KEY POINTS:

- WTI Prints New YTD Low in the European Session.

- Chinese Exports Continue to Fall Further Weighing on Oil Prices.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Crude Oil Forecast: EU Sets Russian Oil Price Cap at $60, OPEC+ Unchanged

WTI FUNDAMENTAL OUTLOOK

Crude Oil remains under pressure this morning printing a new YTD low following three consecutive days of losses. The recent price cap on Russian oil has had very little impact on oil prices as a resurgent dollar and recessionary fears grow.

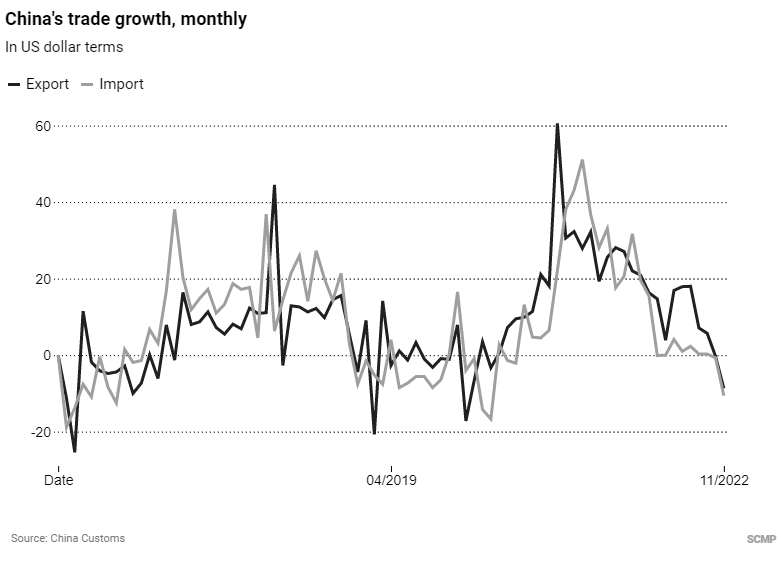

News out of China this morning regarding the further easing of covid regulations has done little to ease demand fears. It would seem that the easing of restrictions has largely been priced in by market participants as rumors began to swirl from last week. The Chinese health authority announced that people with asymptomatic Covid-19 cases as well as mild symptoms may quarantine at home. Chinese imports and exports fell sharply in November in a further sign of weak global demand which could be affecting oil prices as well. Exports fell 8.7% last month as inflation begins to affect global demand with consumers prioritizing essential purchases over luxuries.

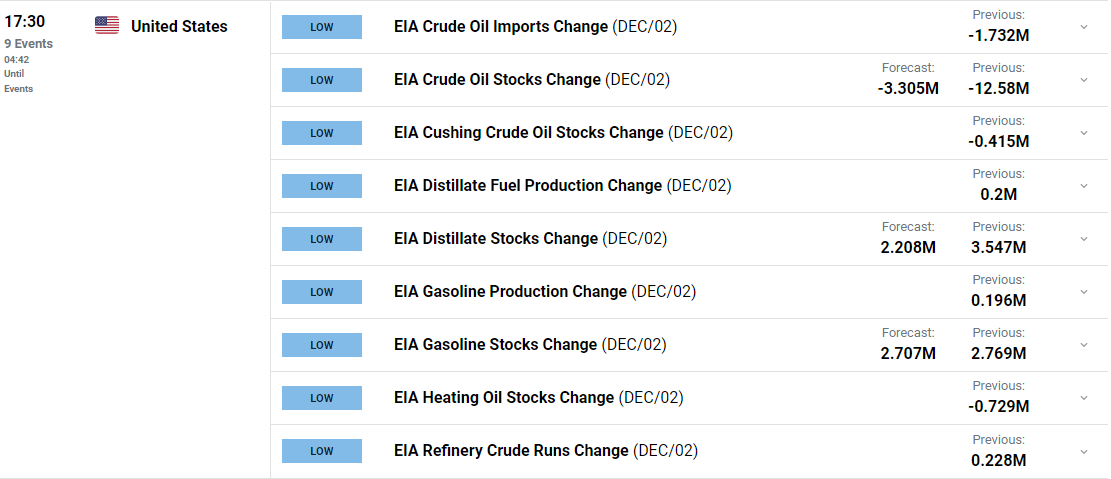

Looking ahead to the rest of the day we have a host of Crude EIA Oil data. The data may add some volatility with further downside a possibility as US oil companies continue to pump oil at a record pace. A continuation of the dollar index recovery could also further weigh on oil prices during the US session.

For all market-moving economic releases and events, see the DailyFX Calendar

From a technical perspective, WTI has printed three consecutive days of losses before a printing a new YTD low in the European session. WTI currently trades some way off the MAs with 20-day MA resting around the $80 handle. We could be in for a potential retracement soon as the RSI is currently in oversold territory on both the 4H and daily timeframes, however this is likely to depend on the dollar index and the EIA data release later today.

WTI Crude Oil Daily Chart – December 7, 2022

Source: TradingView

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently Long on Crude Oil, with 83% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that Crude Oil may continue to fall.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda