USD/CAD PRICE, CHARTS AND ANALYSIS:

- Fed Chair Powell Adopts a Hawkish Stance, Helping Facilitate a Breakout of the Range in Play Since November.

- Monetary Policy Divergence Supports Further Upside.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

MOST READ: GBP/USD Struggles to Hold on to Gains Despite Positive UK Housing Data

USD/CAD FUNDAMENTAL OUTLOOK

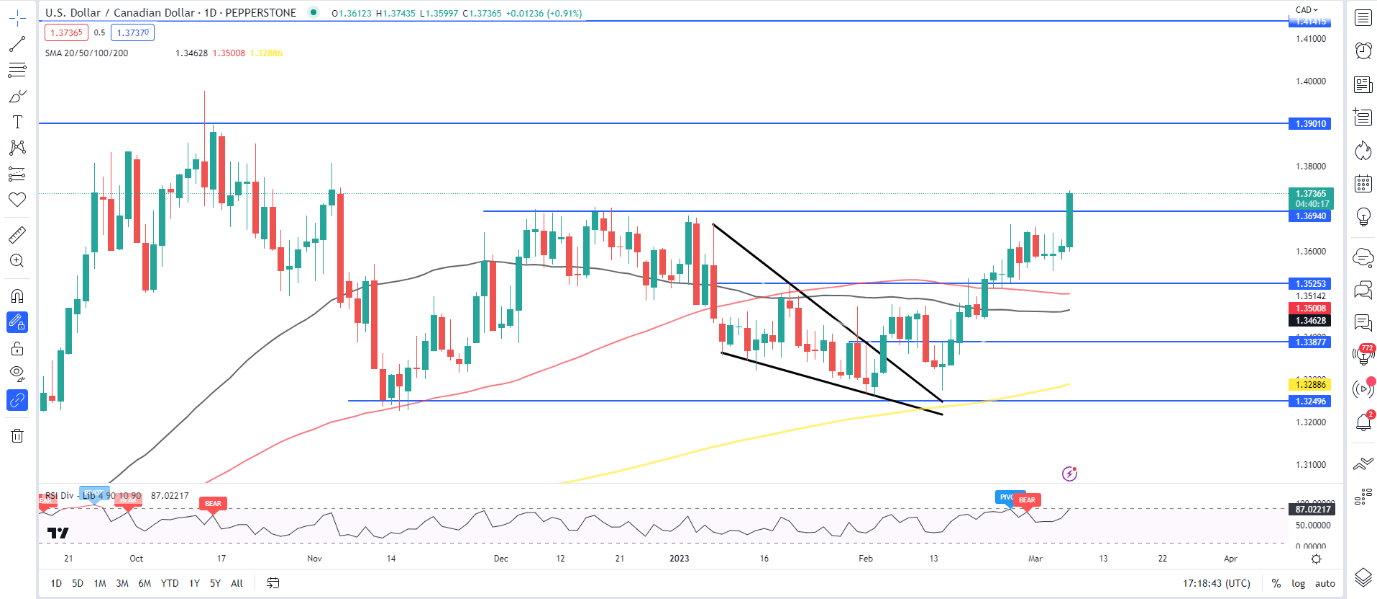

USD/CAD has continued its upside move today following three days of consolidation around the 1.3600 area. The move has been inspired by a host of factors which have formed the perfect cocktail, with the pair eyeing a breakout of the range it has been stuck in since the 4th November 2022.

WTI finally broke above the 100-day MA yesterday trading above the $80 a barrel mark. We have seen the price pull back today adding to the Canadian Dollar’s woes and aiding the advance of the greenback. Data out of China overnight wasn’t the best either with import numbers declining and more importantly a contraction in China’s crude imports for both January and February weighing on oil prices. The Dollar Index attracted fresh buyers in the European session as markets awaited the testimony of Fed Chair Powell on the state of the US economy.

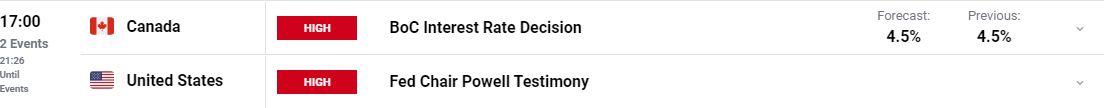

Fed Chair Powell testified before the Senate Banking Committee in Washington DC today adopting a rather hawkish stance, providing the greenback with fresh impetus as he hinted at more rate hikes as well as the possibility of increasing the pace should the data warrant it. Tomorrow brings another day of testimony from Fed Chair Powell as well as the BoC interest rate decision.

For all market-moving economic releases and events, see the DailyFX Calendar

LOOKING AHEAD

The longer-term picture for USDCAD favors further upside at present with the two central banks now on vastly different paths. Given the hawkish tone adopted by the Fed Chair markets are now favoring a 50bps hike at the Feds March Meeting starting on the 21st. The Bank of Canada on the other hand has already paused its hiking cycle with tomorrow’s meeting expected to see the central bank leave rates unchanged.

TECHNICAL OUTLOOK

From a technical perspective, USD/CAD broke out of the range that has been in play since November 2022. We still need a daily candle close above the 1.3700 handle to confirm the break and open up the potential for a push higher toward the 1.3900 resistance level or the 2022 high around 1.3950.

Usually, the longer a pair ranges the more aggressive the breakout. Given that we have the BoC meeting tomorrow should we hear dovish rhetoric from Bank of Canada Governor Macklem it could help facilitate a push higher as well. Looking at the fundamental and technical picture it is clear that the path of least resistance appears to be the upside.

USD/CAD Daily Chart, March 7, 2023

Source: TradingView, Prepared by Zain Vawda

--- Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda