Euro, EUR/USD, US Dollar, Powell, GDP, Holzmann, Trend - Talking points

- EUR/USD is stretching to recent highs on the prospect of higher rates

- All eyes will be on Jerome Powell later today for clues on the Fed’s rate path

- If the US Dollar reacts to his comments, where will EUR/USD go?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

EUR/USD jumped higher to start this week ahead of Federal Reserve Chair Jerome Powell’s testimony to Senate Banking Committee in Washington on Tuesday and Wednesday.

Additional event risk may also lie in the Euro wide GDP figures that will be seen on Wednesday.

Overnight comments from Robert Holzmann boosted the Euro when he said that he could see a 50 basis point lift to rates at the next four European Central Bank (ECB) meetings. Mt Holzmann is a policy maker for the ECB and Governor of Austria’s central bank, the Oesterreichische Nationalbank (OeNB).

Looking forward, it seems that commentary from central bank officials could be the driver for EUR/USD alongside other currency markets and bond markets in general.

The ECB are due to convene on Thursday 16th March ahead of the Fed that will start their gathering the following week on March 22nd.

EUR/USD TECHNICAL ANALYSIS

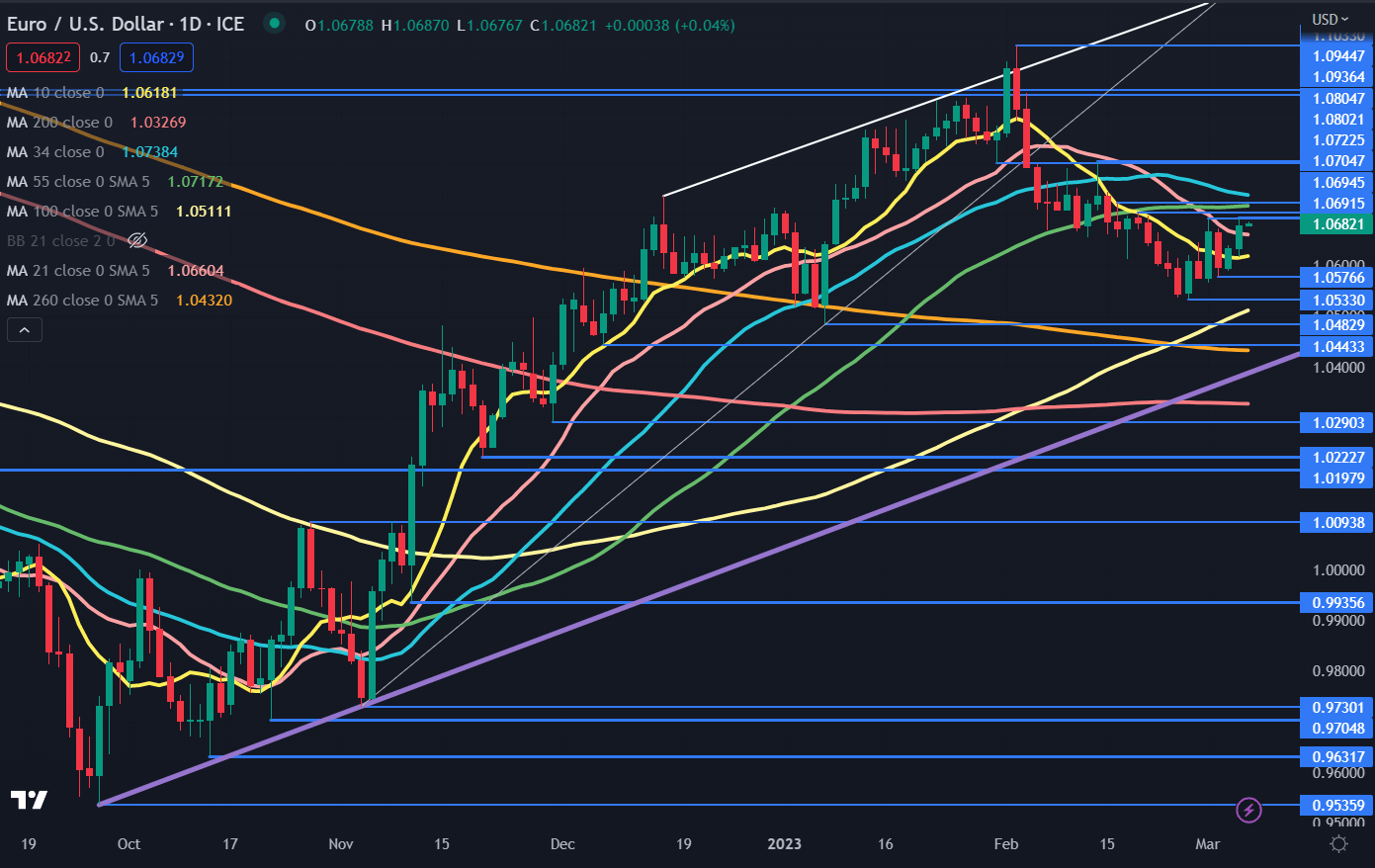

EUR/USD has been in a 1.0533 – 1.0722 range for three weeks despite several attempts to overcome the topside of this range. Those peaks have setup a potential resistance in the 1.0700 – 1.0720 area.

The 55-day simple moving averages (SMA) also currently resides at 1.0717 and may lend possible resistance. The 34-day SMA is also just above there at 1.0738.

The price is currently above the 10-, 100-, 200- and 260 day SMAs and the rally overnight went above the 21-day SMA. If it does move above the 34- and 55-day SMAs, it will be above all short, medium and long-term daily SMAs and might indicate that bullish momentum is evolving.

Resistance could be further up at the breakpoints and prior peaks of 1.0805, 1.0936, 1.0945 and 1.1030.

Overall, EUR/USD remains in an ascending trend channel and support could be at the lower bound of the channel, currently at 1.0390. Ahead of there, the previous lows of 1.0577, 1.0533, 1.0483 and 1.0443 may lend support.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter