US Dollar, DXY, Fed Outlook, Jerome Powell, CPI – Asia Pacific Market Open

- US Dollar flat as Jerome Powell offers no new meaningful updates

- The DXY Dollar Index support breakout has been lackluster so far

- Australian Dollar now eyeing local monthly inflation gauge next

Asia-Pacific Market Briefing – Powell Underwhelms, Focus on CPI

The US Dollar marked time in what was a fairly quiet trading session on Tuesday. Traders were eagerly anticipating a speech delivered by Federal Reserve Chair Jerome Powell during the Wall Street trading session. But, when the time came, he did not directly comment on the monetary policy or economic outlook. This left markets focusing on more pressing matters ahead, namely the CPI report.

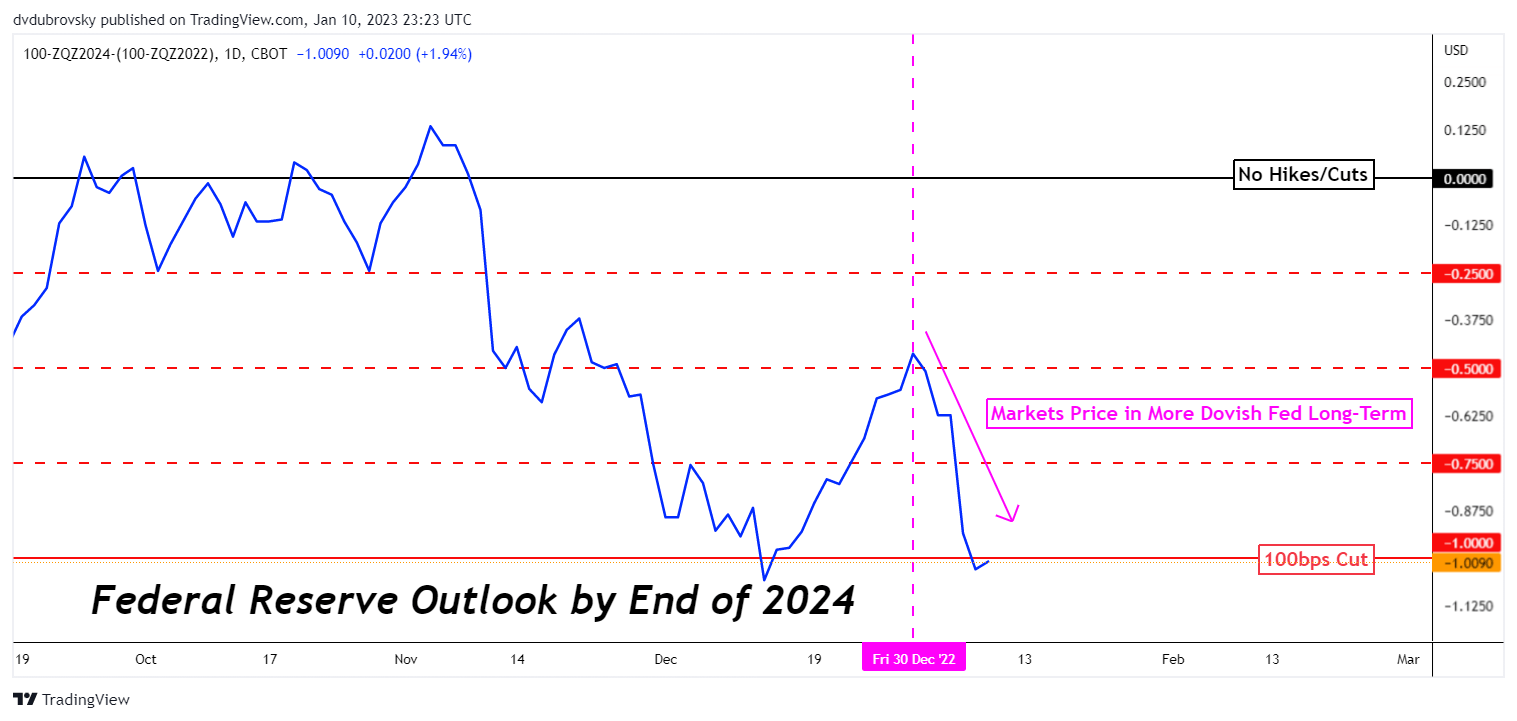

Since the turn of the new year, a couple of disappointing economic figures left markets repricing the broader Fed rate outlook. Looking at the chart below, two more rate cuts were added by the end of next year. That has resulted in broad weakness in the US Dollar and some optimism in equity markets, albeit very cautiously.

Moreover, markets are increasingly looking to a softer-than-expected US inflation report on Thursday. The headline rate is seen clocking in at 6.5% y/y in December, which would be down from 7.1% in November. Consequently, this does mean that a stronger outcome, or even an in-line reading perhaps, may result in disappointment due to rising expectations of a weakening.

Markets Have Added 2 Fed Cuts by End of 2024 Since January Started

Wednesday’s Asia Pacific Trading Session – Australian CPI, AUD/USD

Cautious optimism on Wall Street may see Asia-Pacific indices push higher. Although, meaningful progress may have to wait until after the US CPI data. In the interim, the Australian Dollar will be eyeing local inflation data. Australian CPI is seen clocking in at 7.2% y/y in November versus October’s 6.9%. This may keep the Reserve Bank of Australia on its toes, offering AUD/USD some upside.

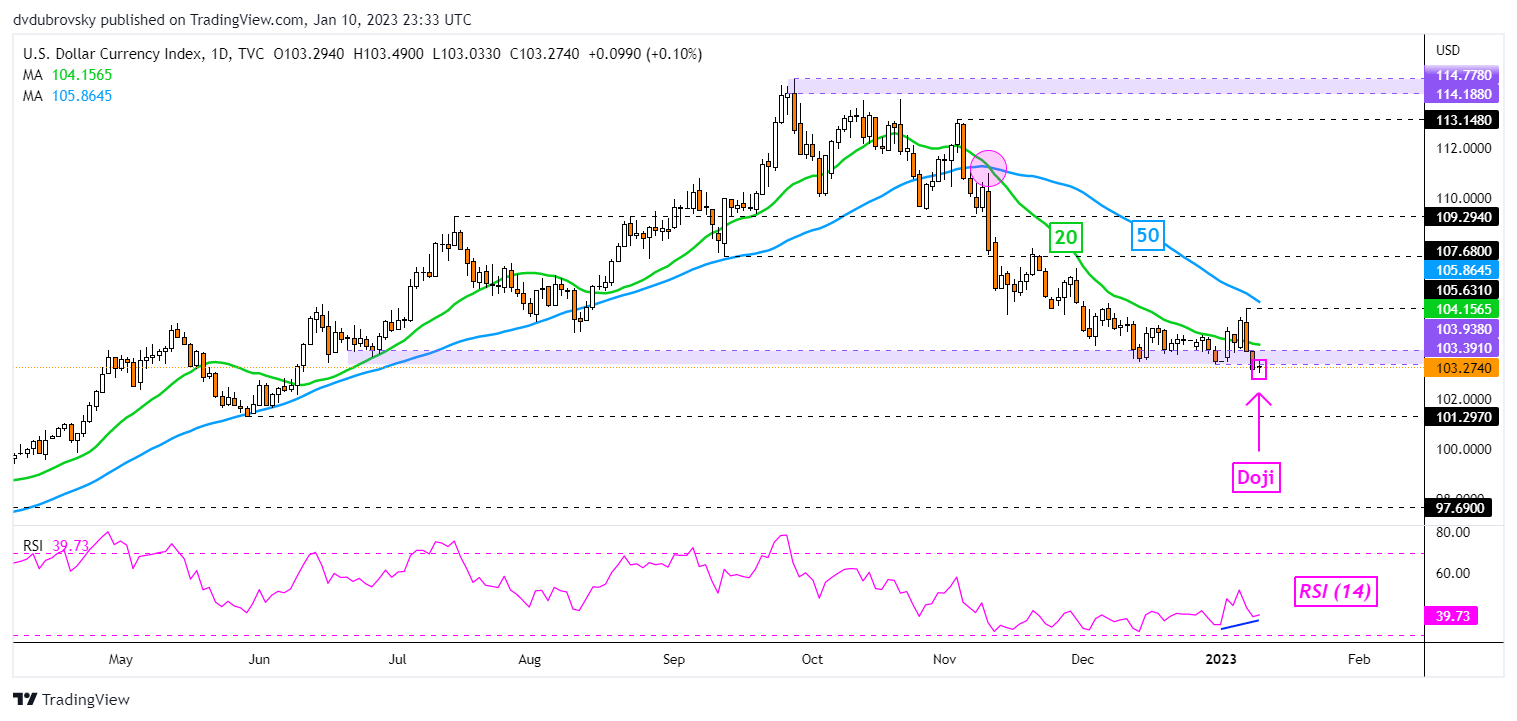

US Dollar Technical Analysis

On the daily chart, the DXY US Dollar Index left a Doji candlestick pattern after prices broke under the key 103.39 – 103.93 support zone. This is a sign of indecision. Meanwhile, positive RSI divergence shows that downside momentum is fading. That is a hint that prices could turn higher. As such, it seems premature to confirm USD’s downtrend resumption at this time. Further downside progress places the focus on the May 2022 low at 101.29.

DXY Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX