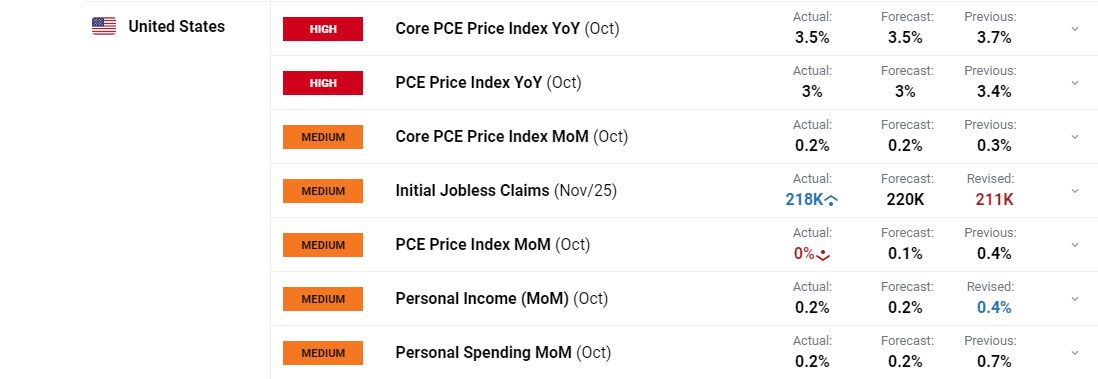

US Core PCE Key Points:

- Core PCE Price Index YoY(OCT) Actual 3.5% Vs 3.7% Previous.

- PCE Price Index YoY(OCT) Actual 3% Vs 3.4% Previous.

- The Data Today Will Only Further Fuel to Fire Regarding Rate Cuts in 2024.

- To Learn More AboutPrice Action,Chart PatternsandMoving Averages, Check out theDailyFX Education Section.

MOST READ: Oil Price Forecast: WTI Faces Technical Hurdles as OPEC+ Rumors Swirl

Elevate your trading skills and gain a competitive edge. Get your hands on the News Trading Guide today for exclusive insights on how to navigate news events.

Core PCE prices MoM slowed in October following two successive months of 0.4% increases. The October print of 0.2%, in line with estimates was the weakest reading since July 2022. ThePCE price indexincreased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The annual rate cooled to 3% from 3.4%, a low level not seen since March 2021, matching forecasts. Meanwhile, annual core PCE inflation which excludes food and energy, slowed to 3.5% from 3.7%, a fresh low since mid-2021.

Customize and filter live economic data via our DailyFX economic calendar

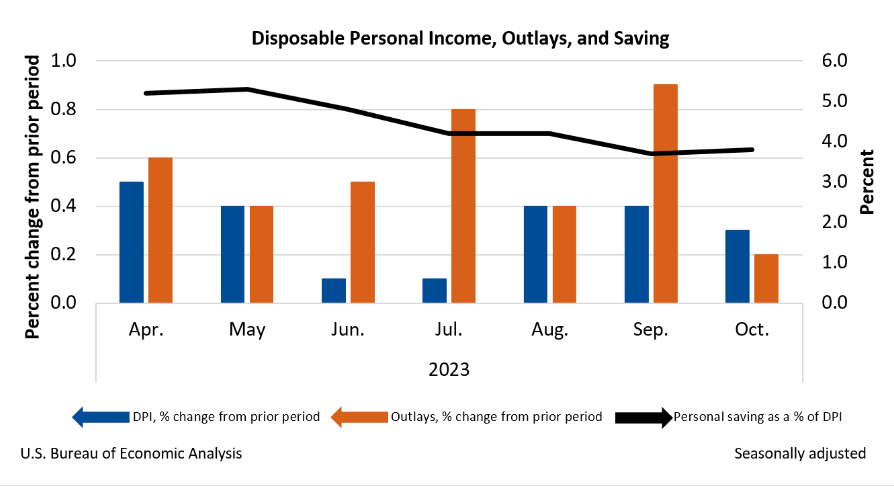

The increase incurrent-dollar personal incomein October primarily reflected increases in personal income receipts on assets and compensation that were partly offset by a decrease in personal current transfer receipts.

Source: US Bureau of Economic Analysis

US ECONOMY AHEAD OF THE FOMC MEETING

The recent batch of data releases continue to indicate a slowdown with the US showing similar signs despite the robust labor market and services inflation. Market participants have been buoyed by the recent batch of data increasing bets for rate cuts in 2024.

Today's PCE data will likely add further fuel to that fire as the slowdown continues. Next week we have the NFP report which could further strengthen the case for the Federal Reserve heading into the December meeting. The question that will bug me if we do see a softer NFP print and sign that the labor market is cooling is whether the Fed will be prepared to finally signal that they are done with rate hikes. December promises to be an intriguing month and the US Dollar in particular will be interesting to watch.

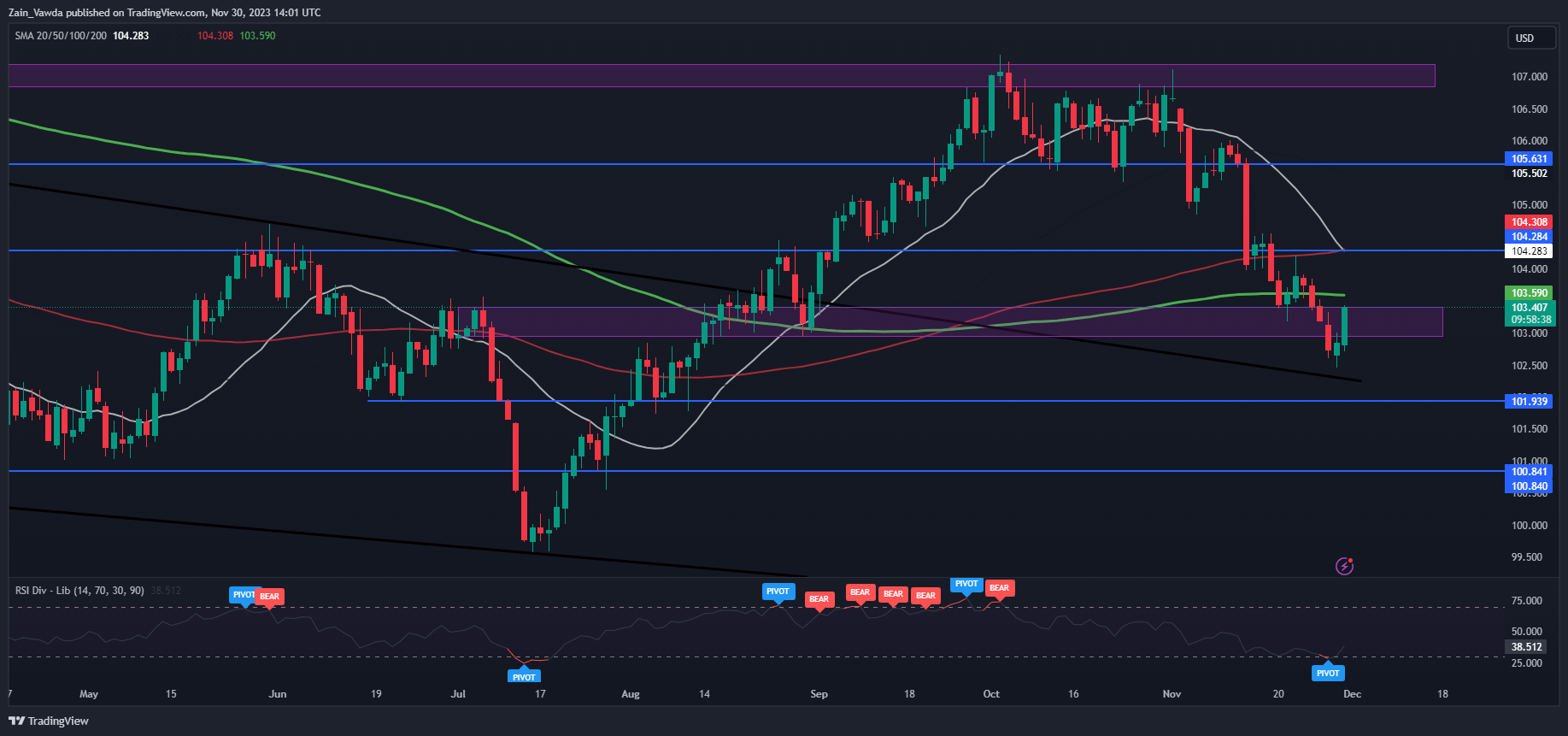

MARKET REACTION

Following the data release the dollar index surprisingly strengthened as we have seen multiple USD pairs slide. This is interesting given the softness of the data and could be down to potential profit taking by USD sellers as well.

The DXY is running into some technical hurdles that lie just ahead with the 200-day MA resting at the 103.59 mark. The overall structure of the DXY remains bearish until we see a daily candle close above the swing high around the 104.00 handle.

Key Levels to Keep an Eye On:

Support levels:

- 103.19

- 103.00

- 102.50

Resistance levels:

- 103.59

- 104.00

- 104.28

DXY Daily Chart- November 29, 2023

Source: TradingView, prepared by Zain Vawda

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda