USD/JPY PRICE, CHARTS AND ANALYSIS:

- USD/JPY Flirts with the 137.00 Level as the 200-Day MA Caps Gains.

- Policy Divergence Hints at Further Upside for the Pair.

- Fed Chair Powell Struck a Rather Mixed Tone in his Second Day of Testimony on Capitol Hill.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: Gold Price Forecast: $1800 Back in Focus as Price Consolidates Following Selloff

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY Printed a fresh YTD high around the 137.900 handle before retreating 100 pips to slip below the 137.00 mark. Gains were capped despite positive ADP data out of the US with the pair remaining in overbought territory.

The hawkish rhetoric by Fed Chair Powell had helped facilitate a break of the 137.00 handle after 7 days of consolidation between the 135.00-137.00 range. Further comments today from Fed policymaker Ellen Barkin who stated that the Fed still has work to do as inflation remains uncomfortably high. Fed Chair Powell continued his testimony today where he appeared slightly less hawkish stating that monetary policy effects may be lagging and slowing the pace of rate hikes this year is a way to gauge the effects of lags more clearly.

Looking ahead monetary policy divergence may come into play on USDJPY which would favor further upside for the pair. The BoJ is expected to maintain its easy monetary policy stance with incoming Bank of Japan Governor Kazuo Ueda only last week confirming his intention to continue with “Abenomics”. Ueda stressed that the Japanese economy remains fragile with wage growth yet to reach acceptable levels. Taking the above into account further gains for USDJPY cannot be ruled and look increasingly likely.

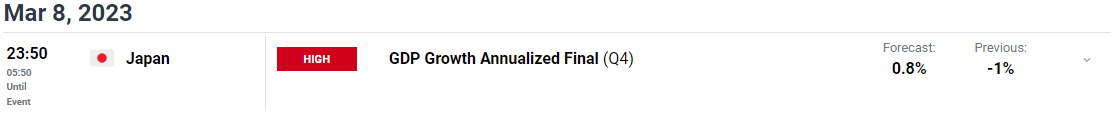

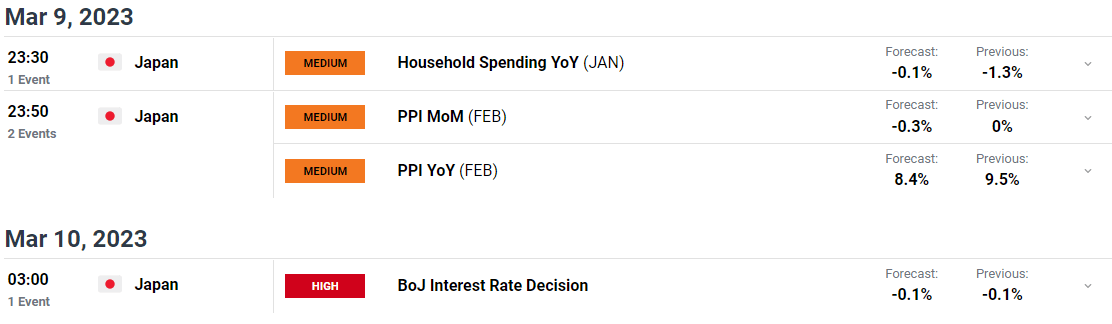

Powell confirmed that the Fed will make decisions based on data while stating that no decision has been made in regard to the upcoming March Meeting. Friday’s NFP print promises to be key as the Fed weighs a 50bps hike with the Fed beginning its blackout period on Saturday. Overnight we have the GDP growth rate out of Japan followed by PPI data on Thursday and the BoJ rate decision Friday morning.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

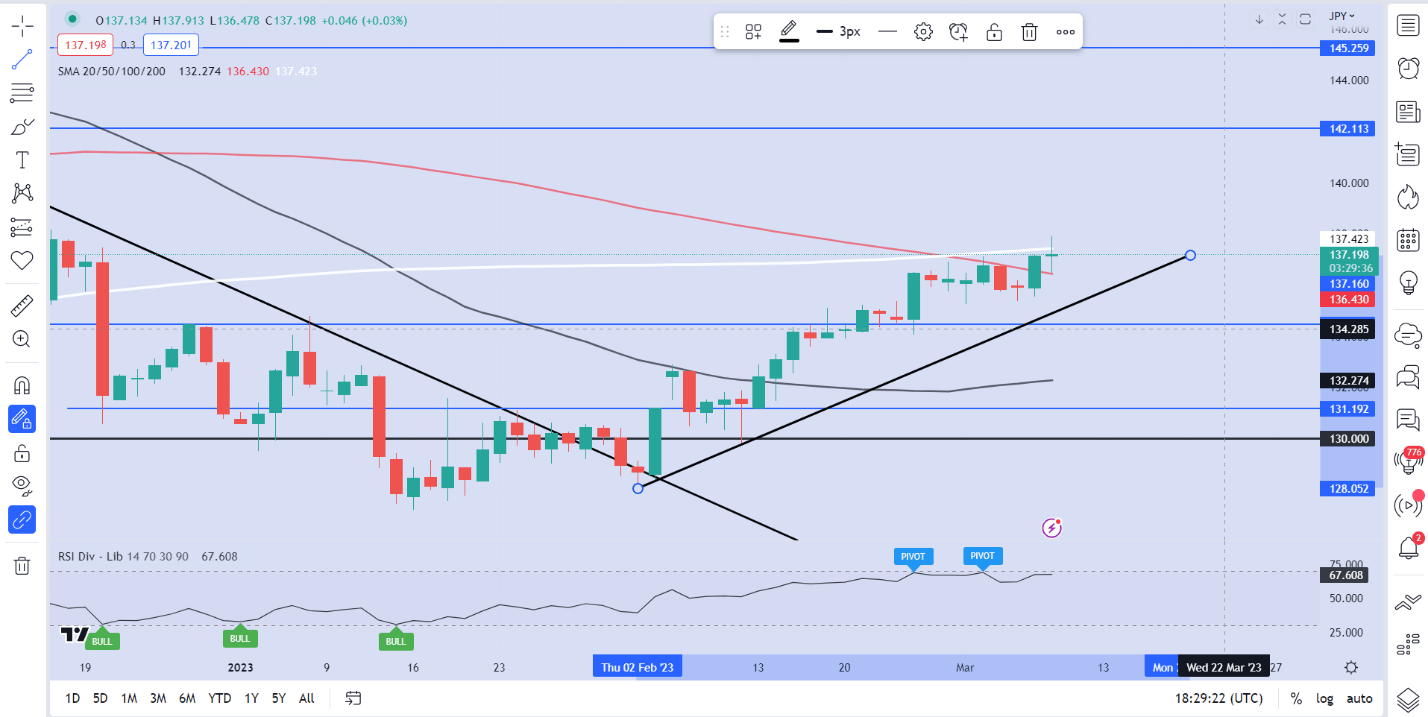

From a technical perspective, USD/JPY has been on an upward trajectory since the middle of January, breaking the descending trendline. The pair seemed to have found a strong resistance are around the 137.00 mark in recent times as we spent around 7 days probing the level and threatening a break higher.

Having now broken higher we are stuck between the 100 and 200-day MA. The technical are giving mixed signals and don’t seem to be on the same page as the fundamentals at this stage.

We have the 200-day MA providing resistance, together with a golden cross formation and of course the RSI which is currently in overbought territory. Given all of the technicals pointing to some form of retracement I do think any such move may be short lived and could be a retest of the ascending trendline (136.00) which is now in play before we do push on and continue higher toward 138.20 and potentially the 140.00 psychological level.

USD/JPY Daily Chart – March 8, 2022

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda