Gold Price (XAU/USD) Talking Points:

- Gold prices remain uncertain - The Vix (known as the ‘fear gauge’) erases 18% of this month’s gain – is it too soon to eliminate contagion fears and a severe recession?

- XAU/USD trades sideways around $1,946 as market participants wait for Jerome Powell to provide insight into the growth outlook for the world’s largest economy.

- FOMC and Fed rate decision are expected to drive gold’s next move.

FOMC Economics of projections and Fed rate decision to guide gold’s next move

Gold prices have steadied after yesterday’s decline, pushing XAU/USD into a tight range around $1,946. With fears around the banking crisis beginning to ease, market participants appear to be regaining confidence. This has been illustrated by a steep drop in the VIX index, which measures the volatility of the S&P 500 and has gained a reputation as ‘fear gauge’.

At the onset of a potential banking crisis, the VIX started to increase at a rapid pace which was exacerbated when Credit Suisse appeared to be in financial distress. However, after rising by approximately 37%, the VIX fell sharply, shedding around 18% of those gains.

Because gold holds a reputation as a hedge against inflation and is sensitive to growth prospects, its safe-haven appeal assisted in driving prices higher. However, it was the expectations surrounding the Federal Reserve’s next move that enabled a break of $2,000.

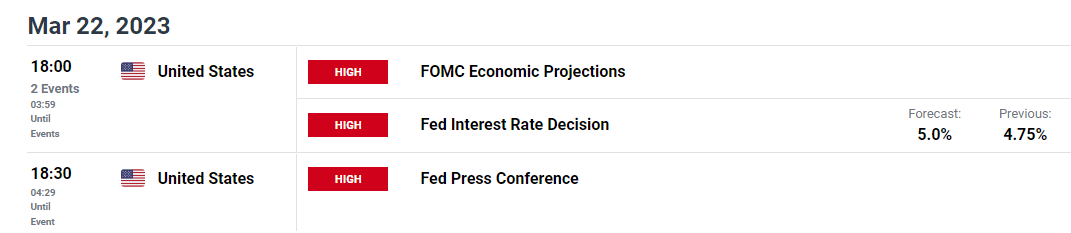

With the FOMC economic projections and the Fed’s rate hike on today’s economic docket, markets are now pricing in a 25 basis-point rate hike, half of what was anticipated a two weeks ago.

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

Gold (XAU/USD) Technical Analysis

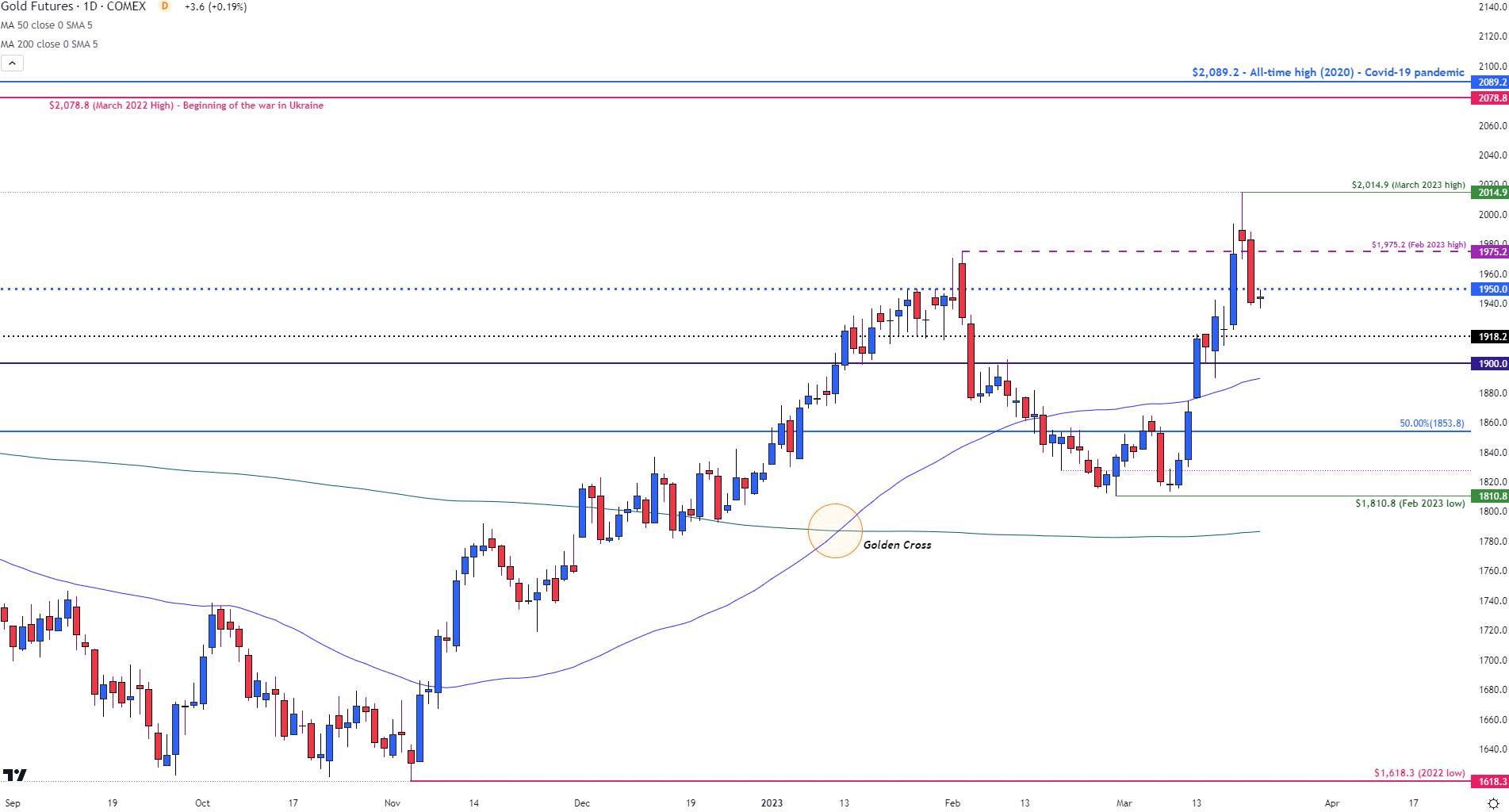

After soaring to a new high of $2,014.9 last week, gold prices started to fall, erasing a small portion of recent gains. With recession fears subtly subsiding, XAU has found temporary support around $1,946. As key technical levels continue to provide support and resistance for price action, there are two scenarios that can play out.

Gold Price Chart (Daily)

Chart prepared by Tammy Da Costa using TradingView

If Fed Chairman Powell hikes rates by 50 basis-points (above expectation) and he suggests that the path for interest rates remain unchanged, then it is possible for gold to experience a sharper pullback towards $1,900.

On the other hand, if the Fed pauses or sticks to a 25 bps (0.25%) hike and hints at a pivot, gold could resume its bullish move, opening the door for $2,000.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707