Bitcoin, BTC/USD, Ethereum, ETH/USD - Outlook:

- Bitcoin is attempting to rise above immediate resistance.

- ETH/USD has been holding above a vital support.

- What is the outlook and what are the key levels to watch?

BITCOIN: Holds above 25000

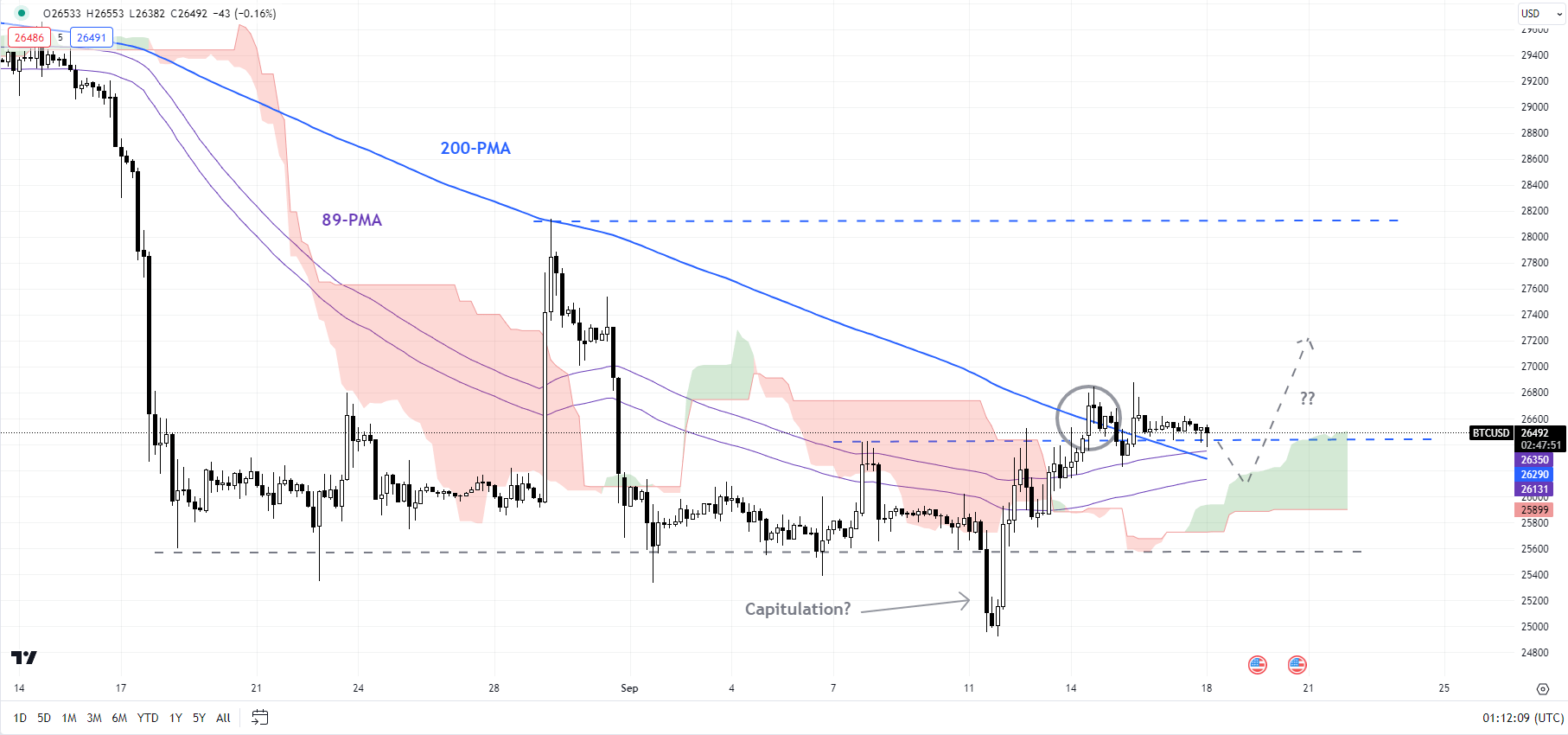

Over the past few weeks, Bitcoin has been holding above strong horizontal trendline support since mid-August, roughly coinciding with the June low of 24750. Last week, BTC/USD attempted to rise above immediate resistance at the early-September high of 26500. While the price action is still unfolding – BTC/USD hasn’t broken above 26500 cleanly – the ongoing attempt to rise above 26500 raises the chances that the worst could be over.

BTC/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

That’s because trends generally turn with capitulation. And the brief dip below 25000 last week coupled with the attempt to rise past 26500 suggests the tide could be turning temporarily in favour of BTC/USD. Still, a decisive rise above the resistance is needed for the imminent downside risks to fade. Such a break could open the upside toward the end-August high of 28150.

BTC/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Having said that, a fall below 24750-2500 would negate the above scenario, potentially triggering a double top (the April and July highs), pointing to a deeper retracement toward the March low of 19550. For more discussion on this, see “Bitcoin & Ethereum Influenced by Thick Cloud Cover; BTC/USD & ETH/USD Price Setups,” published September 5.

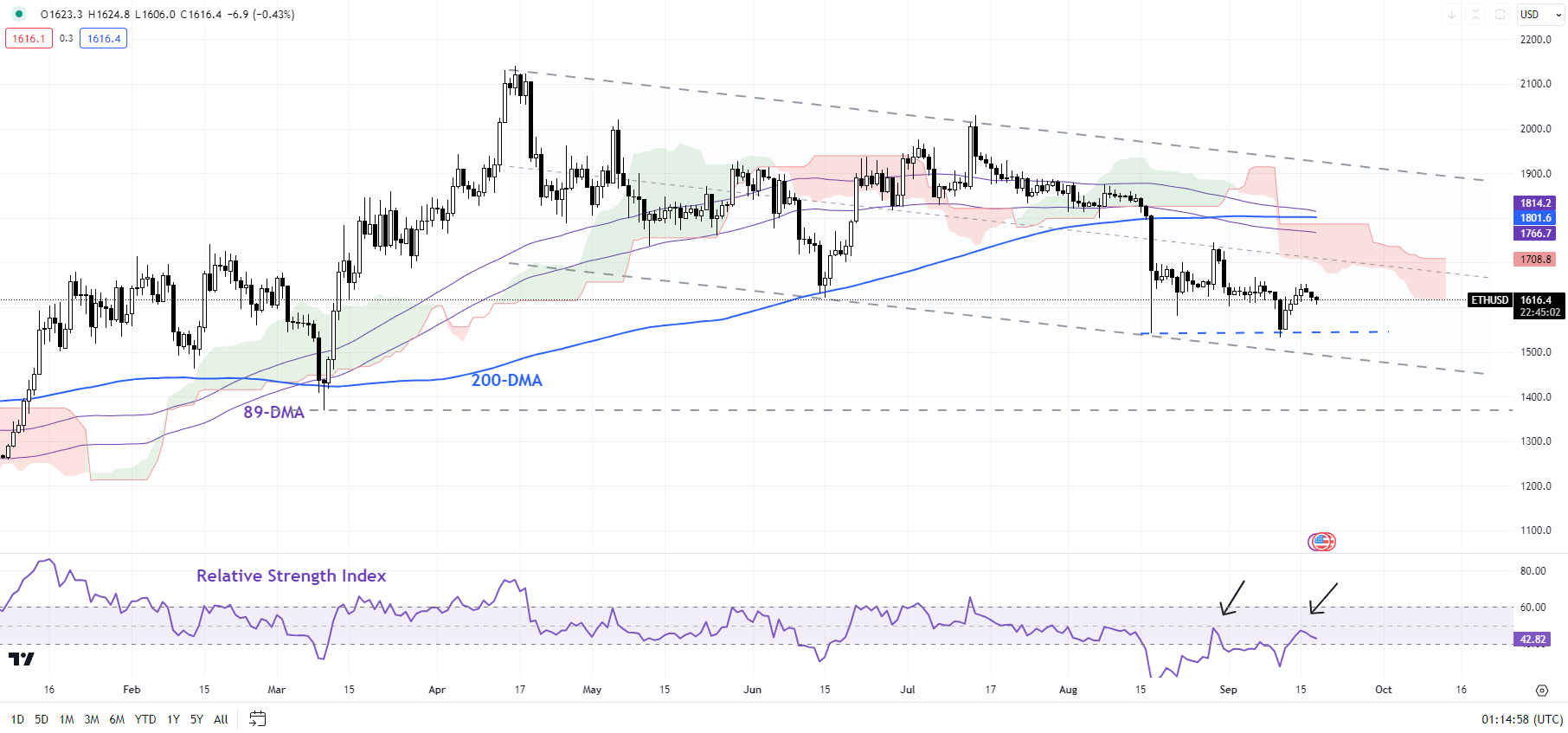

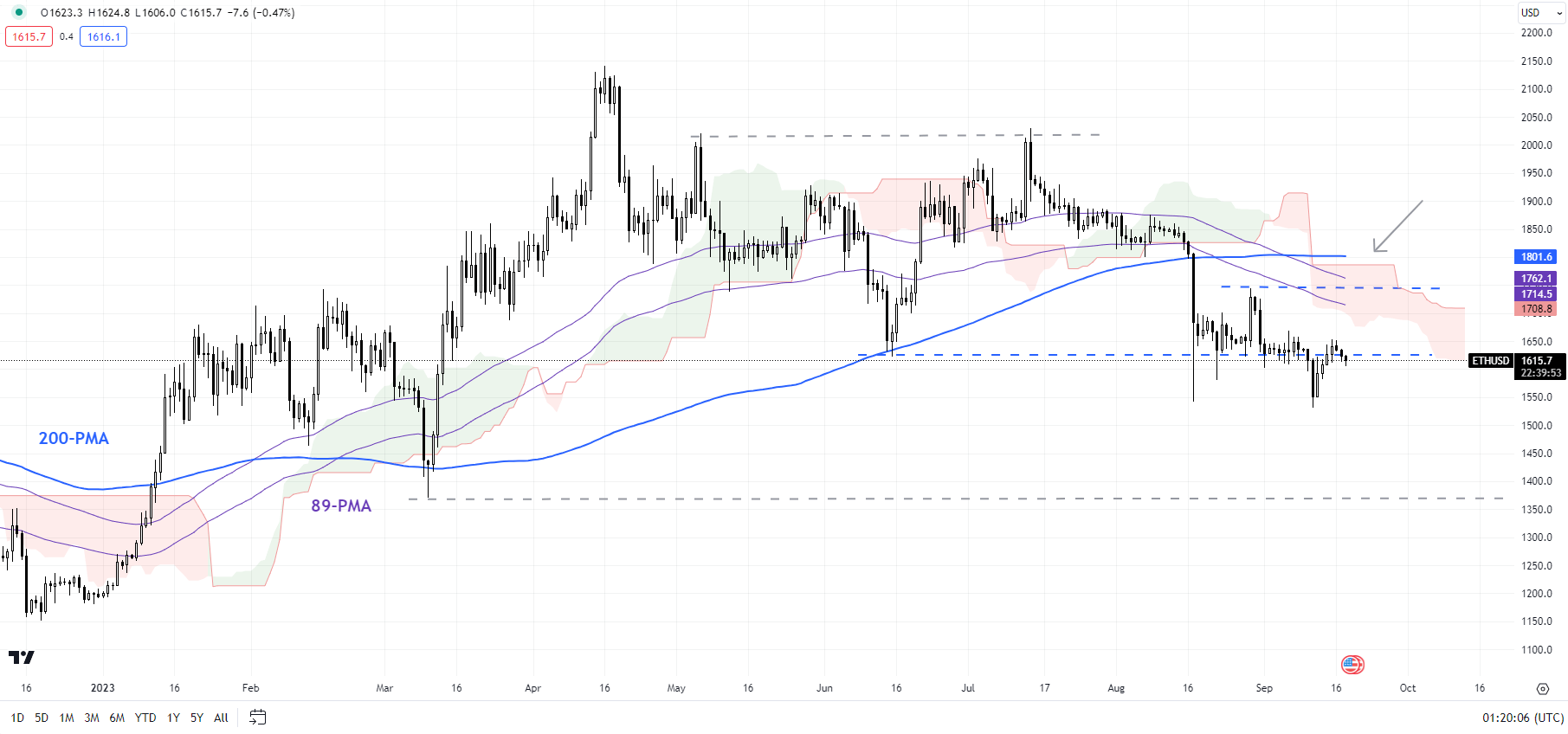

ETH/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

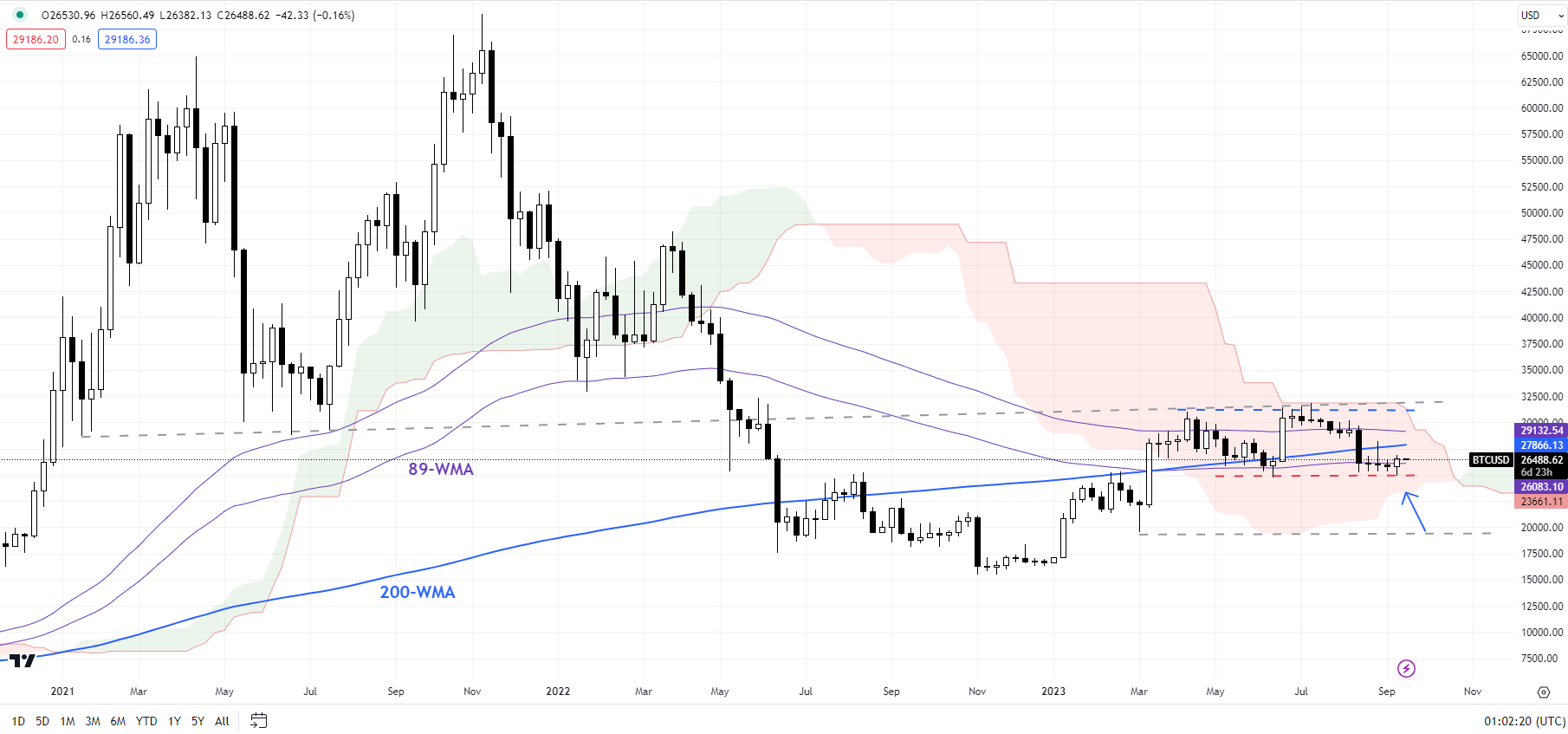

ETHEREUM: Awaiting confirmation of a low

In contrast, while Ethereum has been holding above its August low of 1550, ETH/USD has yet to rise above a meaningful resistance. In line with BTC/USD, similar resistance for ETH/USD is at the early-September high of 1660. Until some sort of upward momentum develops, the balance of risks for ETH/USD remains toward the downside in the near term – not the 14-day Relative Strength Index has been capped at the 50-mark – indicating a corrective rally, rather than the start of a new uptrend.

ETH/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Below the August low of 1550, the next support is on the lower edge of a downtrend channel since April (now at about 1500). A break below the 1500-1550 region could pave the way toward the October low of 1370.

As noted earlier this month, ETH/USD has been under the influence of the bearish Ichimoku cloud cover on the weekly charts. Furthermore, in recent weeks, ETH/USD has been snowed under the Ichimoku cloud on the daily charts. At a minimum, Ethereum needs to surpass 1660. A stronger signal that an interim low was in place would be a crack above the end-August high of 1750.

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish