US Dollar (DXY) Price and Chart Analysis

- US Treasury yields slump on growing recessionary fears.

- Multi-month support is likely to be re-tested.

Most Read: US Dollar (DXY) Remains Under Pressure Ahead of Important US Data

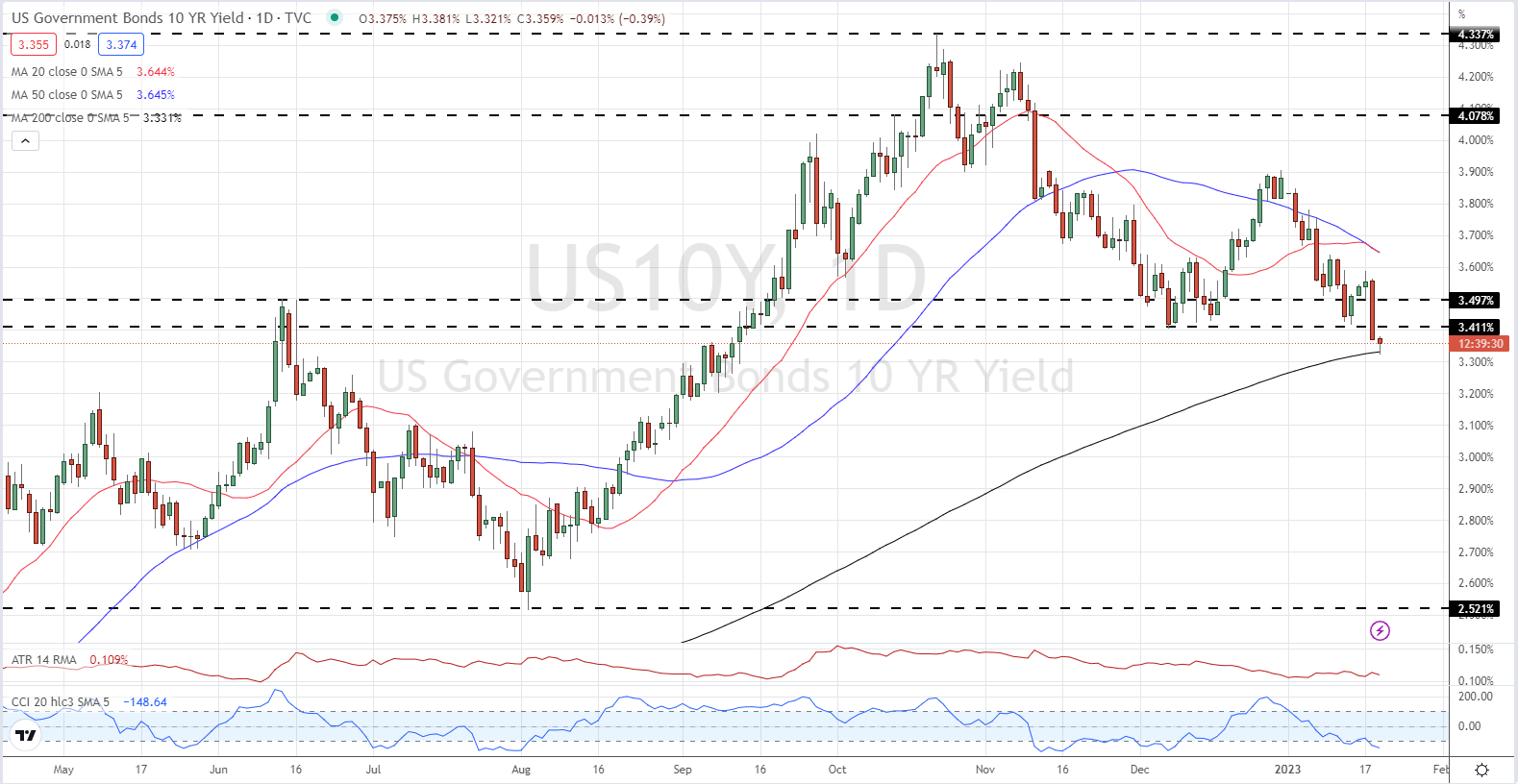

US Treasury yields slumped on Wednesday after the latest batch of data showed the US economy weakening further, prompting renewed recessionary fears. The yield on the 5-year UST fell by 20 basis points, while the 10-year benchmark UST also shed 20 basis points as buyers returned, pushing yields lower. The market continues to test the Federal Reserve’s resolve to keep interest rates higher for longer, and with 25 basis points a lock for the February 1 FOMC meeting, there are already calls - albeit not that many - for rate hikes to pause after next month’s meeting to allow the economy a chance to recover. The Federal Reserve was late to start hiking rates and, if market pricing is to be believed, it is looking increasingly likely that they will be late to stop them, causing the economy unnecessary damage.

US 10-Year UST Yield

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

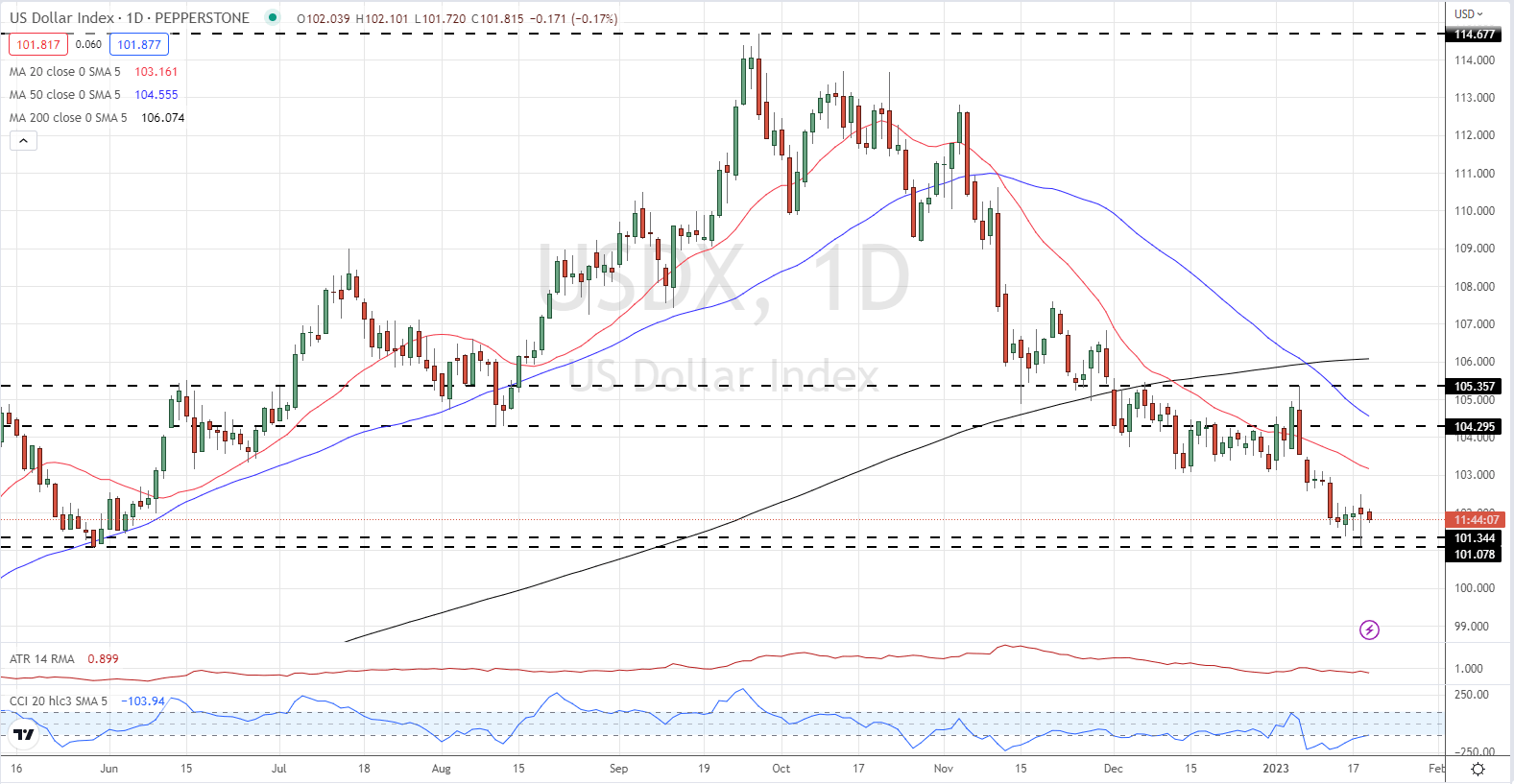

The US dollar remains pointed to the downside and this is unlikely to change. While the greenback may see a period of consolidation over the short term, with bond yields falling and the small possibility of rate hikes being paused next month, the overall outlook for the US dollar is lower. Even if the Fed hikes rates by 25 basis points at the next two FOMC meetings, this is unlikely to be enough to bolster the greenback. The US dollar basket (DXY) is also under pressure from a revived Euro, with the ECB in the middle of a rate hiking cycle. Recent commentary from ECB board member Klaas Knot suggested that the central bank will not stop with just one 50bp rate and that ‘multiple 50 basis point hikes’ are needed. This will widen the yield differential between the US dollar and the Euro further, to the detriment of the greenback.

The USD yesterday touched and rebounded off horizontal support from the May 30 low, a level we identified recently as short-term support. The rebound however looks tame and with all three moving averages continuing to weigh on the dollar, a re-test of yesterday’s low is likely in the short term.

US Dollar (DXY) Daily Price Chart – January 19, 2023

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.