German Dax 40 Forecast: Bearish Below 15,200

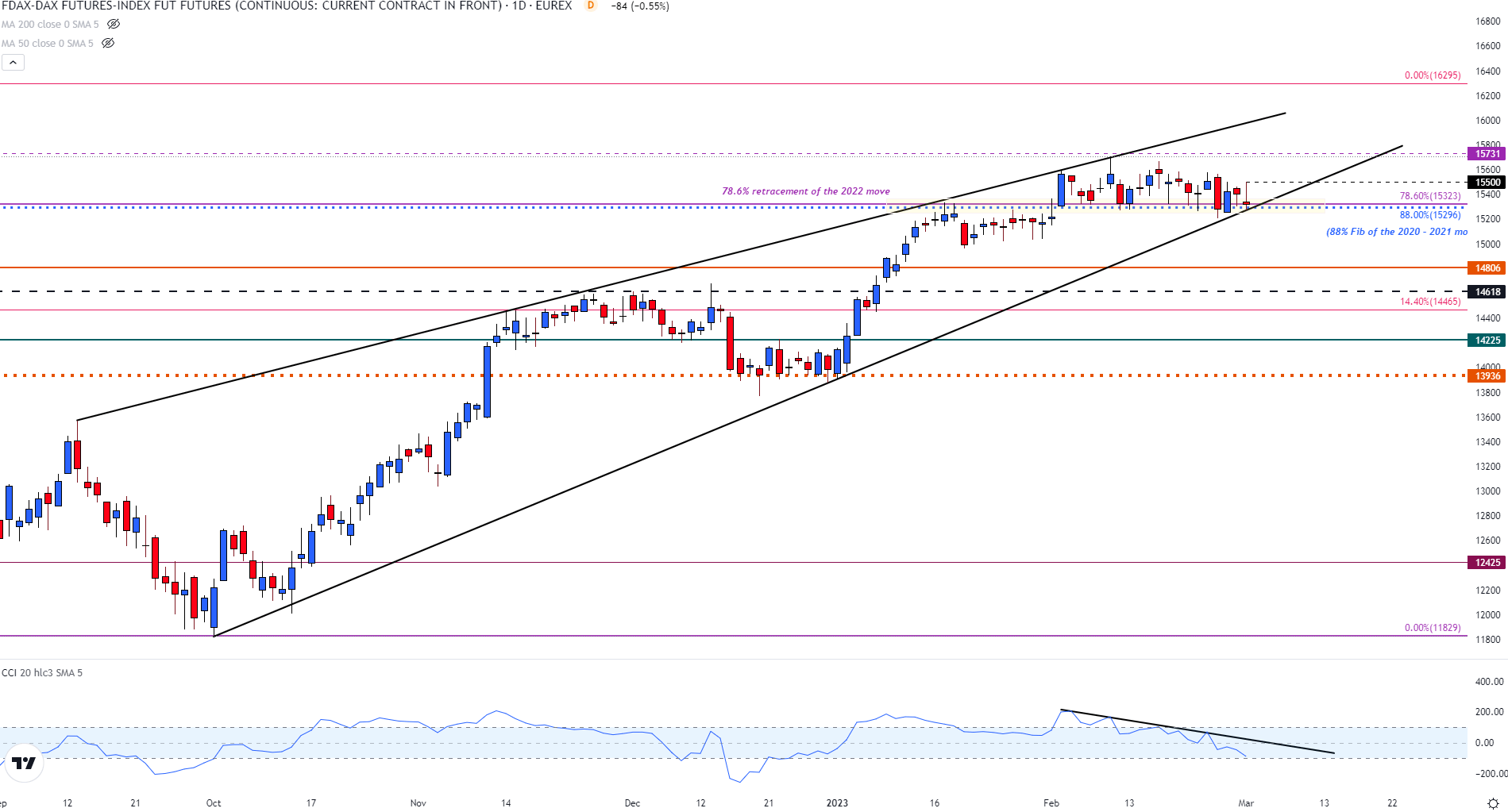

- Dax price index falls between two historical levels of Fibonacci and technical support.

- German 40 threatens lower bound of rising wedge as CCI approaches oversold territory.

- Consolidation builds in a narrow range with a potential hanging man candle on the daily chart limiting the bullish move.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

DAX Price Index Technical Analysis

Dax prices have recently been trading sideways, struggling to break in either direction. While prices have maintained strong bullish momentum at the start of the year, key technical levels have come back into play.

The daily chart below illustrates the manner in which the two Fibonacci’s from historical moves has helped provide support and resistance for price action. With a zone of confluency forming between 15296 and 15323, the formation of hanging man candle and a rejection of 15500 could place additional pressure on bulls.

Introduction to Technical Analysis

Fibonacci

Recommended by Tammy Da Costa

With a rising wedge from the 2022 October low showing a strong rebound that drove Dax prices over 30% over the past four months has run into major resistance at the daily high of 15500.

Dax Price Index (Futures) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Since the beginning of February, this level has helped limit the bullish move, causing the CCI (commodity channel index) to fall. While prices traded relatively flat, the CCI continued lower, falling toward oversold territory.

If prices fall below 15296 (support), a break below 15200 could fuel a bearish breakout. Meanwhile, with the recent data solidifying a higher probability for additional rate hikes this year, fundamental factors will likely assist in driving the next move.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707