Crude Oil Price Forecast: Neutral

- Oil prices reacts to rising recession risks and higher inventories by plunging to 15-month lows.

- US Crude (WTI) falls to technical support as a banking crisis adds to concerns of lower demand.

- Brent Crude oil remains in oversold territory with prices closing the week around $73.00.

Mounting recession Risks, bank failures and lower demand expectations force oil lower

After a week of chaos, oil prices have resumed the downtrend that pushed WTI and Brent crude to 15-month lows. With the US banking system under pressure, mounting recession fears and rising inventories sent oil prices plummeting.

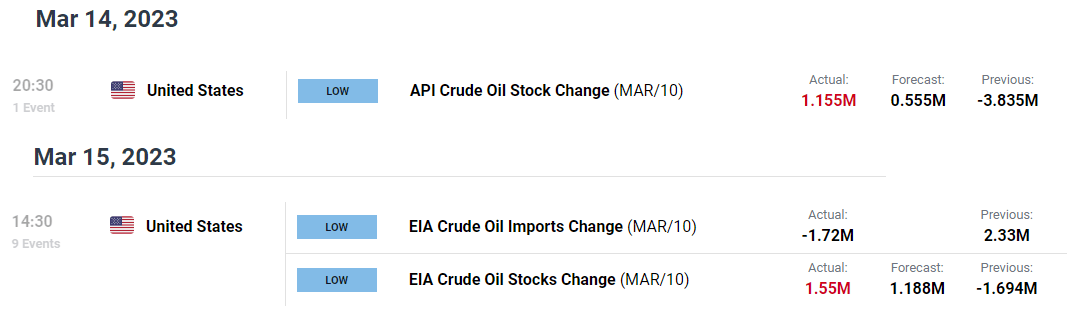

For US Crude (WTI), both the weekly API (American Petroleum Institute) and the EIA (Energy Information Administration) echoed these concerns. While both data points smashed estimates, the monthly IEA (International Energy agency) reported that global supply of oil (including Brent) had risen to an 18-month high.

DailyFX Economic Calendar

Despite the reopening of China’s economy and sanctions against Russian oil by the Europe, the United States and others, oil stockpiles have increased. This contributed to the bearish move, exacerbating concerns over waning demand. Although Saudi, Russia and OPEC+ remain willing to cut production further, turmoil in financial markets continued to weigh on expectations.

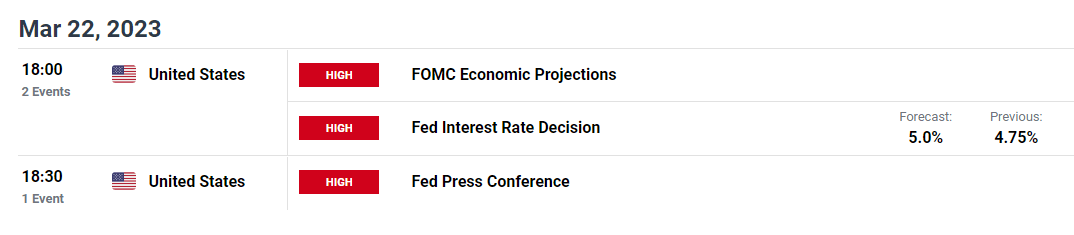

In another week of elevated systemic risks, the price of oil could remain at the mercy of sentiment. While the weekly EIA report will indicate if supply has been reduced. the FOMC and Fed rate decision will likely pose the biggest threat.

DailyFX Economic Calendar

Since oil prices have shown extreme sensitivity to the economic outlook, a higher than expected 50-basis point rate hike or more banks go bust, oil prices could remain vulnerable to further declines.

How Do Politics and Central Banks Impact FX Markets? Visit DailyFX Education to Find Out

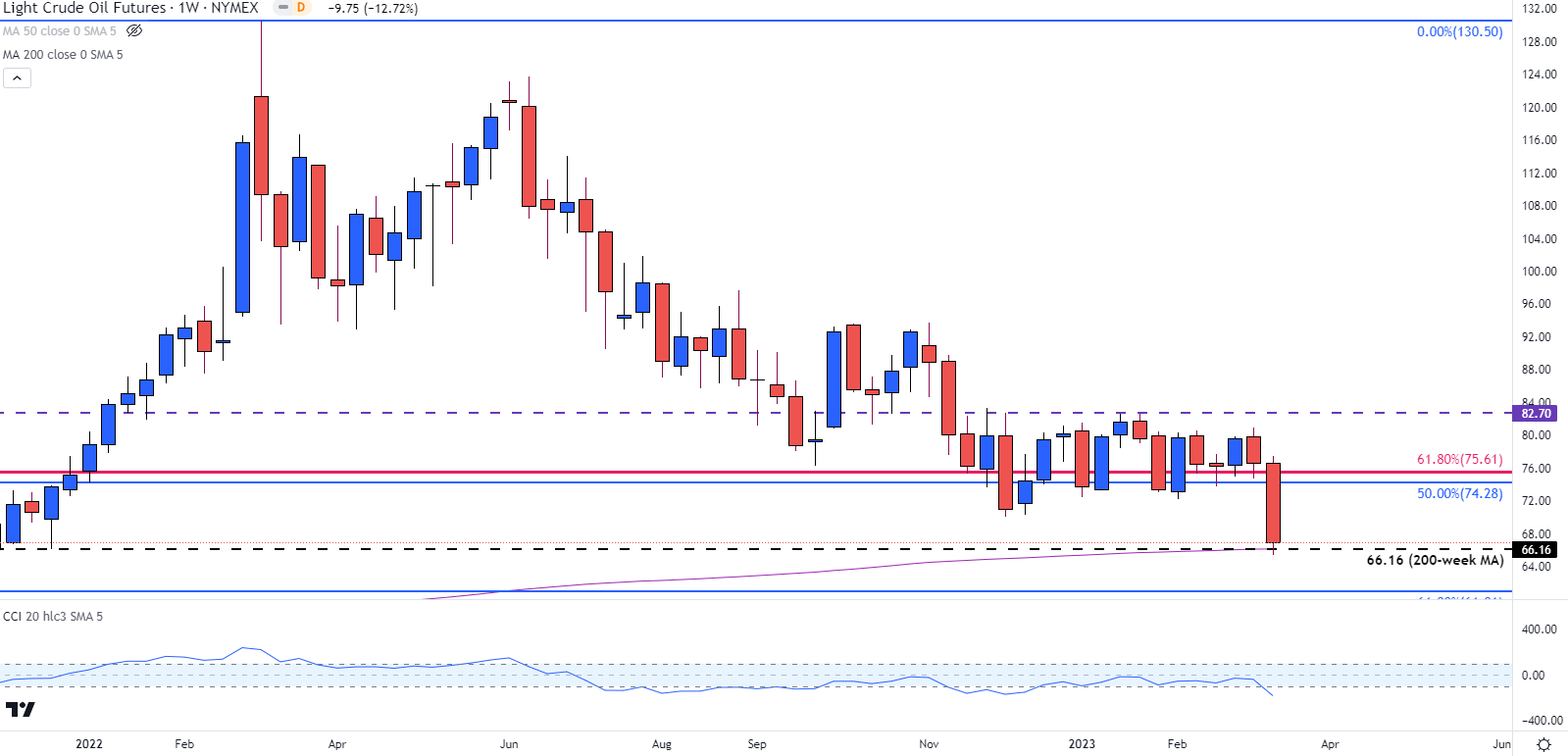

Following the collapse of SVB, and the lifeline offered to Credit Suisse and First Republic Bank, news of further rate hikes or the potential collapse of more banks could force oil lower. With WTI shedding 12.72% in the past week, a downside break of $70.00 has forced prices toward the 200-week MA, currently providing support around the $66.00 mark.

US Crude Oil Futures (CL1!) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Similarly for Brent, a drop below the 50-day MA and below $80.00, assisted in a weekly decline of 11.57%, forcing prices to support at $73.00

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707