GOLD PRICE, CHARTS AND ANALYSIS:

- Gold (XAUUSD) Technicals Flashing Bearish Signals but the Macro Picture Remains Murky.

- Market Sentiment, Dollar Index and the US Debt Ceiling Will be Key for Price Action for the Rest of the Week.

- 50-Day MA at $1981/oz Could Provide Support and Facilitate a Retest of the $2000 Handle.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

READ MORE: Turkish Elections and Implications for the Lira as USD/TRY Eyes Fresh Highs

Gold (XAU/USD) AND DOLLAR INDEX FUNDAMENTAL BACKDROP

Gold prices have steadied following yesterday’s fall as key support level and 50-day MA come into play. The dollar index (DXY) has strengthened in the early part of the week as the continued deadlock over the US debt ceiling continues.

Gold prices have benefitted over the past few months as demand has surged on the back of recessionary concerns and the US banking crisis. However, given all the uncertainties, gold prices failed to sustainably hold above the $2000 mark leading market participants to wonder, is this the end of the bullish cycle? I for one see further uncertainty ahead as Central Banks look to pause rate hikes with Gold likely to be a beneficiary of any further market uncertainty in the second half of the year. The early week dollar strength has come about as safe haven demand for the USD spiked as tensions around the US debt ceiling reached fever pitch yesterday as US President Joe Biden and House Rep. Kevin McCarthy met. There were some positive developments according to both parties. McCarthy did however state that he isn’t optimistic a deal will be reached by the end of the week. Historically speaking the US came close to a debt default in 2011 with a default averted at the last minute. Given the debt ceiling has been raised around 66-68 time since WW2 market optimism this morning may not be misplaced after all.

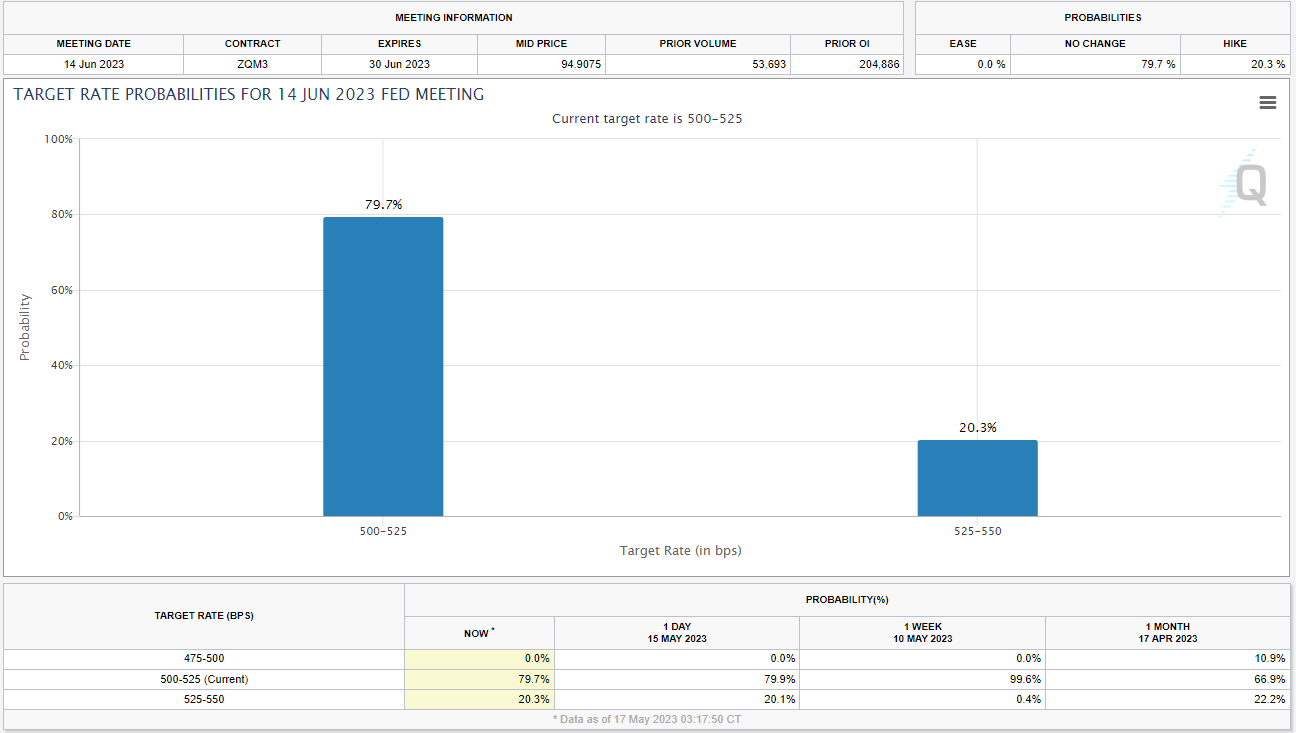

Source: CME FedWatch Tool

Yesterday’s US data came in mixed with retail sales MoM missing estimates while industrial production ticked higher. US Federal Reserve speakers continue to keep markets on alert as we heard from Atlanta Federal Reserve President Bostic said the Fed would need to stay super strong in fighting inflation even if it leads to an increase in unemployment. Austen Goolsbee from the Chicago Fed said rate cut discussions are premature with Thomas Barkin that he would be comfortable with further rate hikes. The comments and safe haven appeal of the US dollar saw the dollar index (DXY) rally to a 2-week high as it taps into the 100-day MA. The developments over the past week have seen expectations for a pause in Fed rate hikes decline from 99% a week ago down to 79% this morning per the FedWatch Tool above.

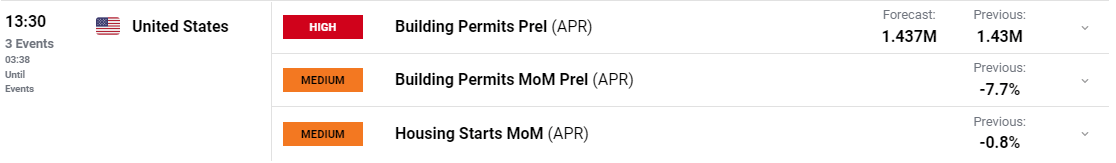

Not a lot to look forward to on the calendar today but we do have some medium impact data out of the US. The building permits preliminary data as well as housing starts for April are scheduled for release and may provide a clearer picture of the US housing market.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

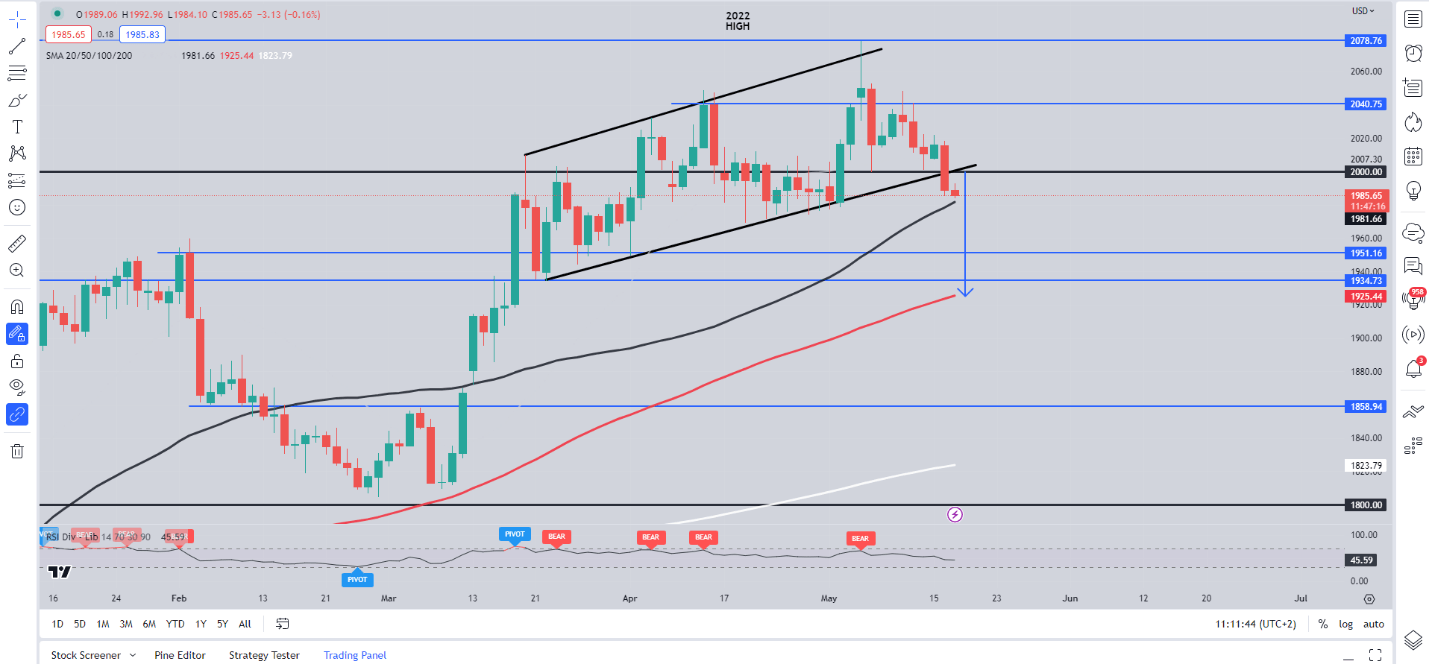

Form a technical perspective, Gold price action has been overshadowed of late by overall market sentiment and safe haven demand. However, the precious metal had been printing lower highs and lower lows since topping out at around the $2079 handle on May 4.

We have broken the ascending channel and currently trade just shy of the 50-day MA resting at $1981.50 with a break below opening up a potential retest of the 100-day MA around $1925. Of course, there are other intraday support levels which could scupper a test of the 100-day MA with support at $1970 and $1950 likely to prove stubborn. A push to the upside brings the psychological $2000 level back into play which currently lines up with the ascending channel breakout.

Foundational Trading Knowledge

Commodities Trading

Recommended by Zain Vawda

In short, we have seen some erratic moves of late which could continue with a lack of high impact data market sentiment, dollar index and developments around the US debt ceiling are likely to drive gold prices. Technicals are flashing bearish signals with a bias to the downside in the short-term seemingly appropriate. A daily candle close above the $2007 mark would invalidate the current bearish bias. I would advise caution and attention to developments on the dollar index as well as the US debt ceiling which could result in some unexpected price swings for the rest of the week.

Gold (XAU/USD) Daily Chart – May 17, 2023

Source: TradingView, Chart Prepared by Zain Vawda

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda