Most Read: Gold Prices Bid Despite Hot PPI, Inflation Data Next - What Now for XAU/USD?

The U.S. Bureau of Labor Statistics will release on Wednesday morning April’s consumer price index data – a crucial economic report closely tracked by market participants that could bring heightened volatility due to its significance for the Federal Reserve’s monetary policy path.

Following Tuesday's elevated PPI results, there is a slight risk that the upcoming inflation figures could also disappoint, undermining confidence in the disinflationary trend that gained traction in late 2023 but seemed to have stalled this year.

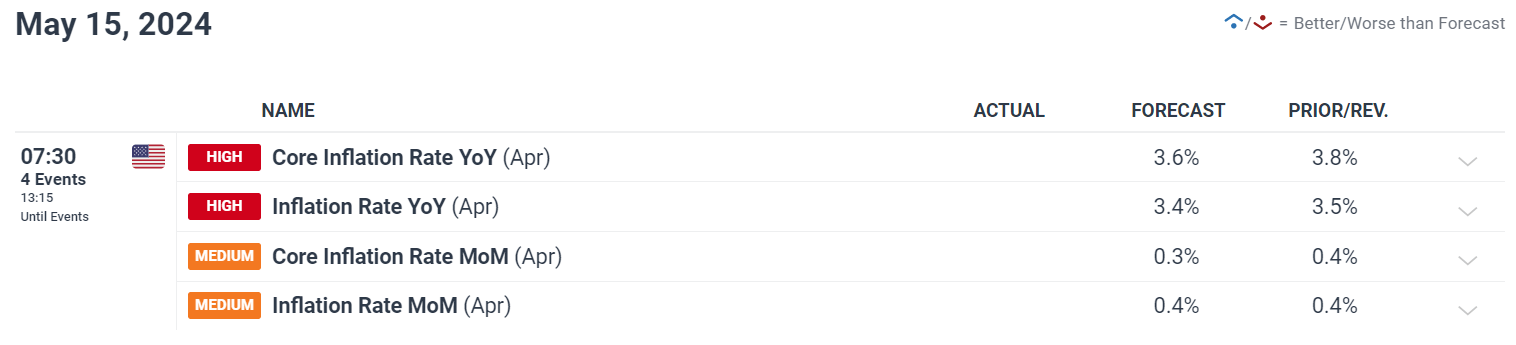

Consensus estimates suggest that headline CPI rose 0.4% on a seasonally adjusted basis last month, bringing the annual rate down slightly to 3.4% from 3.5%. Meanwhile, the core CPI is expected to have climbed by 0.3%, resulting in the 12-month reading easing to 3.6% from 3.8% in March.

Want to know where the U.S. dollar may be headed over the coming months? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

UPCOMING US DATA

Source: DailyFX Economic Calendar

While the Fed has signaled it may wait longer than initially envisioned to start dialing back on policy restraint, it hasn’t gone full-on hawkish, with Powell essentially ruling out new hikes. Another upside surprise in the data, however, could change things for the FOMC and lead to a more aggressive stance.

In the event of hot inflation numbers, the market may recognize that the recent series of robust CPI readings are not merely seasonal anomalies or temporary setback, but part of a new trend: the cost of living is reaccelerating and settling at higher levels.

Wondering about the gold’s medium-term prospects? Gain clarity with our latest forecast. Download a free copy now!

The scenario previously described could lead traders to reduce bets on a September rate cut, shifting their focus to a potential move in December or no easing at all in 2024. Higher interest rates for longer should exert upward pressure on yields, boosting the U.S. dollar. This should be bearish for gold prices.

On the other hand, a benign inflation report, that comes below Wall Street’s projections, should weigh on yields and the greenback, creating a constructive backdrop for precious metals. Such outcome could revive disinflation hopes, increasing the odds of the Fed pivoting to a looser stance at early in the fall.