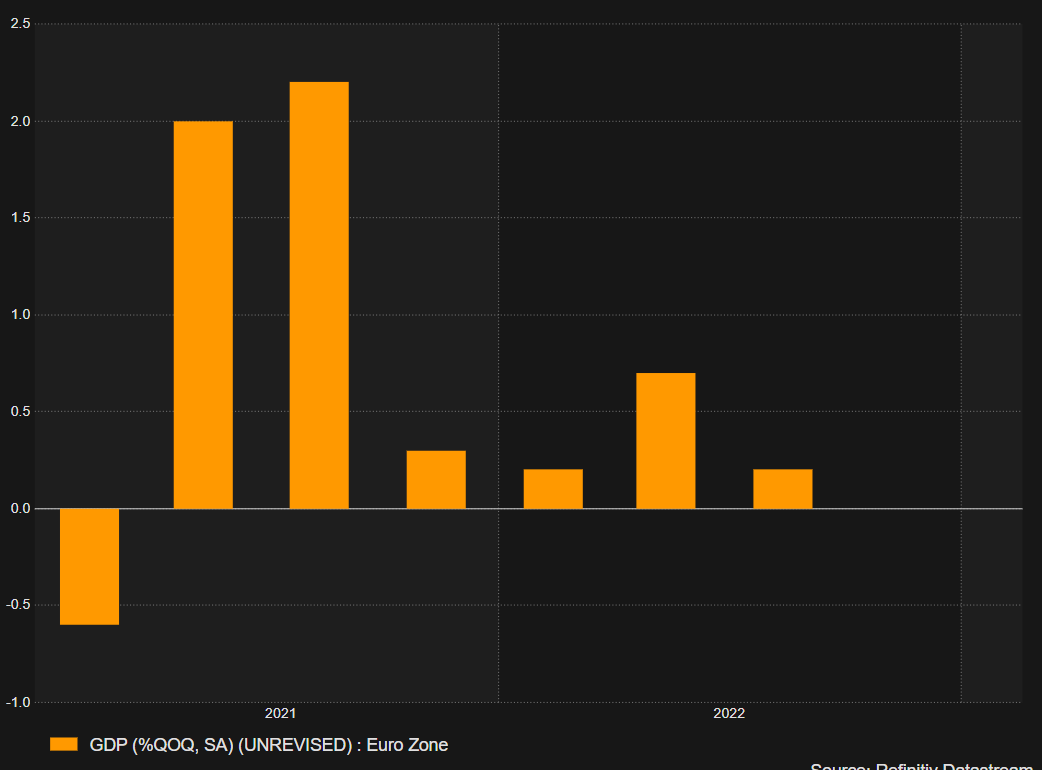

EU GDP Languishes Ahead of the Anticipated Negative Q4 Print Next Week

Source: TradingView, prepared by Richard Snow

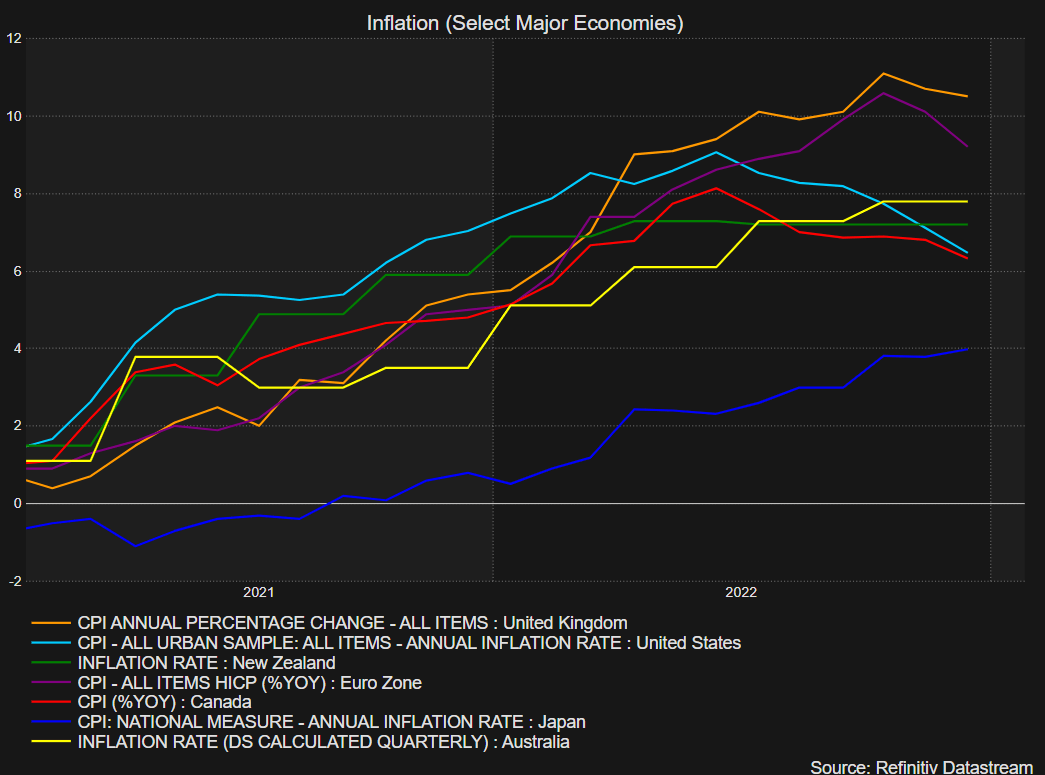

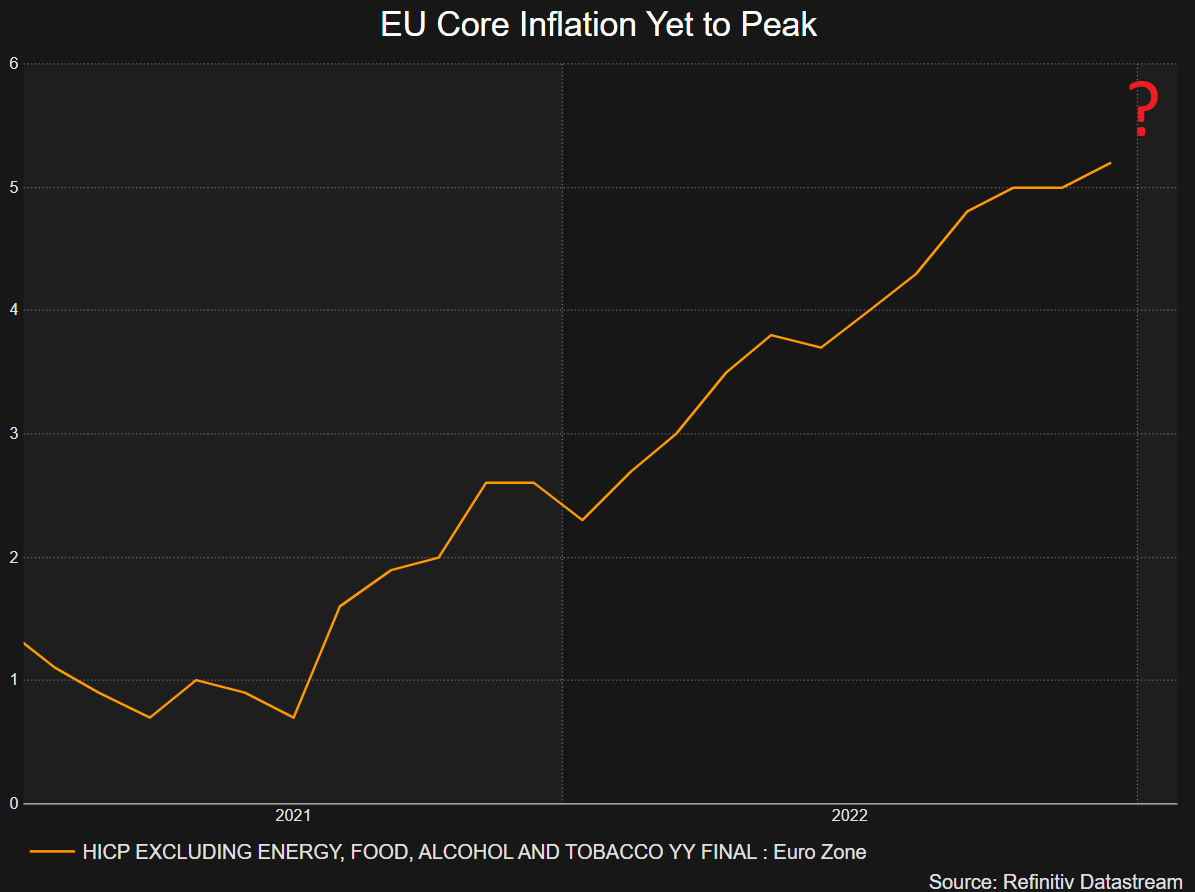

The ECB and the two-sided story of inflation

The chart below shows a trend of disinflation throughout most of the major economies (EU in purple). Headline inflation in Europe appears to have peaked, but their focus remains on core inflation now that energy prices have subsided drastically.

Global Headline CPI Trends

Source: Refinitiv, prepared by Richard Snow

The governing council appears more united than ever judging by recent comments opting for a 50 bps hike without a single dissenter. Hotter core inflation is symptomatic of widespread inflation throughout the economy which tends to be a lot stickier. It is with this in mind that the ECB has communicated its commitment to “stay the course”, as Christine Lagarde would put it, in regard to multiple 50 bps hikes still to come.

Source: Refinitiv, prepared by Richard Snow

Blockbuster Week as High Importance Risk Events Stack up

High impact risk events next week include the following:

- EU GDP and inflation data

- FOMC, BoE and ECB rate meetings

- US NFP and ISM services PMI

Customize and filter live economic data via our DailyFX economic calendar

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX