EUR/USD Price, Chart, and Analysis

- Euro Area service sector activity print a new 12-month high.

- Manufacturing activity contracts at the fastest rate since December.

- EUR/USD stable around 1.0960 in limited trade.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

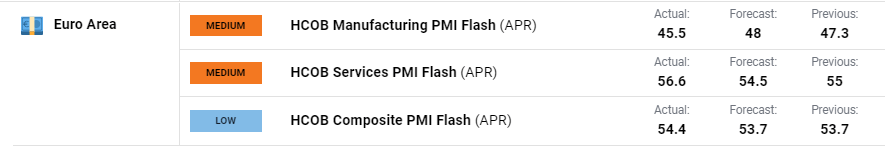

The latest HCOB Flash Eurozone PMIs show a growing divergence between the manufacturing and service sector in the single block. According to the latest release, ‘Growth became increasingly uneven in April, with the service sector reporting its strongest expansion for a year whereas manufacturing output contracted at the sharpest rate since December, falling back into a decline after two months of marginal growth. The resulting outperformance of services relative to manufacturing was the widest seen since early-2009, and the survey has not yet previously recorded such a strong service sector expansion at he time of manufacturing decline’.

HCOB Flash Eurozone PMI – Full Report

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

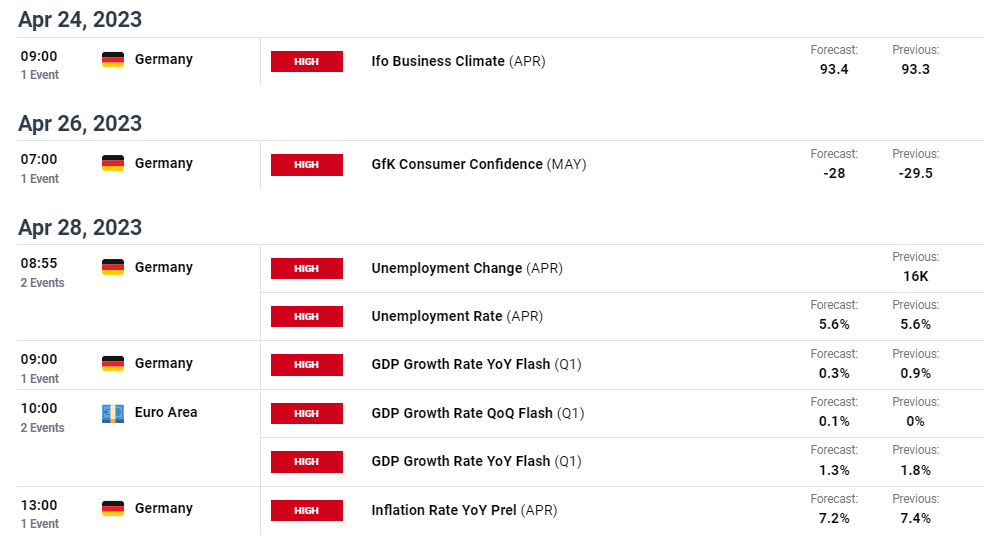

Next week’s economic calendar is heavily loaded with high-impact German and Euro Area data releases that are likely to dictate the single currency’s price action. Next Friday, in particular, is one for traders to watch carefully with German jobs, growth, and inflation data hitting the screens.

USD Price Forecast: Dollar Index (DXY) Bid on Fed Speak

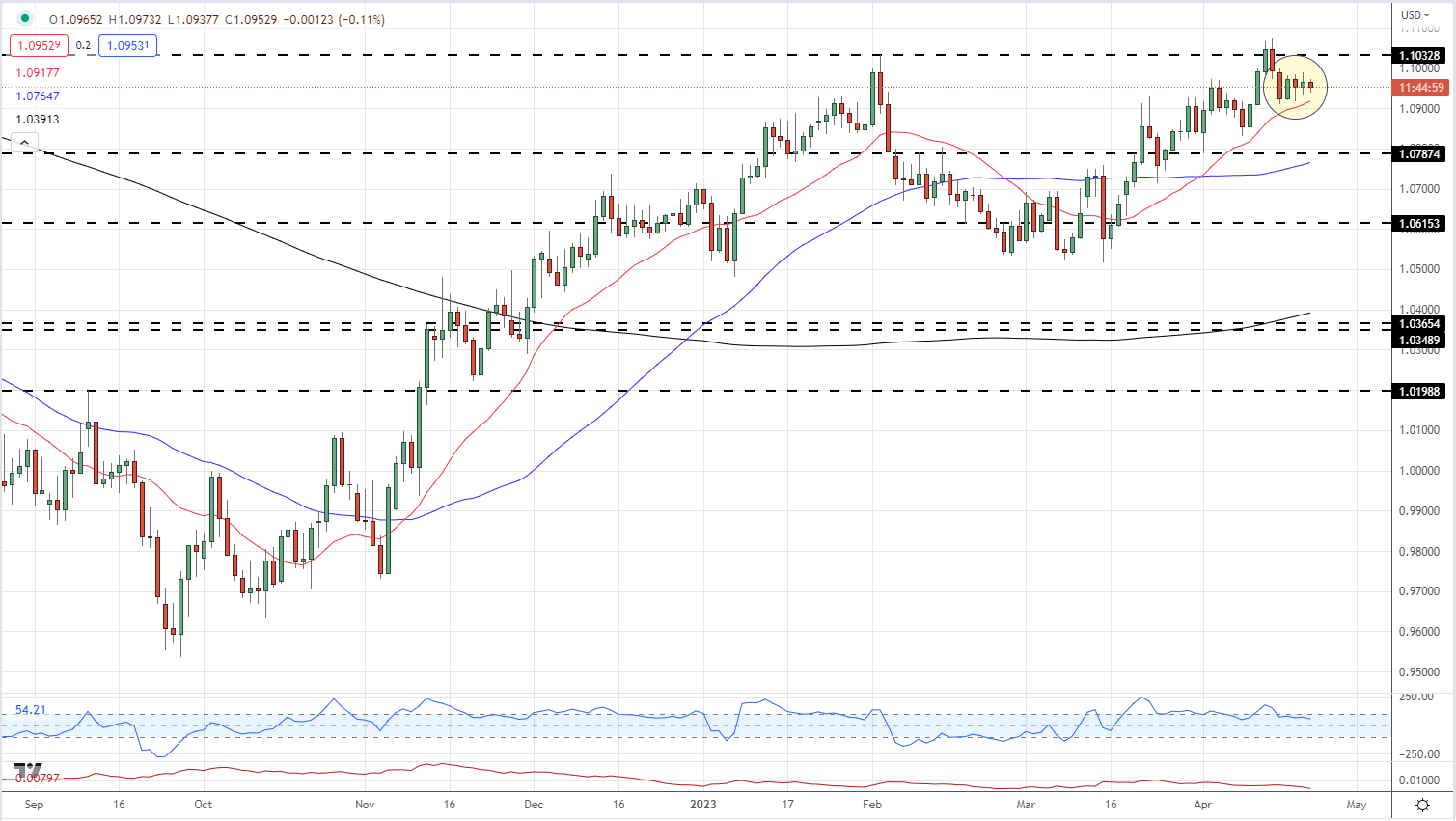

EUR/USD is stuck in a very tight trading range with the pair showing little desire to make a break. Hawkish speak yesterday evening from the Fed’s Mester and Harker gave the greenback a bid coming into this morning, but this is fading, leaving the US dollar listless. The recent range of 1.0909 to 1.1033 remains intact and it seems unlikely that this will be troubled today. EUR/USD volatility is hitting a multi-week low (ATR) while the pair have been unable to break out of Monday’s 1.0909 to 1.0998 range all week.

EUR/USD Daily Price Chart – April 21, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 9% | -1% | 4% |

| Weekly | -1% | 16% | 7% |

Big Weekly Swings in Retail Positioning

Retail trader data show 43.51% of traders are net-long with the ratio of traders short to long at 1.30 to 1.The number of traders net-long is 1.75% lower than yesterday and 49.25% higher from last week, while the number of traders net-short is 0.92% higher than yesterday and 22.68% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.