New Zealand Dollar, NZD/USD, CPI, RBNZ – Asia-Pacific Briefing:

- New Zealand Dollar soars after local inflation data beat

- Traders are pricing in another RBNZ rate hike this year

- NZD/USD bounces off trendline, more gains to come?

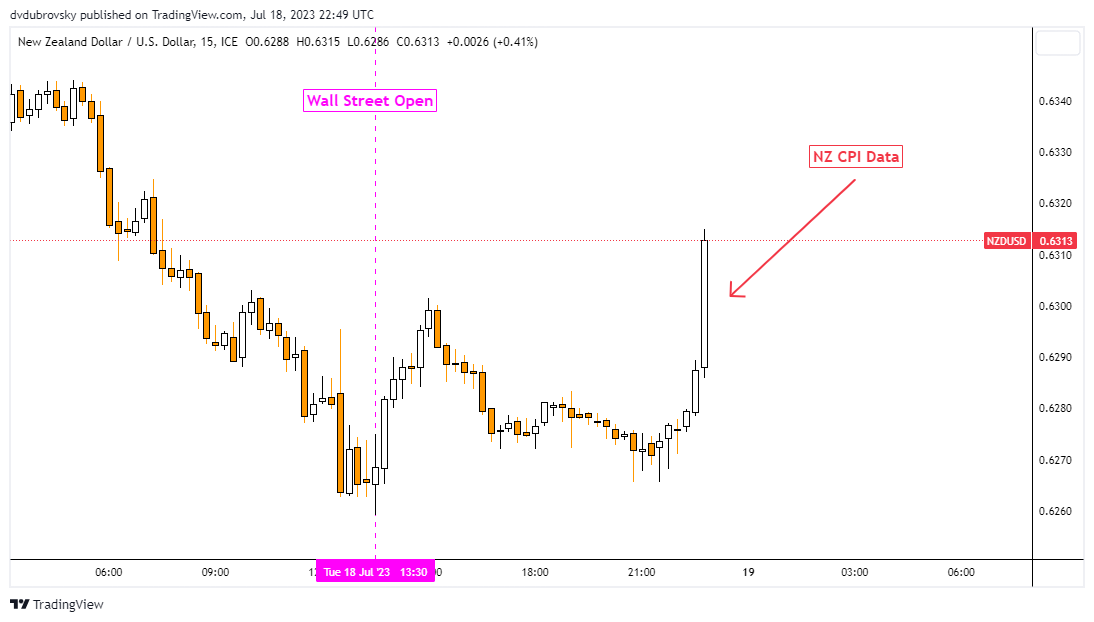

The New Zealand Dollar climbed during early Wednesday Asia trade after unexpectedly stronger local inflation data crossed the wires. In the second quarter, New Zealand’s headline CPI rate clocked in at 6% y/y against the 5.9% consensus. Meanwhile, inflation was 1.1% q/q against 0.9% anticipated. Both readings were down from 6.7% and 1.2%, respectively.

In response, financial markets began to price in a more hawkish Reserve Bank of New Zealand. Prior to the data, financial markets were just barely looking at another hike potential by the end of this year. Now, another 25-basis point increment to 5.75% is being largely priced in. New Zealand government bond yields pushed higher after the data dropped.

Last week, the central bank held its Official Cash Rate unchanged at 5.5% as expected. Policymakers noted that they are confident that restrictive rates will return inflation to target. Moreover, the governor stressed that homeowners have yet to feel the complete impact of the tightening cycle. The average mortgage rate on outstanding loans is seen climbing to 6% early next year from 3% early last year.

Monetary policy comes with lags, which is what makes being a central bank tricky. As such, even if the RBNZ were to hike again, the market pricing is restrained with just one additional hike potentially ahead. This could offer NZD/USD some support in the near-term, especially considering that the next Federal Reserve interest rate decision is not until July 26th. That is when the US Dollar could regain its footing.

NZD/USD Reaction to CPI Data

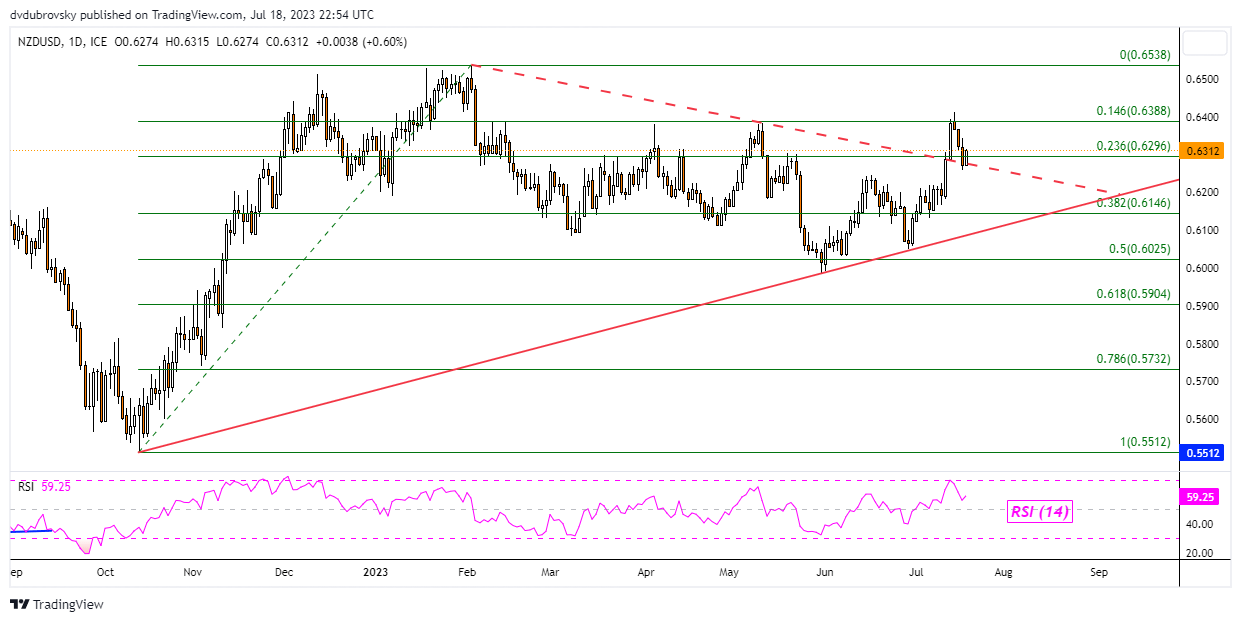

New Zealand Dollar Technical Analysis

On the daily chart, NZD/USD bounced off the galling trendline from the beginning of this year. That line held as resistance, maintaining a near-term downward focus. This is a rising trendline from October has been upholding the broader upside bias. The bounce off the former could open the door to extending higher, placing the focus on the minor 14.6% Fibonacci retracement level at 0.6388.

NZD/USD Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com